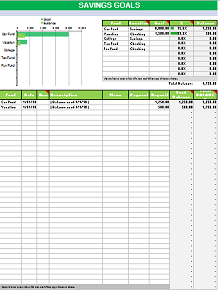

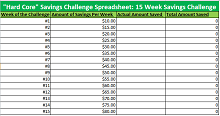

45+ Savings Goal Trackers Spreadsheets

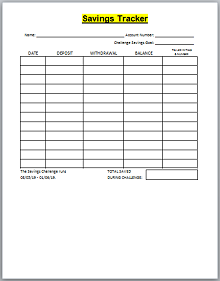

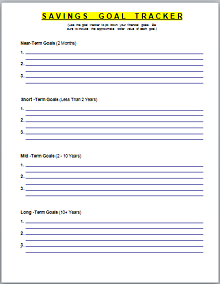

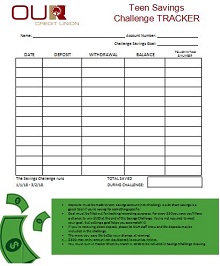

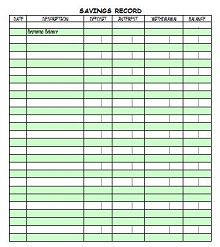

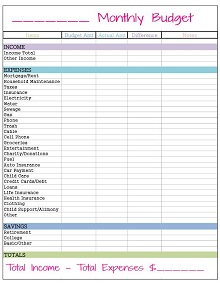

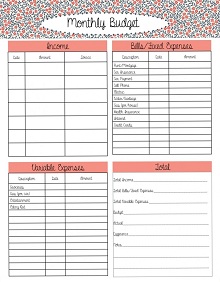

Savings Goal Tracker templates are excel spreadsheets that are used to track your savings. If you do not have the habit of saving money and you want to spend money less than you earn, then saving a tracker spreadsheet will help you to track your savings and take control of your money.

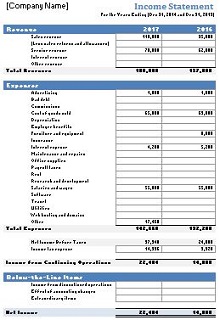

- Accounting Templates

- Art & Media

- Budget Templates

- Business Templates

- Calendar Templates

- Certificates

- Charts

- Education Templates

- Inventory Templates

- Invoice Templates

- Letter Templates

- Medical Templates

- Personal Templates

- Project Plan Templates

- Timesheet Templates

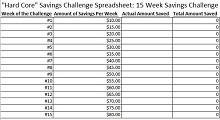

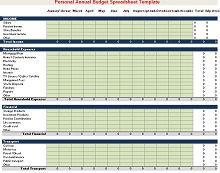

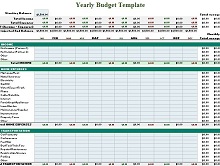

It is the best way to achieve your saving goals. To make it simple, we share a collection of simple saving goal tracker templates in excel, which will help you to manage your budget.

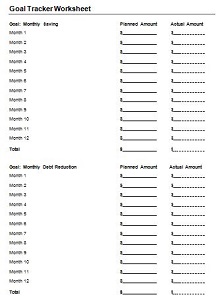

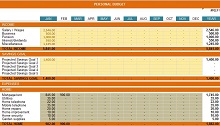

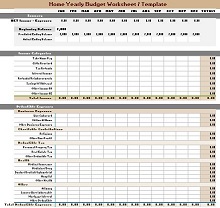

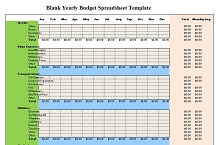

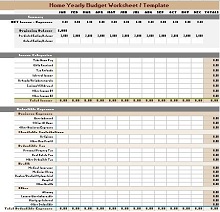

Download Free Savings Goal Trackers Spreadsheets Templates

What Is Saving Goal Tracker?

