40+ Free Proof of Income Letter Samples & Templates (PDF, Word)

A Proof of Income Letter Template serves as a tangible verification of an individual’s income. Landlords, lenders, or potential employers ask for this document to verify one’s earnings and financial stability. A well-crafted proof of income template should include actual income sources and the payment frequency.

It also includes the duration over which the income has been consistent. The proof of income letter offers a concise and efficient method to verify one’s financial condition. This makes it a crucial tool in various financial transactions and applications.

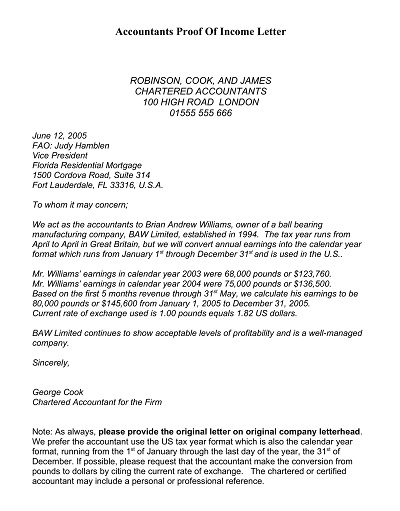

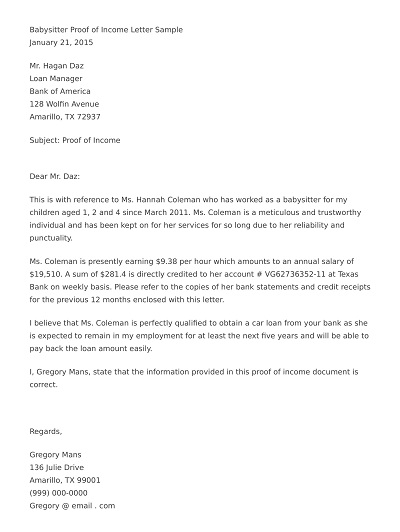

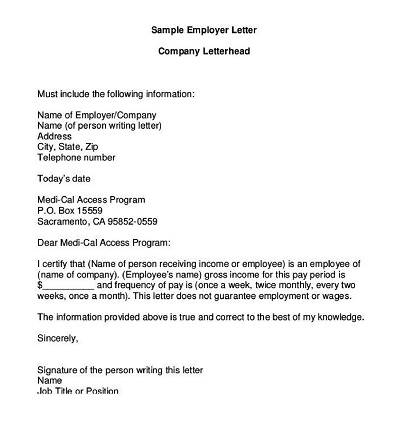

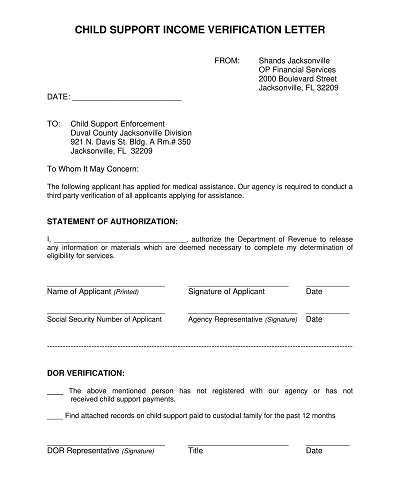

Download Free Proof of Income Letter Samples & Templates

What exactly is a Proof of Income Letter?

A “Proof of Income Letter,” known as an “income confirmation letter,” is a formal document verifying an individual’s income. It includes specific details such as the person’s full name, total gross income, pay frequency, and employment duration. Letter templates are useful because they offer a set layout. This means they ensure all important details are put in, displayed, and well-arranged.

It is crucial to Understand how to construct a proof of income letter appropriately. It can make the difference between approval and rejection. Our guide and templates provide a clear road map to ensure your proof of income letter is professional and effective. Whether you’re an employer, an employee, or a self-employed, these templates will simplify the process.

