30+ Free Simple Overhead Budget Templates – PDF, MS Excel

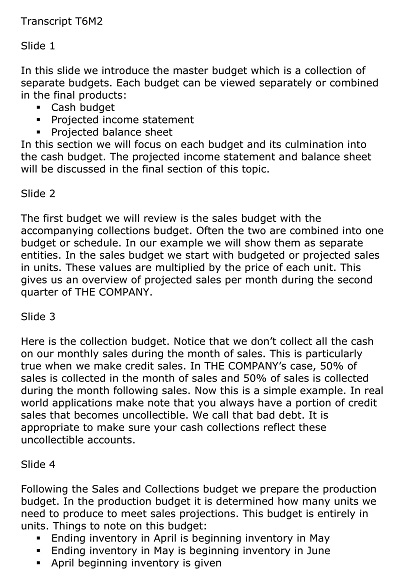

The overhead budget template is crucial for businesses to accurately forecast and manage their expenses. It allows companies to break down their overhead costs into various categories, such as rent, utilities, and office supplies, and allocate funds accordingly. By creating a comprehensive overhead budget, organizations can identify areas where they may be overspending and implement cost-cutting strategies.

This template is especially useful for startups and smaller businesses that must closely monitor their expenditures to ensure financial stability. With the help of the overhead budget template, companies can plan and make informed decisions to achieve their financial goals.

Download Free Simple Overhead Budget Templates

Importance of Overhead Budget

An overhead budget is a fundamental tool for every business that wants to thrive in the long run. It helps businesses to analyze the financial resources they have and prioritize their expenses. With a well-planned overhead budget, businesses can evaluate whether their costs align with their revenues and identify areas that require cost-cutting.

Additionally, overhead budgets can help companies to make informed decisions about capital investment and growth strategies. Businesses can allocate their resources more efficiently and generate higher profits by focusing on their overhead expenses. Ultimately, an overhead budget is essential for every business wishing to remain financially stable and competitive in their respective industries.

Benefits of a Well-Managed Overhead Budget

Managing the overhead budget is crucial to any successful business. A well-organized overhead budget can reap numerous benefits beyond saving the company money. Firstly, it ensures that the company’s resources are allocated wisely and efficiently. It also helps to identify areas that consume the most resources and, in turn, reduces unnecessary expenses.

A well-managed overhead budget can also improve the company’s financial stability by allowing it to make business decisions confidently. Furthermore, it can boost employee morale by averting layoffs or necessitating spending cuts. The benefits of a well-managed overhead budget are far-reaching, and businesses that adhere to this practice increase their chances of thriving amidst competition.

Tips for Reducing Overhead Expenses

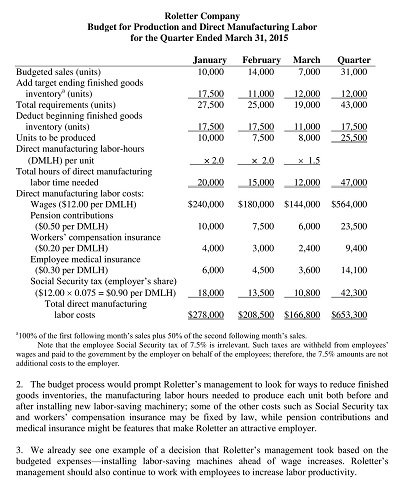

Running a business is no easy feat, and managing overhead expenses is one of the biggest challenges. However, with a few simple tips, you can considerably reduce your overhead expenses and save significant money. Firstly, streamline your operations to eliminate unnecessary costs, such as outsourcing non-core activities, renegotiating contracts with suppliers, and investing in automation tools.

Secondly, create and maintain a feasible budget plan including all expenses, from rent to utilities and employee salaries. Lastly, keep an eye on your company’s cash flow and identify areas where you can cut back on expenses without hampering productivity. Adopting these practices will help you reduce your expenses and lead to greater profitability and success for your business.

How to Create an Effective Overhead Budget Template

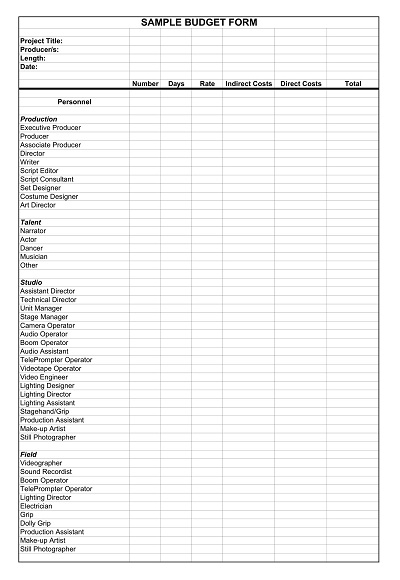

As a business owner or manager, having a clear and concise budget for overhead expenses is important. Overhead expenses are not directly associated with producing a product or service but are necessary to keep the business running. These expenses can vary, including rent, utilities, insurance, office supplies, and more.