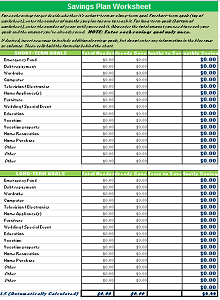

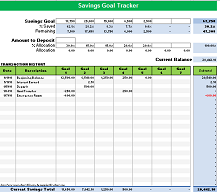

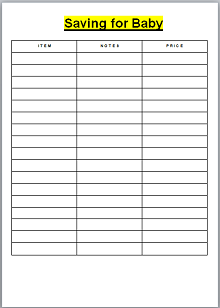

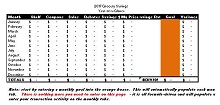

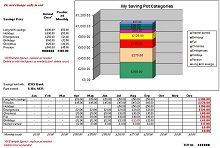

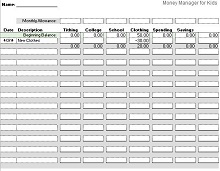

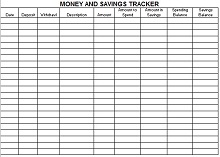

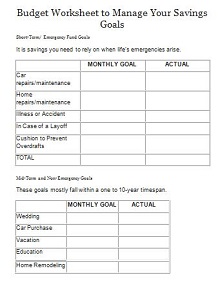

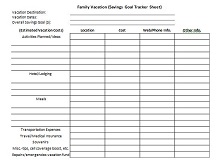

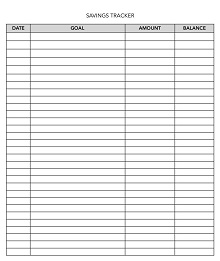

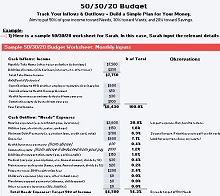

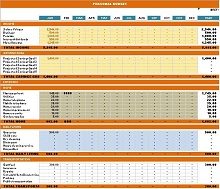

Saving spreadsheets contain budget categories like emergency funds, vacations, and a bigger home for your savings, which means that you spend your savings on the things you specified in the spreadsheet. You can calculate how much money you allocate for each goal. So these serve as saving calculators as well.

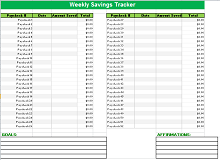

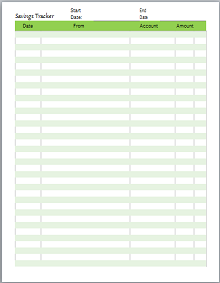

Here is a list of free printable saving goal tracker spreadsheets that will help you to track your savings. It is a great tool to keep you on track.

How To Use Saving Goal Tracker Spreadsheet

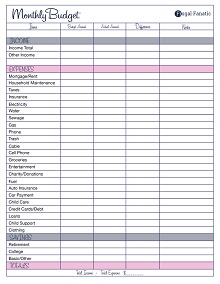

The first step is to consider your savings amount as your “expense.” The spreadsheet contains a budget category for your savings like education fund, emergency fund, and saving for your travel or education. This means that you spend your savings on these specific goals.

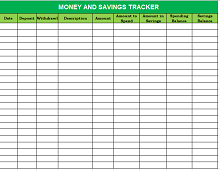

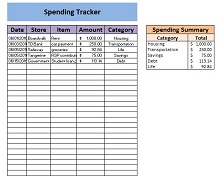

Split is a single transaction to several budget categories. When you deposit in your savings spreadsheet, then this money is allocated to multiple saving goals. A saving goals tracker spreadsheet is the best tool to track your savings.

Write the date when you make a transaction along with the description of the transaction. Write how much you allocated for each goal. It is beneficial to achieve your goals.

Benefits Of Saving Goal Tracker

- Helps to track your savings and manage your budget

- Helpful to take control of your money spending

- When you set your priorities by saving a goal tracker, then it is easier for you to save your money.

- Helpful to make changes when it seems difficult to achieve your savings goal

- When you set your savings goals with the help of a goal tracker spreadsheet, then you meet your timeline easily.

- This helps you to fulfill your dreams, which can not be met because of financial issues.

- It helps you to become financially strong.

- If you are hit with any unexpected cost, then you don’t need to ask friends or family for money.

- It’s a kind of personal daily expense sheet.

- It helps you to focus on your savings goals.