50+ Credit Card Authorization Form Templates (Free PDF, Word)

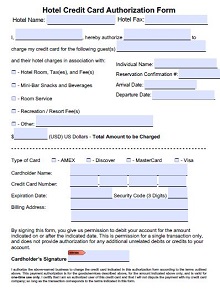

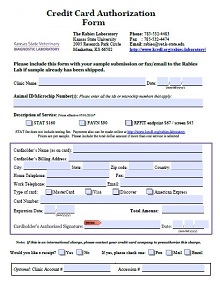

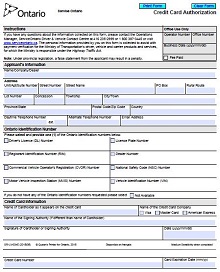

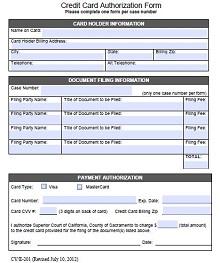

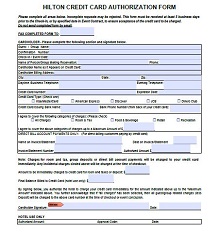

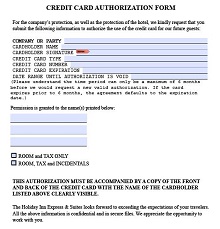

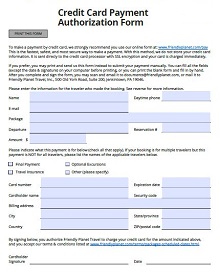

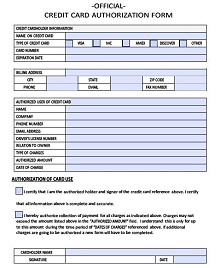

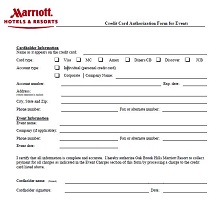

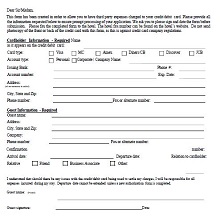

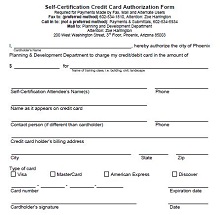

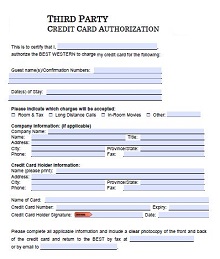

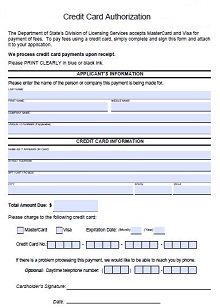

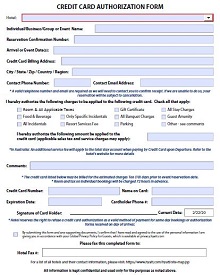

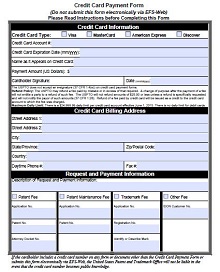

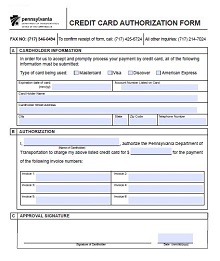

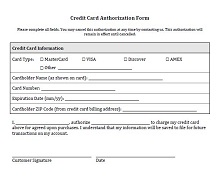

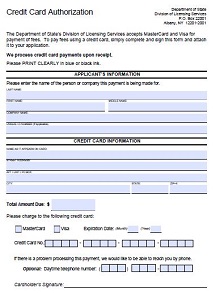

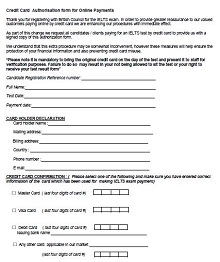

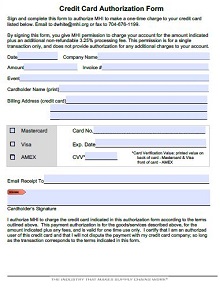

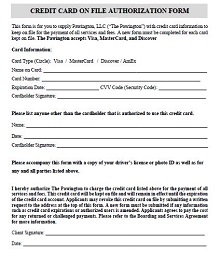

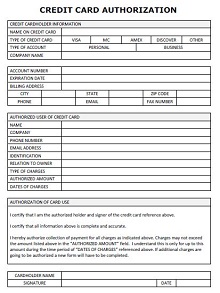

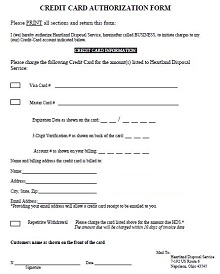

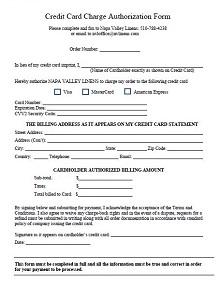

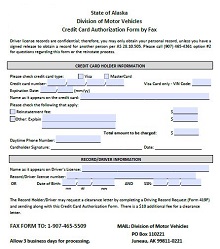

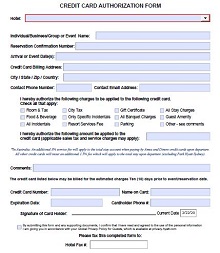

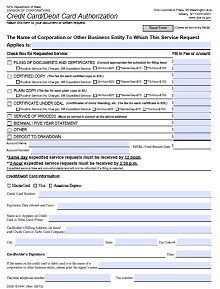

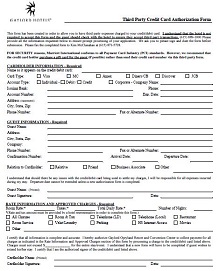

