15+ Free Month-end Closing Checklist Templates – MS Excel, PDF

The month-end closing checklist template is a great tool to ensure the end of the month is accurate and consistent. It can help small businesses keep their finances in order and stay organized when preparing both monthly and yearly reports. The template makes sure that all important financial records are up-to-date so taxes, loans, payrolls, deposits, and profits are managed correctly and efficiently.

It also includes sections for tracking customer invoices, expenses, inventory balances, and accounts receivable/payable. By making sure you have a clear overview of cash flow and other transactions at the end of each month, this checklist can be an invaluable tool for any business.

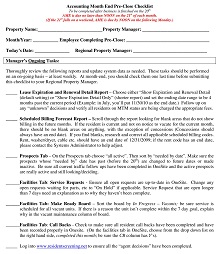

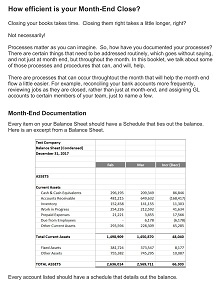

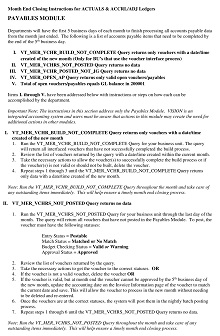

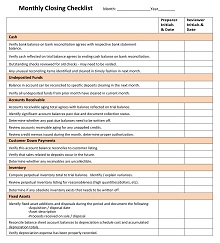

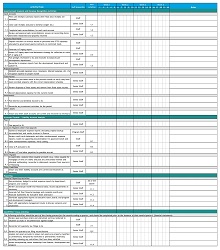

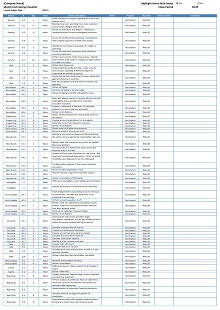

Download Free Month-end Closing Checklist Templates

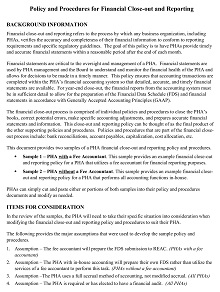

Roles and Responsibilities for Month-end Closing Checklist

Regarding month-end closing checklists, certain roles and responsibilities must be taken for them to succeed. As a business owner or manager, you should lead the process by delegating responsibility and meeting deadlines. Other roles include managers verifying disclosed information and accountants reviewing customer payments.

The due diligence of all stakeholders plays a pivotal role in ensuring that the month-end closing is accurate and properly recorded. Considering each job function, every part of the checklist process can run as smoothly and effectively as possible.

Components of Month-end Closing Checklist

Month-end closing is an essential process for any business; it helps the company monitor its financial performance and understand the impact of certain business decisions. A good month-end closing checklist should include a careful review of income and expenses, a comparison between budgeted and actual results, an assessment of pertinent accounts receivable, a valuation check on inventory levels, an analysis of outstanding expenses and liabilities, and a detailed review of cash transactions.

Furthermore, it should identify any anomalies in the data or discrepancies with day-to-day operations so that corrective action can be taken if needed. Accurate and timely month-end close is an important part of keeping accurate financial records that could affect the longevity and profitability of any organization.

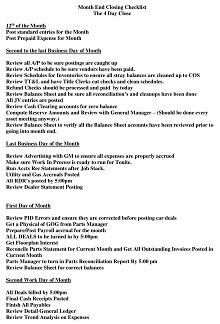

Timeline and Deadlines for Month-end Closing Checklist

Finishing up the month-end checklist can be a stressful and tedious process for any business, but having a timeline is paramount for implementing a streamlined workflow. Many people underestimate the value of deadlines and can overlook potential issues or fail to strategize how they will get everything done properly.

By creating a timeline and deadlines earlier in the month, one can stay on top of their tasks and avoid surprises at the month’s end. With an organized plan, businesses can efficiently close out their monthly checklists without feeling overwhelmed and having to correct errors.

How to Create a Month-end Closing Checklist Template for Your Business

A month-end closing checklist template is invaluable for any business owner or manager. It allows you to keep track of all your tasks and activities that must be completed at the end of each month to ensure that everything is running smoothly. But how do you go about creating such a template? Read on to learn more!

Identify Your Tasks

The first step in creating a month-end closing checklist template is identifying the tasks that must be completed at the end of each month. This could include reconciling bank accounts, reviewing invoices and payments, preparing financial reports, etc. Make sure to list all these tasks so you can easily refer back to them when it comes time to create your template.

Organize Your Tasks into Categories

Once you have identified all the tasks you must complete at the end of each month, it’s time to organize them into categories. This will help make the process easier when it comes time to create your template. Some common categories might include accounting/finance, customer service, operations/production, sales/marketing, etc. This will help ensure that all the relevant tasks are included in your checklist and nothing gets missed out.

Create Your Template

Now it’s time actually to create your month-end closing checklist template. Begin by creating a list of all the categories you identified in step two, then add subcategories under those main headings (e.g., accounts payable under Accounting/Finance).

Then, start adding the tasks related to each category (e.g., reconciling bank accounts). Finally, add notes or other important information about each task (e.g., which accounts need reconciling). Once you’re done with this part of the process, you should have a comprehensive checklist that covers all aspects of your business operations.