Types of Proof of Income Letter Templates

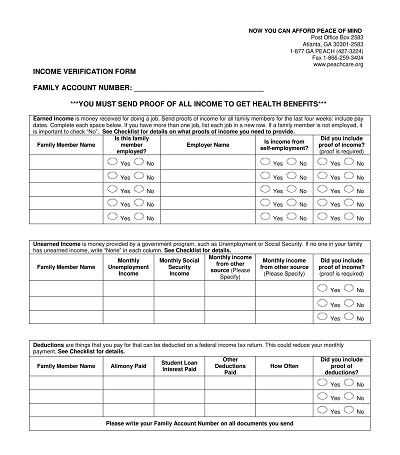

Here are the types of proof of income letter templates:

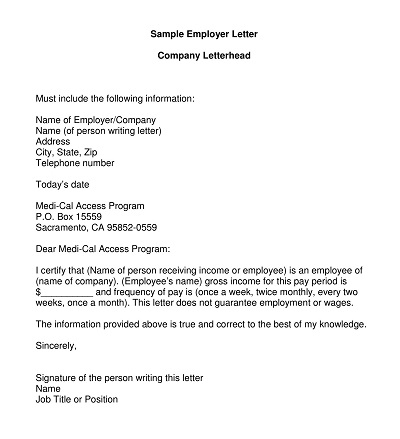

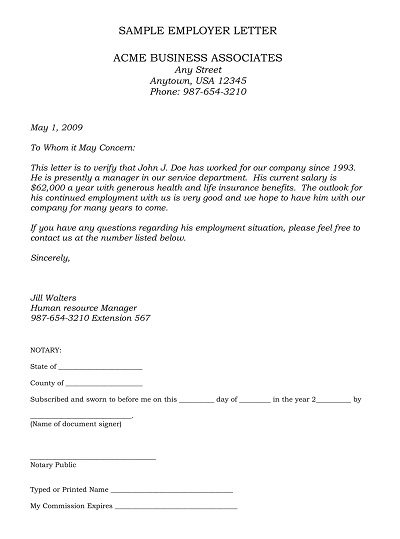

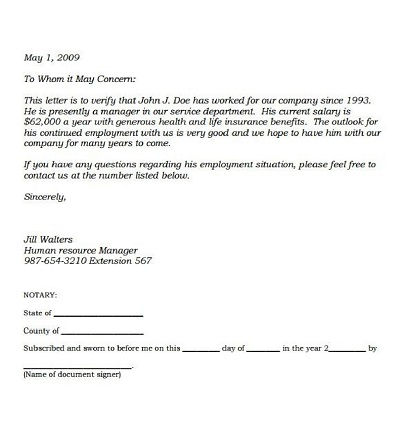

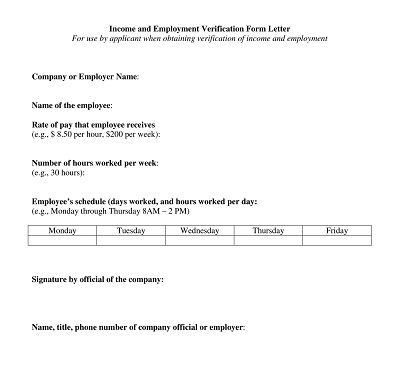

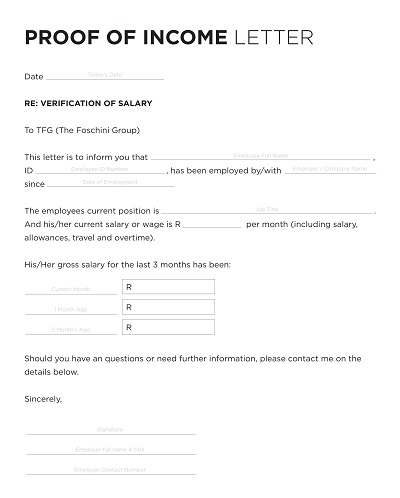

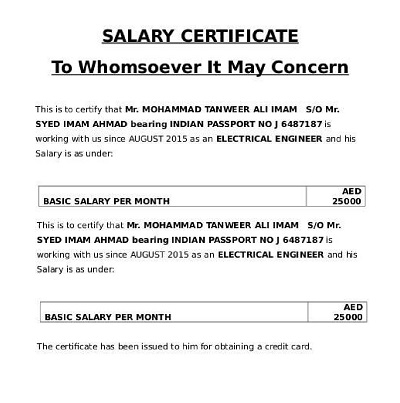

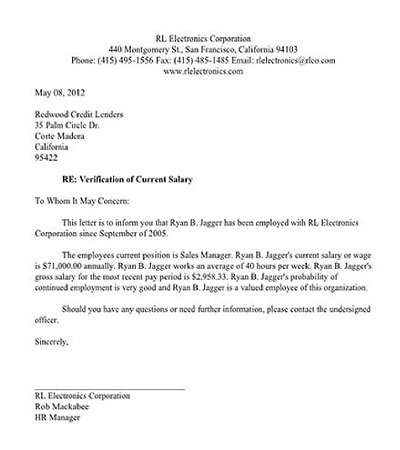

Employee Income Verification Letter

An Employee Income Verification Letter is a document provided by an employer that verifies an employee’s employment status and income. It serves as proof of income, often used when an employee is applying for a loan or renting an apartment. The letter may contain information such as the employee’s salary, hours worked, and job tenure.