Creating an overhead budget template can help you plan and manage these expenses effectively. This blog post will guide you through the steps to create an effective overhead budget template and help you stay on top of your overhead expenses.

Gather Information

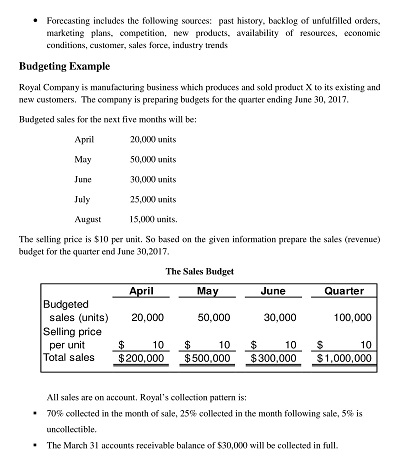

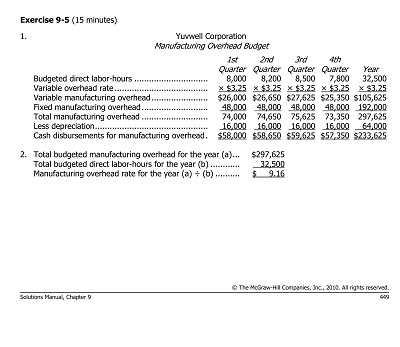

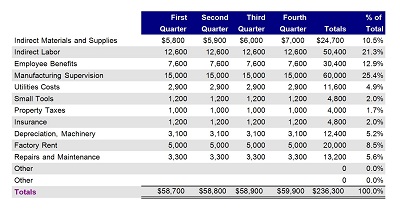

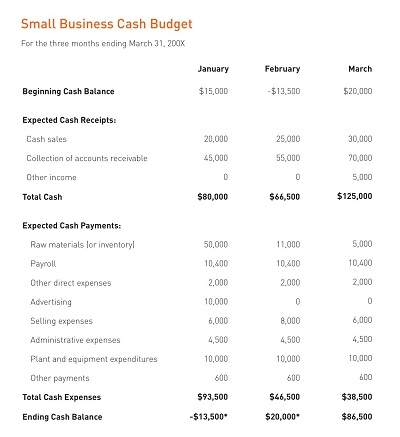

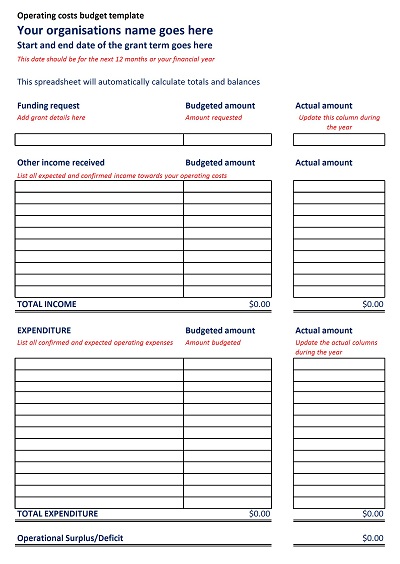

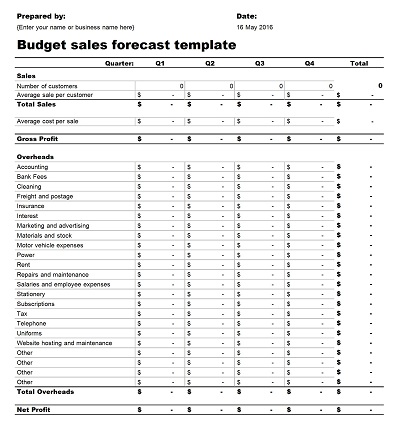

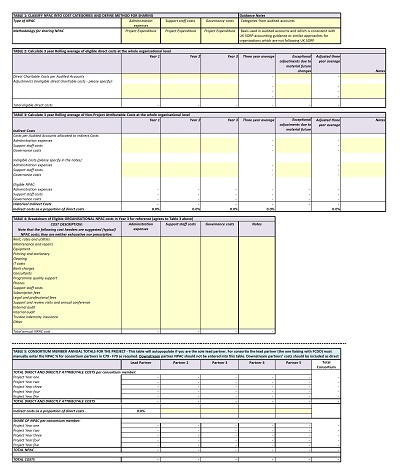

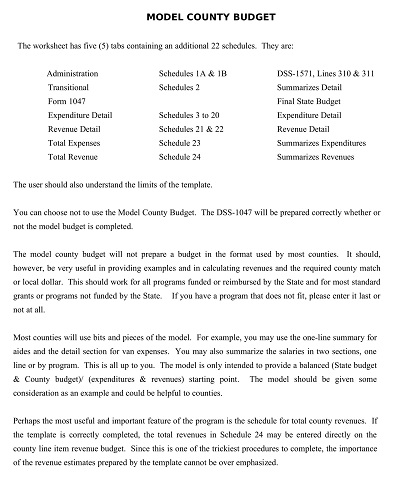

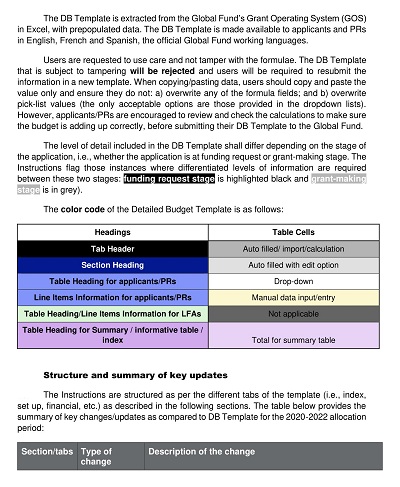

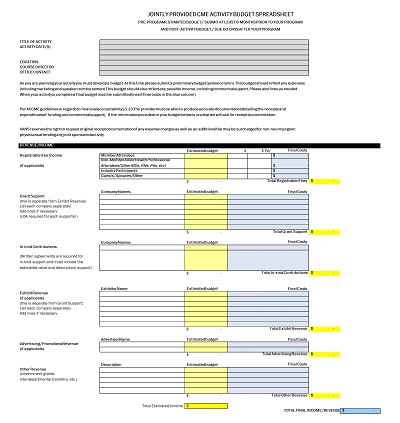

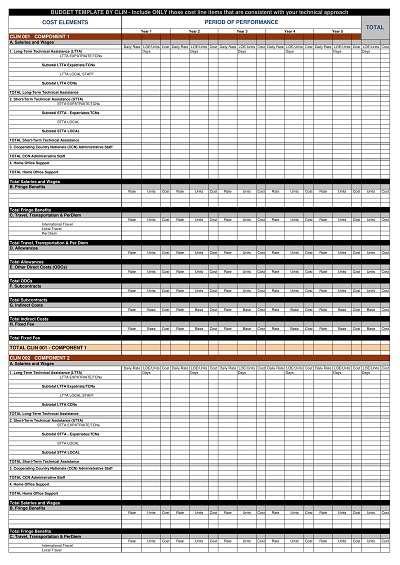

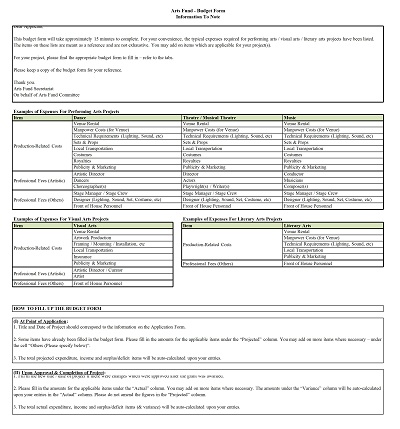

The first step in creating an overhead budget template is to gather all the necessary information. This includes a list of all the overhead expenses that your business incurs. It is important to break these expenses into categories and subcategories to track them effectively.

It is also important to collect data from previous months or years to estimate the expenses accurately. You can use accounting software, spreadsheets, or other tools to get this information.

Categorize and Allocate Expenses

Once you have gathered all the necessary information, the next step is to categorize and allocate expenses. You can use different categories such as rent, utilities, insurance, taxes, phone/internet, office supplies, etc. It is important to allocate expenses accurately to ensure a realistic budget.

