40+ Bank Deposit Slip Templates & Examples [FREE]

Banks play an important role in financial life. The banking system encourages people to save and secures their money in banks. The banking system makes comfort for people to deposit and make loan transactions of money through banks.

- Accounting Templates

- Art & Media

- Budget Templates

- Business Templates

- Calendar Templates

- Certificates

- Charts

- Education Templates

- Inventory Templates

- Invoice Templates

- Letter Templates

- Medical Templates

- Personal Templates

- Project Plan Templates

- Timesheet Templates

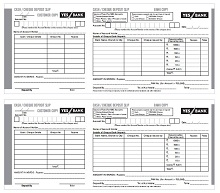

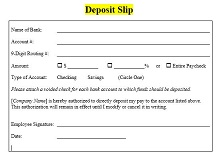

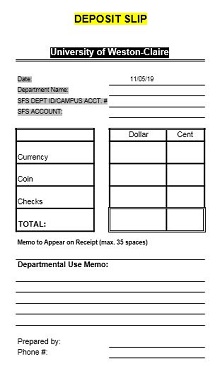

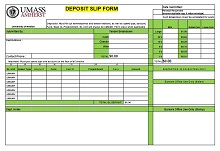

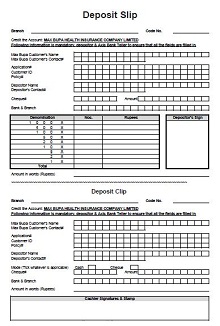

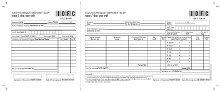

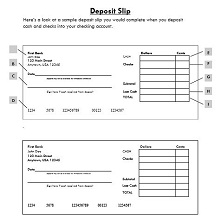

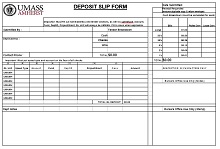

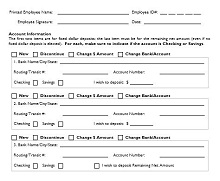

A deposit slip template is a piece of paper that you have to fill out when you deposit into any bank account. The deposit slip is given by the bank to the customer that contains information about the way of deposit such as cheque or cash, account number, and date. Here is a list of deposit slip templates you can download here.

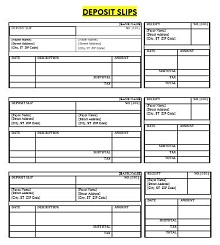

Download Free Bank Deposit Slip Templates

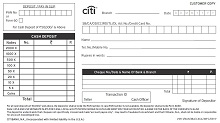

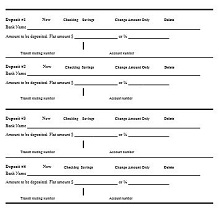

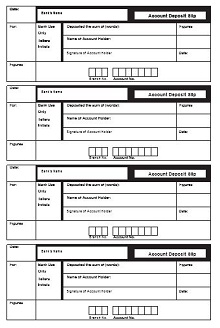

The Bank deposit slip template is filled out by the person who wants to deposit money in a bank account. It is issued by the bank with blank fields to their clients to put all the details about deposit cash. You can see the bank deposit slip examples that help you to fill it out effectively and download free deposit slip templates in PDF, Excel, and Word formats to make an efficient deposit slip.

It serves as proof that the deposit was made. In our collection, you can find printable cash deposit slips in a variety of designs to make an appropriate deposit slip for the bank and post office. In this article, we’ll discuss everything about cash deposits and deposit slips to understand them easily.

What is a Bank Deposit Slip?

Banks play an essential role in the business sector for money transactions. The bank issues a document that contains the necessary information about the service that banks provide, which serves as proof of their service.

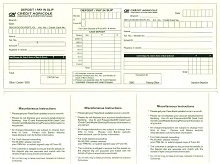

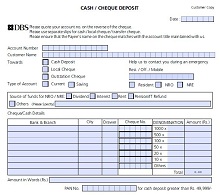

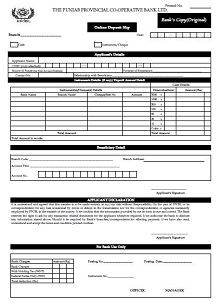

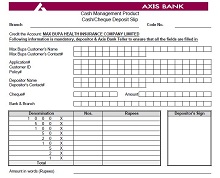

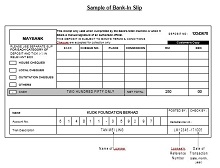

A bank deposit slip is issued by the bank to fill out when the client wants to deposit cash into another bank account. It contains essential information about cash deposits such as name, account number, type of deposit, date, and cash details. It also states that the deposit is made by check cash or both. The cheque is an old but standard method of payment; you can make deposits or withdraw money through a check from a bank account quickly. If you want to create an effective checkbook for your bank, then download blank cheque templates from our site.