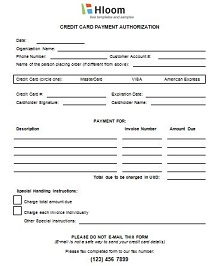

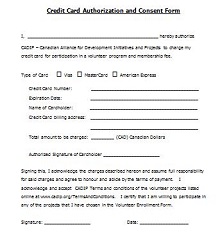

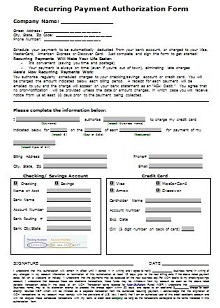

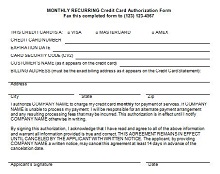

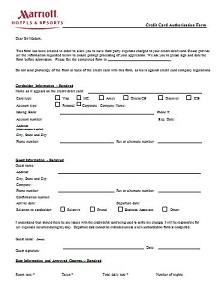

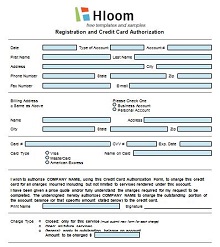

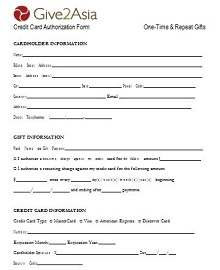

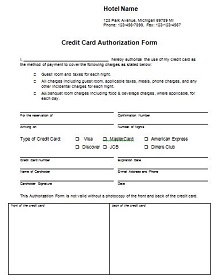

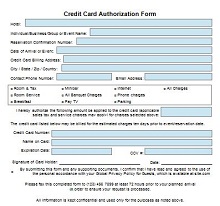

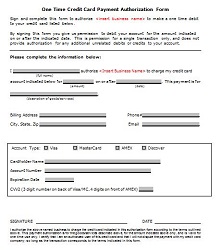

A credit card authorization form is an important document in business transactions. It is typically used when a customer or client makes a purchase online with a credit card, and it is intended to give the merchant permission to charge their card for payment. Generally, the form includes details such as the customer’s name, address, phone number, credit card type and number, authorization amount, and expiration date of the card.

Additionally, some businesses may require additional information such as shipping addresses or any other related details specific to that particular purchase. As these forms are often filled out electronically, they help ensure that all necessary information is captured quickly and securely, this helps improve accuracy and prevent fraudulent activities on both sides of the transaction.