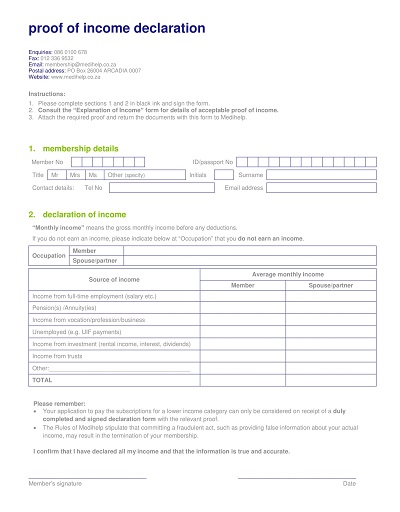

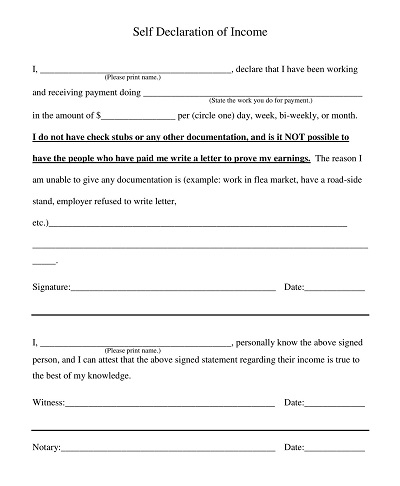

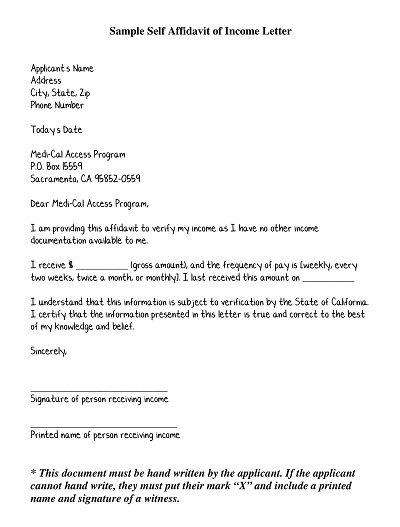

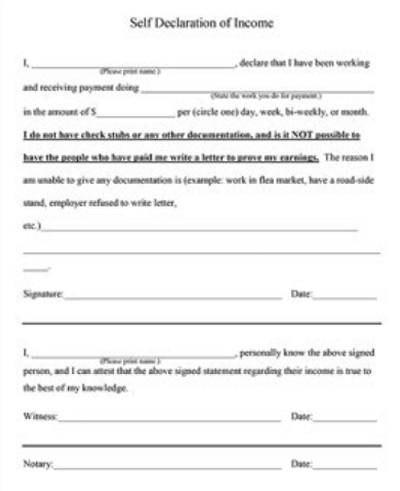

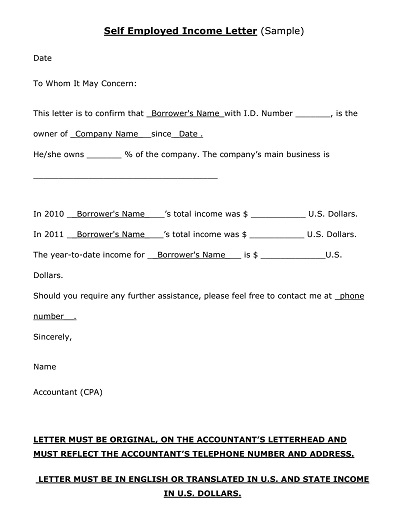

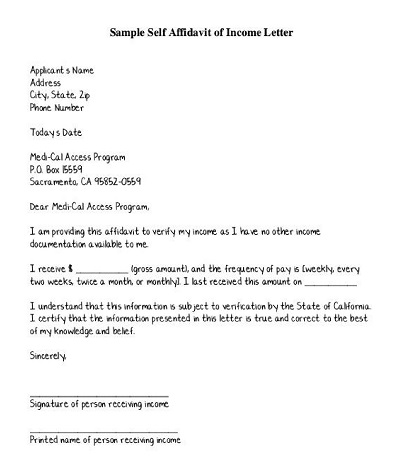

Self-Employed Proof of Income Letter

A Self-Employed Proof of Income Letter is a document that certifies a person’s income when they are their employer. This letter is crucial in situations like applying for a loan or renting a property. It includes information about the person’s business, work type, average monthly or yearly