The bank teller ensures the validity of the information that the client provides then the teller makes your transaction. The deposit slip template makes this process easier for banks to gather all the information from clients quickly. The format of this slip should be appropriate and simple, which is easily understandable by the deposit. It is the best way to track how much money you transfer from one bank account to another, on what date, and to whom this money has been sent. The deposit slip template helps you to make an effective and simple deposit slip for your client. A blank deposit slip is given to the depositor to fill up all the fields to make cash deposits. You can get free bank deposit slip templates in different formats to make this easier.

Importance of Bank Deposit Slip

The bank deposit slip is used to verify the deposit a person made in a bank account. The purpose of the deposit slip is to gather information about the deposit to issue this to the client as proof of their transaction. It serves as proof for both the client and the bank that the money or other financial instrument has been deposited in the bank account number you wrote on the slip. When a deposit detail is missing from your bank statement, then this slip works as proof of your deposit.

It is also useful to track the money in your account, how much amount you have in your account, the date when you deposit cash, and details about the bank account if you deposit money in your account from someone else’s account. In trade, when you purchase something from a company, then the company asks you to deposit payment in their account. When you deposit money, the bank gives you a deposit slip which you can use as proof of your payment. It helps you to avoid any legal issues.

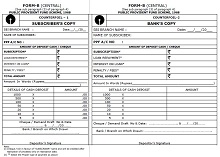

Components of Deposit Slip

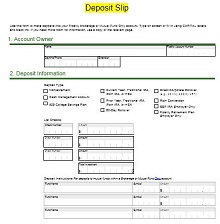

To write the correct information on the deposit slip, you should know every component of it. The parts of the deposit slip may vary from place to place. But the following components are standard to include in every deposit slip like a Bank of America and Chase bank deposit slip. Below we share details of essential elements to write it effectively.

- The depositor’s name: The name of the person who deposited cash is pre-printed on the slip, but you ensure that it is correct or not.

- The date: The date when the deposit has been made.

- The account number. The account number field on the slip is used to provide the account number to the bank in which you want to deposit money.

- Cash: The amount that you wish to deposit.

- Check: This section of the deposit slip is used when you want to deposit a check in a bank account.

- Subtotal: Sum all the amounts you want to deposit next to the subtotal field.

- Less cash: A less cash field appears at the end of the deposit slip that is used to enter the amount you get back from this deposit slip.

- Signature: The signature of the depositor when he/she gets cashback from this transaction.

Types of Deposit Accounts

Banks offer you different types of deposit accounts to manage your money transactions effectively. The method to deposit money is according to the nature of the account. Different types of deposit accounts are used for various purposes. Some people deposit money in their accounts for safety, and others may deposit money to earn interest. Types of deposit accounts are as follows:

- Saving Bank Account: This type of account is used by people who want to save money for a long period. They deposit their money for saving purposes and withdraw it through an ATM and checks. There is a limit from banks to withdraw a certain amount of money at one time. They earn interest on the balance that they deposit in their account.

- Current Deposit Account: The current deposit account is used to make payments through cheques. This type of account is perfect for public institutes, government departments, and the business sector for payments. The restriction on this account is less than the savings bank account. You can withdraw a certain amount of money at one time from your current deposit account.

- Fixed Deposit Account: Banks offer you to deposit money in a fixed deposit account for a specific time to earn a high rate of interest on it. When you deposit money in the savings account banks, give you a low rate of interest, and you are allowed to withdraw this time at any time. In a fixed deposit account, the client doesn’t have permission to withdraw money before a certain period.

- Recurring Deposit Account: This type of deposit account is used to deposit a fixed amount monthly for a certain period and earn interest. It is the best way to save money for regular-income people. Banks allow the account holder to close a recurring account before its maturity. The account holder gets back all the money that he/she deposits in the account with interest.

