20+ Payment Reminder Letter Templates & Samples (PDF)

A payment reminder letter is an official document sent by a company or individual to remind the customer about the payment of an overdue invoice. It is a legal process to get the money by sending a friendly payment reminder letter that you are owed. Download free overdue payment reminder letters in PDF and Word formats.

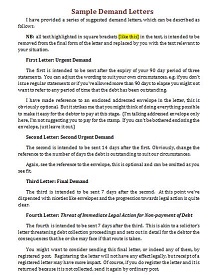

You can see the reminder letter samples and examples to understand them clearly and efficiently. Below, we share a complete guide that will help you get paid quickly.

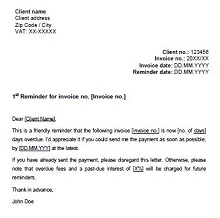

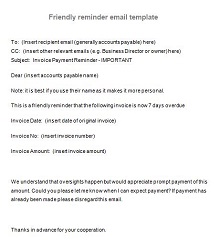

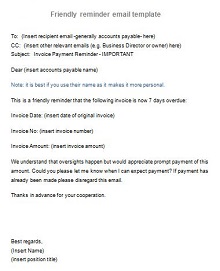

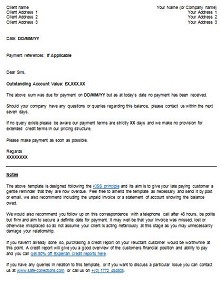

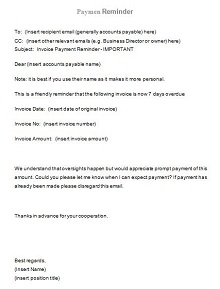

Download Payment Reminder Letter Templates

Payment Reminder Letter

A payment reminder letter is called a reminder letter that is used to get paid off an overdue invoice that you owe. When a customer doesn’t pay you on time, a letter is sent as a reminder to get money for your service or product. It is the best, quicker, and easiest way to ask someone for payment. Keep calm; use positive words in a friendly and firm tone in your demand letter.

One of the most difficult tasks in a business is to ask for payment from the customer when the due date has passed. You can send a copy of the invoice with this letter stating details, the payment method, and the type of service and goods. Companies or individuals send payment demand letters before the due date to remind the amount. It may also be sent when the due date has passed. If you are writing a payment letter professionally, it is essential to write this by following the standard format like MLA format. You can find here outstanding payment reminder letters in PDF, Word, and available in every format you prefer. These free printable templates help you to craft a well-formatted letter. Instead of sending a letter, you can ask for the payments from your client by crafting a payment reminder email. You can also find here a sample and example of a reminder email that helps you to understand it easily.

What Should Be Included In The Reminder Letter

Customers are the most important stakeholders of any project. All of your hard work and investment are to provide a better service to the customer. A company or organization is nothing without its employees; it is vital to appreciate the hard-working employee with a recognition letter to increase the productivity of your company. Some people are too harsh when they ask for the overdue payment. It is a crucial task to retain existing customers. Hence it is essential to send a polite payment reminder letter. Key elements of this letter are as follows:

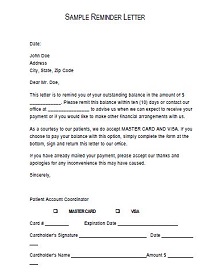

- Name of the sender: The individual or company wanting payment for their service or products.

- Sender’s address: Address of the company

- Contact details: Please provide your phone number, email address, fax number, and web address if you have one.

- The date: When the email or letter is crafted.

- Name of the receiver and contact details: After the date, write the receiver’s name, address, phone number, and other contact details.

- A professional and positive salutation.

- State the purpose of this letter in the body section in detail politely.

- Deadline date

- Closing words

- Signature at the end of the letter.

A letter with these components helps you to make a strong letter; you can download free templates for the outstanding payment.

When To Send Payment Reminder Letter

It’s a good practice to send a letter 2 or 3 days before the last date mentioned on the invoice. There is a chance that the customer is angry by receiving a reminder letter before the due date. It would be best if you kept calm during this legal process. It is necessary to send a payment reminder letter at an accurate time. It is standard to send payment within 30 days of receiving an invoice or delivery package. You can see our complete article on packing slips with a vast collection of free templates.

- It should be sent before 2-3 the due date mentioned on the invoice.

- If the customer does not pay after the due date, send a second reminder letter 2-3 days before the expected time.