income, and relevant financial details. The validation of this letter may come from a third party, like an accountant or tax preparer who knows the individual’s finances.

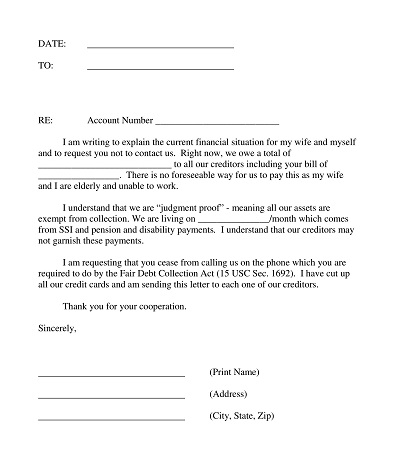

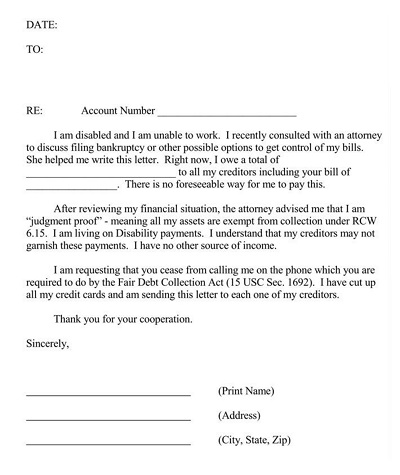

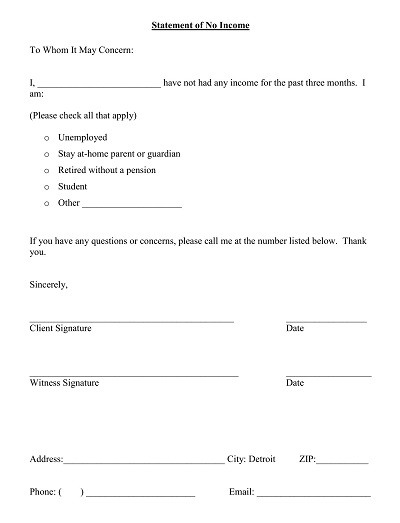

Unemployment Income Verification Letter

An Unemployment Income Verification Letter is a document that serves as proof of income for individuals who are unemployed or receive federal support. It is crucial for applying to specific services or programs, such as subsidized housing.