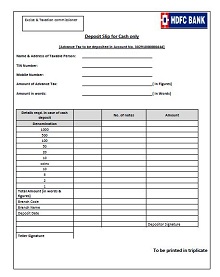

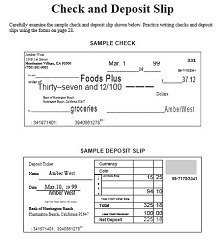

How to fill out a deposit slip

Filling out a deposit slip is not a difficult task if you see the sample deposit slip it helps to understand it quickly and efficiently. Sometimes, an example of the deposit slip is not enough to understand it. Below we share a few easy steps to fill out a deposit slip effectively without any mistakes.

- Step 1: Write the name of the depositor on the slip where it is required.

- Step 2: Write down the account number in which you want to deposit money.

- Step 3: Write the amount of cash you want to deposit next to the “Cash” label on the slip. If you don’t have then skip this field.

- Step 4: If you want to deposit a check, then write the amount with the check number next to the “Check” label on the slip. If you have two checks to deposit then write the check number with the amount of each cheque. If you don’t have any cheque to deposit then leave this blank.

- Step 5: Go to the subtotal field and write the total amount of the deposit in the subtotal field.

- Step 6: In the “Less Cash” field, write the amount that you get back from this deposit. If you don’t want to withdraw money from your deposit, then leave this line empty.

- Step 7: This is the total amount of cash that you deposit after subtracting the amount that you withdraw from the deposit.

- Step 8: If you get cashback from the deposit then sign your slip where it is required.

How to get a copy of the deposit slip

It is essential to be clear in your payments. You can ask a person for a deposit slip as proof of deposit when he/she made it in your account, and you should give the deposit as proof when you made payment in someone else’s account. It may create problems when you don’t have evidence of the deposit that you made. To prevent any problems, you should get a copy of the deposit slip. See below to get a copy of the deposit slip quickly:

- You can see the bank statement to find the deposit for which you need a deposit slip. The bank statement of your account contains information about all the transactions.

- Go to the branch where you have an account and ask them to send a deposit slip of a specific deposit.

- You can get the deposit slip without going to the bank if you have online banking. Log in to your account and submit a request to send a copy of the deposit slip.

- If there are any charges to get a deposit slip, then pay these charges from your account if you send a request online but if you visit a branch to get a deposit slip then pay them on the spot.

- When you receive the deposit slip, make sure it contains all the essential information, and that all this information is correct.

Pros and Cons of Direct Deposit

Direct deposit is a widely used payment method for employees and employers. Direct deposit is a way to transfer the salary of the employees directly to their accounts. There are some advantages and disadvantages of direct deposit that you should consider before implementing it. Some pros and cons of direct deposit are as follows:

The Pros of direct deposit are as follows:

- It is safer and more secure than a paycheck. If an employee loses the payment check, then it creates difficulty for you because the check contains the company’s account number, routing number, and your signature which may be detrimental to your business.

- It is a convenient way to send the salary of your employees into their accounts at any time anywhere, and employees can receive it from anywhere.

- It saves your effort, time, and money. When you pay your employees through a check, it may take time to sign and put a cash amount correctly on all these checks.

- The record of every employee’s salary is easily accessible in a few simple steps.

The cons of direct deposit are as follows:

- It might not be possible that all the employees should have a bank account. Employees need to open an account for direct deposit.

- When employees withdraw money from their bank account, they pay a fee for every transaction. Some companies apply charges for direct deposit.

- There is a long process to stop direct deposit. If you use a paper check to pay your employees, then it is easy to stop the payments due to specific reasons.

- If an employee changes the bank account, then the changes in the direct deposit information take a long period.

Frequently Asked Questions

What is a cash deposit slip?

A cash deposit slip is issued by the bank that contains the information about the cash deposit.

Difference between the deposit slip and check?

The deposit slip is used to deposit money in a bank account where a check is used to withdraw money from a bank account.

When must you sign the deposit slip?

When you get cash back from the deposit slip, then the bank teller asks you to sign the deposit slip.

What does less cash mean on a deposit slip?

The amount that you withdraw from the deposit check will be written here.

What if someone lost the deposit slip?

You can submit the request to get a copy of the deposit slip in the bank where you have an account. If you have online banking, then you can submit this request online to get a copy of the deposit slip.

What is the withdrawal slip?

A withdrawal slip is issued by the bank when someone withdraws money from a bank account in cash.