- Accounting Templates

- Art & Media

- Budget Templates

- Business Templates

- Calendar Templates

- Certificates

- Charts

- Education Templates

- Inventory Templates

- Invoice Templates

- Letter Templates

- Medical Templates

- Personal Templates

- Project Plan Templates

- Timesheet Templates

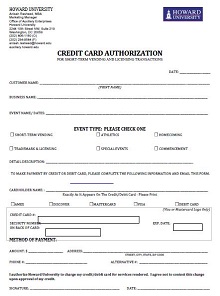

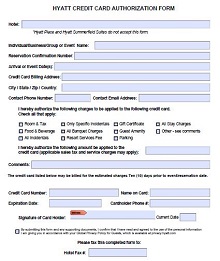

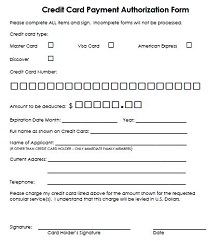

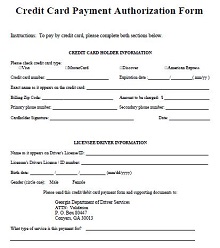

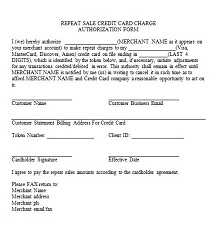

Download Free Credit Card Authorization Form Templates

What is a Credit Card Authorization Form?

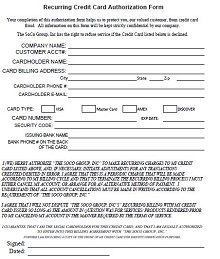

Credit card authorization forms are a way for companies to process payments securely. The form allows customers to authorize businesses or organizations to take specific transactions, like recurring payments, out of their accounts without requiring them to add the information every time. Companies use these forms as an alternative to paper checks and serve as a safeguard against unauthorized credit card use.

Depending on the type of form requested, customers may need to provide additional information like identifying information or signature details that the company then verifies before any payment is made. As an added security measure, credit card authorization forms must be completed prior to processing payments, ensuring an extra layer of protection for customers while ensuring a clean and reliable payment history.

How Credit Card Authorization Forms Protect Businesses from Fraud

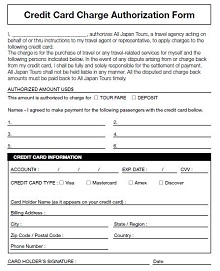

One of the most important functions of a credit card authorization form is to protect businesses from fraud. When customers provide their credit card information, they also provide their name, address, and other identifying information. This information can be used to verify the customer’s identity and ensure that the credit card belongs to them. Another way that credit card authorization forms protect businesses from fraud is by requiring customers to sign the form.

This signature provides an additional layer of protection against fraudsters who may try to use a stolen credit card. Finally, businesses can use credit card authorization forms to limit their liability in the event of fraud. By requiring customers to provide their credit card information on a form, businesses can minimize their exposure in the event that a customer’s credit card is used without their permission.

How to Use a Credit Card Authorization Form

There are a few things that businesses should keep in mind when using credit card authorization forms. First, businesses should make sure that they have the proper permissions in place before charging a customer’s credit card.

Second, businesses should keep track of all authorized charges and keep copies of all signed authorization forms on file. Finally, businesses should take steps to protect themselves from fraud by requiring signatures on all forms and keeping track of all authorized charges.

Creating a Credit Card Authorization Form Template for Your Business

As a business owner, it is important to create an effective credit card authorization form template to ensure that all transactions are secure and compliant. It is essential to use the correct language, layout, and payment security protocols when creating a credit card authorization form in order to protect your customers’ information. Here’s how you can create your own credit card authorization form template.

Designing the Layout of the Form

The first step in designing your credit card authorization form is to determine the information that needs to be included. This includes name, address, telephone number, email address, and credit card information.

When creating the layout of your form, make sure that it is organized and easy to read so that customers can fill out their information quickly and accurately. Additionally, include any disclaimers or terms of service at the bottom of the page.

Including Payment Security Protocols

When it comes to collecting customer payment data online, safety should be a top priority for any business owner. You must make sure that all payment information is securely transmitted from your site and stored safely in your database.

To do this, you must encrypt all customer data using Secure Socket Layer (SSL) technology before sending it over the internet. Additionally, include data protection methods such as tokenization or encryption at rest when storing customer data on your servers.

Creating an Authorization Process

Once you’ve designed the layout of your form and included necessary payment security protocols, it’s time to create an authorization process for collecting payments from customers via credit cards or other payment methods such as PayPal or Apple Pay.

Each payment method requires its own set of steps in order for customers to authorize payments successfully with their preferred method of payment. For example, PayPal payments require customers to log into their accounts and authorize payments with two-step authentication, while Apple Pay requires customers to authenticate their identity with Touch ID or Face ID before completing purchases.