30+ Fillable Blank Check Template – FREE

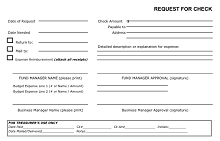

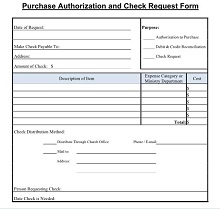

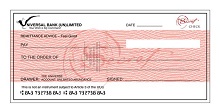

Huge collection of free blank check templates in PDF, Docs, Excel, and other formats. These free editable blank check templates are easy to download and use. An official bank gives blank checkbooks to their clients for authentic transactions of money, and it may be cashed or deposited. A blank checkbook is a combination of a hundred blank checks.

Blank check templates are perfect for that purpose. Check out our guidelines for blank checks, which help you understand more about them. These templates are available in different designs, formats, and accounts.

Download Free Fillable Blank Check Templates

What Are Checks?

Checks are pieces of paper to withdraw or deposit money from a specific bank. A cash check is an instruction for the bank to pay a specific amount to the bearer. Nowadays, the paper check is one of the safest and most secure ways for money processes like deposits or withdrawals.

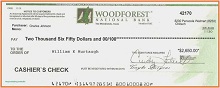

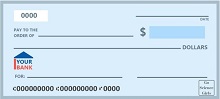

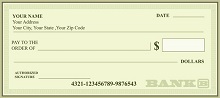

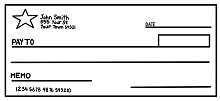

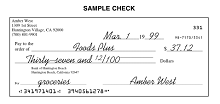

You fill in a bank deposit slip when you deposit in any bank account. Online payments are common at this age, but some people still rely on paper checks for money management and security. There are different checks for different banks that you can download in one click, and these templates are perfect for any official bank. It contains the date, the payee’s name in the center of the check, the amount in numeric form, the amount in words, and the payor signs at the end of the checks sign the end of the check to make it a valid check. Customers prefer to make operations on the money with the bank check tool rather than the internet-based payment.

Every bank issues a unique checkbook to every customer who has an account. To make the bank officials’ work easier, we share an amazing collection of printable blank check templates you can download in one click. You can see free blank business check templates in different formats for business purposes that you will find nowhere else.

Essential Elements Of Blank Check

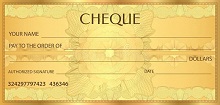

To clearly understand the check, you must understand every component of the blank cheque template. Below we share some details about every element of the blank check; these are as follows:

- Name of the bank at the top of your check.

- Date; In the top right corner of the check, a dateline appears.

- Name of the person on a check who will receive the money. If you cashed by yourself, write your name.

- Amount in words.

- Amount in numeric form.

- The signature line is the most essential part of the check. It works as a permission document or authorization to release a specific amount. In the bottom right, a signature line appears for the drawer’s signature to make it legal.

- Check the number; it will help you record your checks and how many checks you use for payment.

- Account number: The bank issues a unique code for every customer. The account number on the check indicates the specific transaction, like withdrawing or depositing money against this account number.

- You can see the routing number on the left corner of the check. The first nine-digit code is the routing number, also called the region number.

- Drawer: a person who writes the check

- Payee: The person or organization receives the money

- Drawee: Where checks are represented for payment

Different types of checks

We share a vast collection of editable blank check templates which you can use according to your needs. Different types of checks are as follows:

Bearer Check

A check is called a “bear check” when the bearer section appears on the check that is not canceled or marked. A bearer check is payable by the person who presents it to the bank; it can be any person. It is not a secure or safe check, but sometimes it is very helpful. Any person can cash bearer checks if they are lost. It is a risky check in nature.

Order Check

A check is called an order check when the bearer on the check is canceled or marked. This type of check is cashed by the person whose name is mentioned on the check. No other person can release money except the payee. It is safer than the bearer check because only the payee can cash it.

Crossed Check

A check is called a “Crossed Check” when two parallel lines appear on it. This means that the cheque is not encashed on the bank counter; the credit is transferred to the payee’s account.

Open Check

A check is called an “Open check” when it is not crossed or can be encashed at the counter of the bank.

Anti-Dated Check

If a check is cashed by the payee earlier, the date mentioned on the check is called an “Anti-Dated Check.” These types of checks are cashed over a period of three months. They are invalid if they cannot be cashed during those three months.

Stale Check

When a check is presented in the check after three months, it is considered a “Stale Check” and can not be encashed by the bank.

Reasons why you still need paper checks

With many advantages, people use internet-based payment to save time and faster transactions of money, but most people still rely on paper checks. There are many advantages to paper checks, which we discussed later. There are various reasons for using this standard method of payment. There are multiple reasons why people still need paper checks. Some reasons are as follows:

Cash payment

Checks are the king of all payment methods regarding security and management. Small organizations use checks for their payment instead of online. You can keep a record of your payments. For money transactions, you can use different checks for different purposes. Some businesses like insurance companies, government offices, hospitals, and donation centers use paper cash for money transactions. These organizations don’t accept payment in debit or credit.

No fees

When you use other means of payment, you pay a specific fee. That’s why most organizations or retailers use the check paper method: there is no fee deduction. A money order is also an appropriate way of money transfer, but there are also chargers for using it. With lots of other benefits, the other one is free of cost. Payment through check is better than any other means. You can see Fillable blank check templates in Word or PD.

Useless for thieves

The name of the payee on the check means that it is only payable by the person whose name is mentioned on the check. If the payee loses the check, the finder cannot encash it. In terms of security, it is a secure and safer form of payment.

The best way to keep a record

A paper check is one of the appropriate ways to keep records of your payments. You can make a carbon copy of the check to keep it as proof of your payments. For that purpose, most organizations or retailers use check paper because paying bills with it is much easier than other means of payment. Here you can find different checks in unique designs and download free personal blank check templates in Word, PDF, or vector format.

Stop payments

If you lose your checkbook or checks, you can request your bank to stop paying through checks. It is possible to stop some specific payments when you issue a check to a party.

A few Things You Must Know About Bank Check

Below we share some key points that you must know about bank cheques.

- The check can be issued by a person who has a current account.

- Just write the date when you signed it.

- Write the name of the person who receives the payment.

- The check is valid before the duration of three months from the date written on it.

- Some other lines appear on the check making it invalid.

- Don’t make a “bearer check.”

Benefits Of Paper Checks

Every payment method has various advantages and disadvantages. See lots of benefits of check paper:

Benefits

- Secure way of payment

- It helps to keep a record of every payment.

- Government offices and small businesses commonly use them because bill payment with checks is much easier than other means of payment.

- The money will be protected from thieves because the check is only payable to the person whose name is mentioned on the check.

- Easily prove the payment you have made with the carbon copy of it because they are traceable.