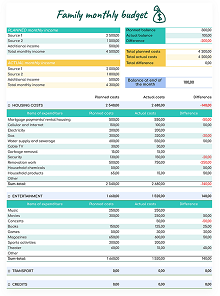

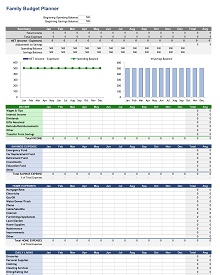

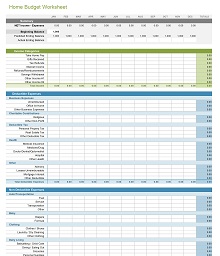

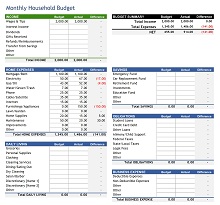

16+ Free Family Budget Templates – Printable PDF, Word

Creating a family budget template can be an invaluable tool for managing finances. It provides a macro view of your financial picture and a detailed breakdown of spending in all budget areas. With this information, spotting areas that need more attention or where you can make better financial decisions is easy.

By setting up a family budget template, you can prioritize expenses and ensure everyone in the household is on the same page financially. This template need not be complicated; even taking a few minutes each month to update it will help you keep track of your money so you can focus on living life rather than stressing over it.

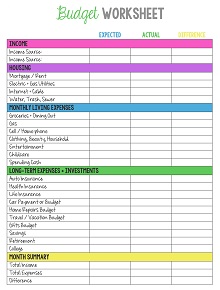

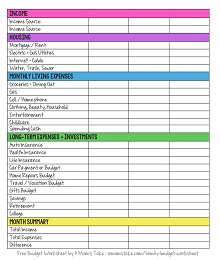

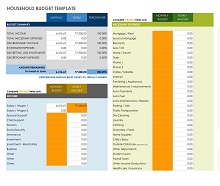

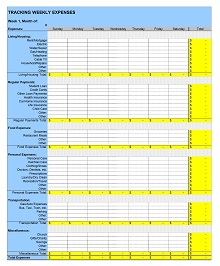

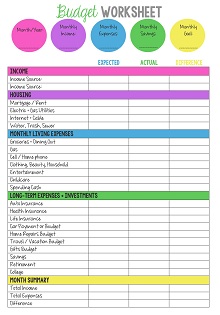

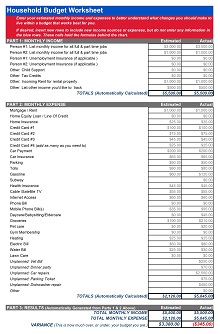

Download Free Family Budget Templates

Types of Family Budget

As a family, having a budget can be a great way to save money and keep track of your spending. But it can feel overwhelming knowing where to start when creating one. That’s why it’s important to understand the various types of family budgets available to find the one that works best for you and your family. Here are some of the different types of budgeting that are out there.

Zero-Based Budgeting

This type of budget starts with zero dollars and requires you to allocate every dollar you earn towards something specific. At the end of the month, all your income should be allocated and accounted for. This type of budget is ideal for people who have trouble controlling their spending or are trying to get out of debt. It forces you to think about where each dollar goes instead of leaving money unaccounted for in your bank account at the end of each month.

50/30/20 Budgeting

The 50/30/20 budget divides your monthly income into three categories: 50% for essentials such as bills, 30% for discretionary spending (like entertainment), and 20% for savings or debt repayment. This is great if you need some flexibility in your budget but still want to ensure you’re saving enough each month while also putting money aside for unexpected expenses or unforeseen circumstances such as job loss.

Envelope System

The envelope system requires each family member (or household) to get an envelope labeled with what they will use it for, such as “Groceries” or “Entertainment,” etc., then fill it up with cash from their allowance or salary so that whenever they need something from these categories, they can take the cash out from their envelopes without having to worry about overspending on their credit cards or dipping into savings accounts. This system is great if you want a more hands-on approach to tracking your spending and sticking within your allotted amount per category.

Why a Family Budget is Important

Creating and following a family budget can be an effective way to keep your finances under control. With a budget, you can manage your spending habits better, as well as those of other household members. An accurate budget helps families understand their resources, from income to assets. It is important to avoid surprises when it comes time to purchase something or pay expenses.

Budgets also help with long-term financial planning by identifying goals and allowing for tracking of progress. A budget also ensures that money is put toward important priorities like savings, investments, and debts. When done correctly, a family budget puts you in greater control over your financial destiny and has the potential to improve the quality of life for everyone involved greatly.

Tips for Sticking to a Family Budget

Planning and sticking to a family budget can be difficult, especially during financially challenging times. But with a few tips, it can become much easier. The first tip is to track all big and small expenses, including those normally forgotten, such as haircuts, vehicle registration fees, and pet costs. Second, allocate money properly in advance for large expenditures such as tuition payments or vacations. If possible, set up an automatic payment system so you will never miss a due date.

Another great tip is to set achievable goals for your family budget together and list long-term plans like saving for college or retirement along with smaller budgeting targets that are easier to meet monthly. Finally, don’t forget to reward yourself occasionally when budgets are met! With these simple steps and patience, any family can become budget-savvy.

Managing Debt as Part of the Family Budget

Managing debt is important in creating and maintaining a solid family budget. Not only can carrying too much debt lead to long-term financial struggles like higher monthly payments, but it can also cause tension between family members responsible for keeping finances in order.

To help manage debt as part of a family budget, set up a payment plan with creditors and ensure everyone is committed to following the plan. Keep track of progress along the way and celebrate successes as a family when goals are achieved. With some planning and diligence, managing debt can become just another aspect of the budgeting process that helps keep your finances organized and your peace of mind intact.

How to Create a Family Budget Template

Money is an essential part of life, and having a budget allows you to track your expenses and save for the future. A family budget template can help you stay organized and on track with your finances. Creating a family budget template is simple, but it takes time and commitment to ensure it’s effective. Here are some steps needed to create a successful family budget template.

Gather Your Financial Information

Gathering your financial information is the first step in creating a family budget template. That means collecting bank statements, bills, receipts, and pay stubs for all household income sources (e.g., salary, part-time job). You want to accurately reflect all sources of income when creating your budget plan. This will also help ensure that no money is unaccounted for at the month’s or year’s end. You’re ready to move on once this information is gathered in one place.

Analyze Your Expenses

Now that you have all your financial information in one place, it’s time to analyze where your money is going each month. Divide expenses into fixed costs (e.g., rent/mortgage, car payments) and variable costs (e.g., groceries, restaurant meals). Ensure you include both necessary expenses and discretionary spending (e.g., entertainment). This will give you an idea of how much money you spend each month on different categories so that you can make adjustments if any category seems out of balance with your goals or overall financial picture. Once done analyzing these expenses, move on to step 3.

Set Goals

When creating your family budget template, setting goals for yourself and the entire family regarding spending habits is important. Some unnecessary expenses can be eliminated, or there are areas where more savings could be made each month (e.g., utilities). Setting goals helps keep everyone accountable when it comes to living within their means while also allowing room for personal growth financially as well as emotionally speaking it encourages everyone involved to think about their spending habits critically so that they can make smarter decisions in the future about how best use their funds wisely.