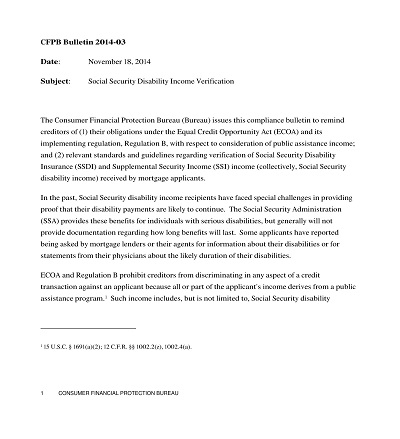

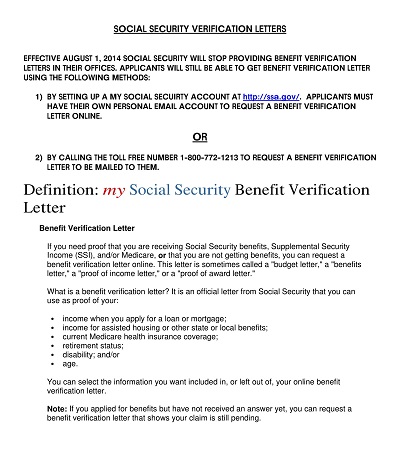

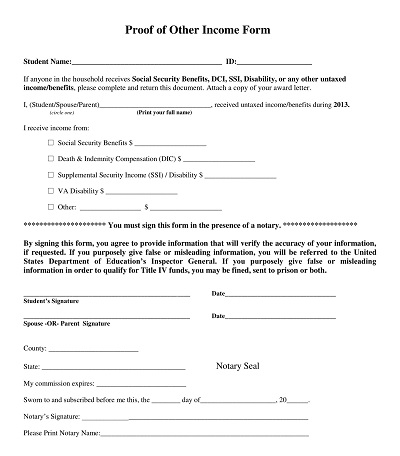

Social Security Proof of Income Letter

A Social Security Proof of Income Letter is a paper that shows how much money people get from Social Security benefits. This letter is crucial when people show their income level for various purposes, such as applying for a loan or renting a house. The letter specifies how much and how often a person gets benefits from the Social Security Administration. It’s an official document from the Social Security Administration, usually given when requested.

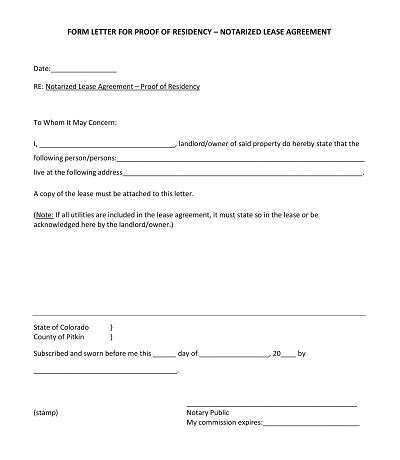

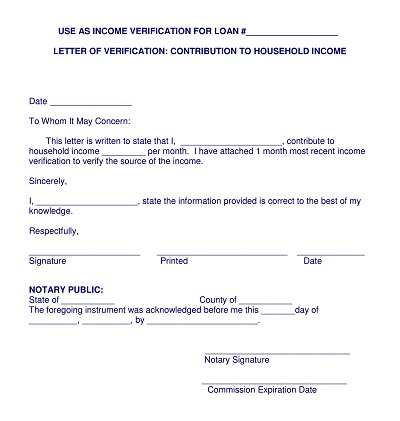

Rental Income Verification Letter

A Rental Income Verification Letter is a document that proves income derived from renting out properties. Property owners often use it to show their financial status for transactions such as securing a loan or applying for a credit card. The letter includes:

- Rental details.