- Send the third reminder letter a week after the due date.

- Send a final reminder letter 14 days after the due date and clearly state the legal action you will take if the customer does not pay.

- If payment is not received after the final demand letter, you can pursue a legal process to recover the money you are owed.

- When you receive the invoice payment, sending a Thank you letter is standard.

You can find here the friendly payment reminder samples and templates to ask your customers for payments politely.

Things To Keep In Mind While Writing A Payment Reminder Letter

These are essential things to remember while writing a payment demand letter to the customer. These things are as follows:

- For the success of any business, it is essential to build a great relationship with your client, but some people are rude and harsh when asking for payment for services and goods. Use positive words and follow the polite rule while writing a demand letter.

- Use positive words like “thank you” or “we request.”

- Clearly state the purpose of this letter.

- Attach a copy of the invoice for prompt payment.

- Confirm that the customer receives the invoice on time.

- The body of the letter states clearly how much the customer will pay.

- Also, include your method of payment with your bank details of yours.

- Write the deadline in a soft but professional way within which the customer should make the payment.

- I ask you to respond to this letter.

- The header of your writing should clearly state the purpose of this letter. It should also show how many times you send the letter, such as “second letter for payment” or “final payment reminder letter.”

To make your work easier and simpler, we share a collection of persuasive payment reminder letters before, after, and before some legal actions. You can download these editable letter templates according to your needs.

How To Write The Payment Reminder Letter

It is one of the crucial tasks to gain new clients for your business, but the hard one is maintaining this relationship with the existing customer. It is common to receive late payments from customers. For that purpose, the company or individual writes a reminder letter when the due date for the invoice payment is near or passed.

For some people, writing a payment reminder letter to a client isn’t very easy. Below, we share a few easy steps that help to make an effective letter for outstanding payments quickly. Follow these steps to get overdue payments from the customer. These are:

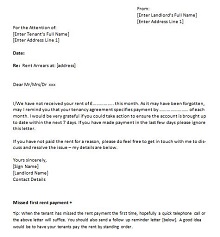

The letterhead of the reminder letter

The letterhead is the most important section and should be crafted carefully because it states who is the sender of this letter. A payment reminder letter may be sent from the individual or company. Include the sender’s name, address, phone number, and email on the letterhead by following the MLA format. After the sender’s details, write the date of sending this letter.

Salutation

Find the name of the person from whom you are asking for money or write the name of their position with the titles Mr, Mrs, and Miss, such as “Mr manager,” “Mrs John.”

State the purpose of this letter in the first paragraph

Usually, in the first paragraph of any letter, we find the primary purpose of the letter. It is standard to state the purpose of the letter in the first paragraph of the letter.

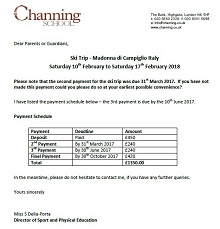

Mention the extra fees for late payment in the 2nd paragraph

There is a rule in the market that the customer pays extra charges for late payments. Write the amount in digits that you owe and state the amount separately with extra fees. For example, the amount of the service or goods that the customer will pay is 2000$, plus charges of late payment are 100$. State that the customer will pay 2100$ when the due date is passed.

Include payment details and the deadline in the third paragraph

Write your bank details with a method that the customer will use for payment. Also, include the timeframe within which the customer made the payment.

Close the letter

It is good practice to use positive words to close the letter.

Sender’s name with signature

Write the sender’s name at the end of the letter with the signature to make it an official letter.

Tips To Get Overdue Payment

Establishing great communication with your customers is the key to any successful business. Follow these steps to chase your invoice by being rude to the customers.

Send a reminder letter.

First of all, send a reminder letter to your customer. It is an easier, simpler, and quicker way to get overdue payments. Make sure to post it at a specific time like 1-2 days before or after the 3-4 days of the due date.

Be polite

Your polite behavior builds a great relationship with your customers. Be respectful in your words. Use some positive words in your letter and convey your message in a soft and polite manner.

Speak directly with the client

To chase your invoice quickly, pick up the phone and call your customers. Speak directly with your client instead of writing a letter or sending a demand email. Tell your client about the terms in case of late payment.

Notify customer about legal action

If the due date passes and the client doesn’t make the payment, they are owed. In the final reminder letter, tell them about the legal action.

Warn about your extra fees

2-3 days before the due date, write a reminder letter to your customers clearly stating the extra fees in case of late payment.