45 Private Placement Memorandum Templates (PDF, Word)

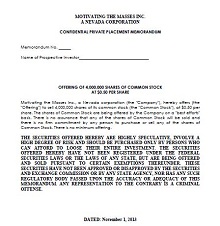

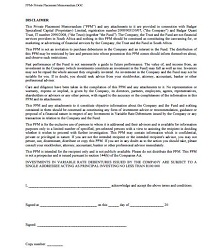

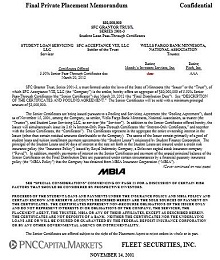

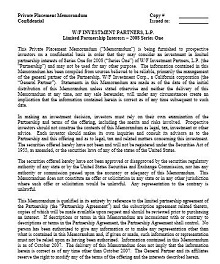

A Private Placement Memorandum (PPM), sometimes referred to as a private offering memorandum, is a document used to raise funds for a private offering. The PPM contains important information about the offering, including details about the issuer, the securities offered, related risks, and the investment structure.

Many companies choose to use Private Placement Memorandum templates provided by legal professionals or investment banks, but it is also important to tailor the language specifically for your investment opportunity. This document is a critical tool in securing funding and gaining trust from investors, so it’s worth taking the time to communicate all necessary information accurately and effectively.

- Accounting Templates

- Art & Media

- Budget Templates

- Business Templates

- Calendar Templates

- Certificates

- Charts

- Education Templates

- Inventory Templates

- Invoice Templates

- Letter Templates

- Medical Templates

- Personal Templates

- Project Plan Templates

- Timesheet Templates

Download Free PPM Templates

What is a Private Placement Memorandum (PPM)?

A private placement memorandum must be provided to potential investors to comply with SEC regulations. It can also serve as a valuable reference for investors and the issuer during fundraising. While not required for all private offerings, a well-drafted PPM can help ensure compliance and provide clarity for both parties involved.

How To Create a PPM For Your Business?

While creating a PPM can be daunting, following proper guidelines can help ensure that your offering document accurately presents the information needed to attract potential investors. Ultimately, a well-crafted PPM can be a valuable asset in raising funds for your business. You can download dozens of private placement memorandum examples and samples in this post.

Why Do You Need a PPM For Your Business?

When it comes to securing investments for your business, a Private Placement Memorandum (PPM) can be essential. A PPM provides potential investors with important information about the company, including its history, financial status, and management team. It also outlines any risks associated with investing in the company and details the terms of the offered investment opportunities. Without a PPM, it can be difficult for investors to make informed decisions about whether or not to invest in your business.

Additionally, selling securities without a PPM can have legal consequences in certain cases. By creating a comprehensive PPM, you increase the chances of attracting potential investors and protect yourself from potential legal issues. A PPM is an important tool for any business looking to secure external funding.

Types Of PPMs

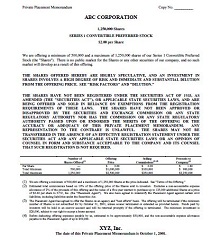

When raising capital for a business venture, a private placement memorandum (PPM) is often the go-to method for attracting investors. However, not all PPMs are created equal. The two main types of PPMs have accredited investor and qualified purchaser offerings.

An accredited investor PPM can only be offered to individuals or entities that meet certain criteria, such as having a net worth over one million dollars or earning an annual income above a certain threshold.

A qualified purchaser PPM can be offered to anyone but often carries more regulations and restrictions.

It’s important to carefully consider which type of PPM best fits your business before embarking on the fundraising process. In addition, some industries may require specialized PPMs to comply with specific regulations – for example, real estate businesses may need a Regulation D PPM to legally sell investment properties.

By thoroughly understanding the different types of PPMs available, you can ensure that you attract the right investors and stay compliant with all necessary laws and regulations.

FAQs

What Is The Difference Between Private Placement Memorandum And Prospectus?

The main difference between a PPM and a prospectus is the audience that they are targeting. A PPM is only meant for accredited investors; anyone can see a prospectus. accredited investors are individuals with a net worth of over $1 million or an annual income of over $200,000.

Another difference between the two documents is the amount of detail included. A PPM will typically include more detailed information about the risks involved in investing, while a prospectus will be more general in nature.

Finally, a PPM is not required to be filed with the Securities and Exchange Commission (SEC), while a prospectus is. This means that a PPM can be distributed without going through the same level of scrutiny as a prospectus.

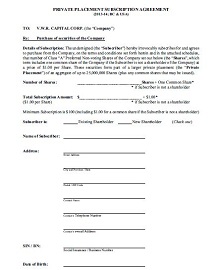

What Is The Difference Between a Private Placement Memorandum And a Subscription Agreement?

The key difference between a private placement memorandum (PPM) and a subscription agreement is that a PPM is a document that provides information about an investment opportunity, while a subscription agreement is a contract between an investor and the issuer of the securities.

What Is The Difference Between a Private Placement Memorandum And a Limited Partnership Agreement?

A limited partnership agreement (LPA) is a contract between the general partner and the limited partners that governs the terms of the partnership.

While both documents are important for any investment, they serve different purposes. The PPM provides potential investors with information about the investment, while the LPA sets forth the rules and regulations governing the partnership itself.

What Is The Difference Between Private Placement Memorandum And Offering Memorandum?

An offering memorandum is a document used to offer securities for sale. The document contains information about the security, the issuer, and the terms of the offering. The memorandum is also used to solicit investors.

What Is The Difference Between a Private Placement Memorandum And an Information Memorandum?

An information memorandum (IM) is a document that provides potential investors with information about a particular investment opportunity. IMs are typically used by venture capitalists and private equity firms when they are considering investing in a company.

What Is The Difference Between a Private Placement Memorandum And an Operating Agreement?

An operating agreement is an agreement between a limited liability company (LLC) members that outlines the company’s operating procedures. The operating agreement typically includes provisions regarding the LLC’s purpose, management structure, and member rights and responsibilities.

What Is The Difference Between a Private Placement Memorandum And a Business Plan?

A business plan is a document containing a company’s goals, strategies, and plans to achieve them. It also includes information on the company’s marketing and financial plans.