- The amount of rent received.

- The duration of the rental agreements.

Relevant financial documents like bank statements and tax returns confirm this letter.

Why Use a Proof of Income Letter Template?

A Proof of Income Letter Template is useful for income verification and validation. If you’re unsure about the details to include or how to arrange the content, this template comes in handy. Crafted with precision, it meets the standards set by various institutions. The template ensures you include all necessary details, presenting them in a neat, standardized format. Professional and easy to understand, these templates take the guesswork out of formatting. Fill in your details and ensure you’re not missing any critical information.

Income proof templates are useful, especially for bosses who must make many of these documents for various workers. Having a ready-made layout saves the trouble of starting from scratch. These templates help keep things correct. With important areas already outlined, the risks of mistakes are lowered. This correctness is vital, as errors in an income confirmation note can result in problems or even legal troubles.

Key Components of a Proof of Income Letter Template

A Proof of Income Letter Template should be clear and concise and include all the needed information. Here are the key components that it should include:

- Header: This is your letterhead, which includes your name, address, and contact information. If you’re an employer, it also includes the company’s name and address.

- Date: The current date when you’re issuing the letter.

- Recipient’s Details: The name and address of the individual or organization requesting the proof of income. A simple “To whom it may concern” will serve if not specific.

- Subject: A brief, clear description like “Proof of Income for [Your Name]”.

- Body of the Letter: This is the most important part of the letter. It outlines the purpose of the letter, your employment status, income sources, and the duration of the income consistency. If you’re an employee, it should also include your role in the company and employment period.

- Signature: Your signed affirmation that the information provided is accurate and up-to-date. If an employer is writing the letter, they should sign it.

- Contact Information: Include a call number or email where you can be reached for further questions or clarifications.

Steps to Use a Proof of Income Letter Template

Using a proof of income template is straightforward; that can save you time and effort. Follow these steps to make the most out of your template:

- Choose the Right Template: Select the template from the above that relates to your situation. Make the right choice here to ensure the document meets your specific needs.

- Fill Out the Header: Input your personal information or company’s details if you’re an employer.

- Add the Date: Include the current date on the letter.

- Specify the Recipient: Address the letter to the individual or organization who wants your proof of income. If you don’t have this information, a “To whom it may concern” will work.

- Include a Clear Subject: A concise subject like “Proof of Income for [Your Name]” should be written.

- Write the Body of the Letter: Here, you will detail your employment status, income sources, and the duration of income consistency. If you’re an employee, include your role and the length of your employment.

- Sign the Letter: This step is crucial as it affirms that your information is accurate and up-to-date. The employer should sign employee letters.

- Provide Contact Information: Include a reliable way to reach you for further inquiries or clarifications, such as a phone number or email.

Tips for Writing a Proof of Income Letter

Here are some tips to help you create a compelling and credible letter:

- Accuracy is crucial: The information you provide must be accurate and up-to-date. Any dissimilarities could lead to unnecessary complications or even legal issues.

- Stay Professional: Use a professional tone and language. While being friendly is okay, remember that this is a formal document.

- Be Concise: Stick to the facts and avoid unnecessary decorations. The reader is interested in the proof of income, not a story.

- Don’t Forget the Details: Include necessary details such as your role, income sources, and the duration of the income consistency. If you’re an employer, include details about the employee’s role and time with the company.

- Proofread: Check for any grammatical or spelling errors. These mistakes can detract from the professional appearance of your letter.

- Get it Signed: Don’t forget to sign the letter. The signature is your affirmation that the information provided is accurate and up-to-date.

- Provide Contact Information: Include a reliable way to reach you for further inquiries or clarifications.