You can also allocate expenses based on departments or projects to help you track expenses better. For example, if you have a marketing department, you can allocate all expenses related to marketing under that department.

Determine Budget Period

The next step is to determine the budget period. A typical budget period can be monthly, quarterly, or yearly, depending on your business needs. Choosing a budget period that works best for your business is important. You can also create different budget templates for each period to help you monitor expenses more closely.

Set Budget Limits

The next step is to set budget limits for each category or department. This step is critical to ensure you do not overspend on overhead expenses. You should set realistic and achievable limits based on historical data and future projections.

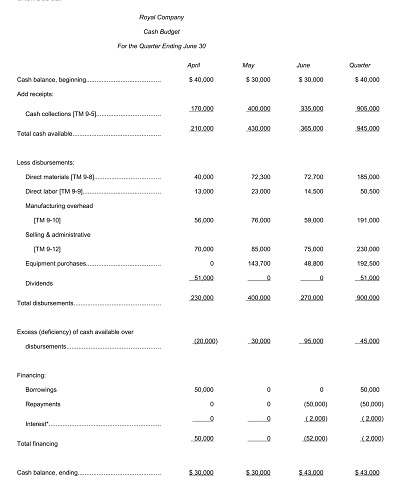

Monitor and Adjust the Budget

Once you have created your overhead budget template, monitoring and adjusting it regularly is important. This helps you stay on track with your expenses and adjust the budget when necessary.

You should review your budget periodically, compare it against actual expenses, and make necessary adjustments. This helps you identify areas where you can cut costs and improve your financial performance.