22+ Free Non Profit Budget Templates

Budget spreadsheets are important for both profit and non-profit organizations. The budget template sheets are a good way to keep track of all the revenues and expenses in an organization. It also gives a perfect overview of what is the current financial status of any business. Here we have collected a few sample nonprofit budget templates for you.

A nonprofit budget template is an essential tool to control the financial resources of a nonprofit organization. A well-planned budget is the first step to planning the future of a nonprofit organization that helps to achieve the desired goals with limited resources. There is a collection of free nonprofit budget templates in Word, PDF, and Excel format that allows you to make better decisions for your organization. The nonprofit sample budget helps you to create a perfect plan to manage the income and expenditure of the organization.

You can download free monthly and annual nonprofit budget templates which are available in a variety of designs to track your financial resources like how to raise funds and how to spend them smartly. These templates are customizable and created in an appropriate format to define all things clearly. In this article, you’ll know all about the nonprofit budget.

- Accounting Templates

- Art & Media

- Budget Templates

- Business Templates

- Calendar Templates

- Certificates

- Charts

- Education Templates

- Inventory Templates

- Invoice Templates

- Letter Templates

- Medical Templates

- Personal Templates

- Project Plan Templates

- Timesheet Templates

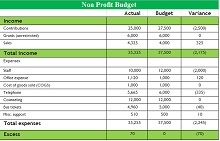

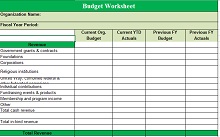

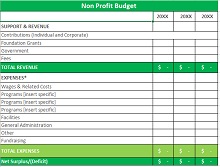

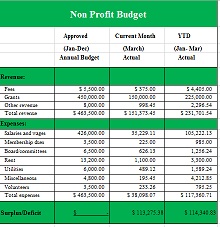

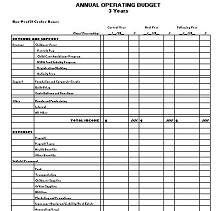

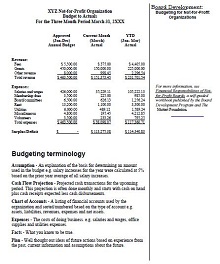

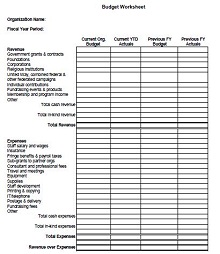

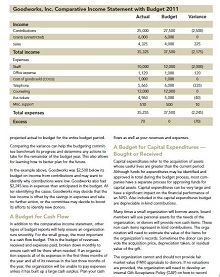

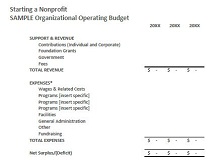

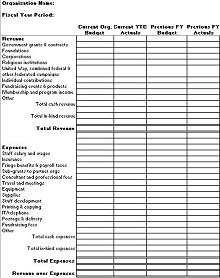

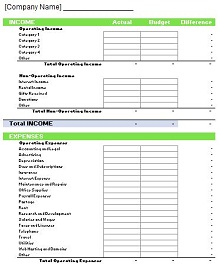

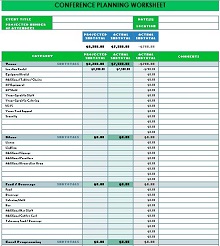

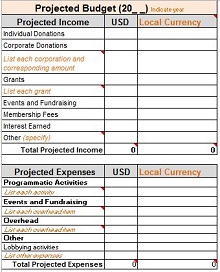

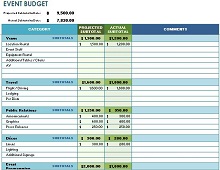

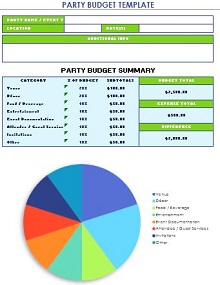

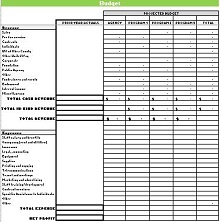

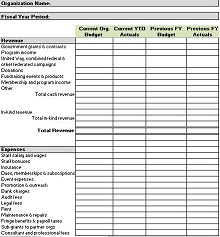

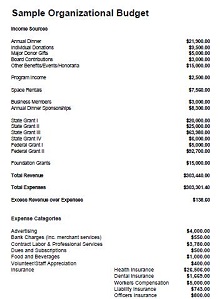

Download Free Non-Profit Budget Templates

What is a Nonprofit Budgeting?

Planning is vital to achieving your desired goals in any field of life. In this way, profit or non-profit organizations create annual or monthly budget plans to track expenditure and revenue. It is the best way to organize all the things efficiently like how to get an amount of money to complete a specific program, how much money we need, and where this money will be spent.

Budgeting gives you a way to accomplish all things smartly. In our collection, you can find perfectly designed non-profit budgeting form templates that help you track your income and expenses efficiently. For a non-profit organization, donations and grants are may the only way to meet the expenses that they face in helping others. You can find a tremendous collection of donation receipt templates that you can use to let the donor know that the donation he/she has made has been received successfully.

The stakeholder of a specific program makes some critical decisions based on its budget. If you want to take your organization to the next level, perfect budget planning reduces the risk of failure and gives you a way to do that. So many companies fail in their starting year, and there are many reasons for their failure, and the big one is poor planning and budgeting.

Lack of investment and poor management can lead your company to failure. In this way, accurate budgeting by calculating the current and expected revenue that the company receives with annual expenses and savings reduces the risk of failure. Download the budget sheet in Excel, Word, and PDF format which helps you to create a successful budget.

Objectives of budget

A budget sheet is a financial document to plan the future of a profit or non-profit company with limited resources. It is an essential document for the effective management of the annual or monthly financial resources of an organization. For the success of a specific program, it is necessary to determine the expenses before starting it. Some primary objectives of creating a budget are as follows:

- Control and manage the organization’s expenses.

- It provides a way to achieve desired goals with limited resources.

- Helpful to determine the future income in a specific period.

- Useful to make essential decisions in adjusting the goals when financial resources are not enough.

- The budget makes a clear comparison between previous and future financial conditions that helps to decide whether this program or business is profitable or not.

- It is the best way to monitor the performance of an organization.

- It coordinates the different departments of the organization towards the same goals.

- A budget sheet motivates the organization’s manager to manage the activities of the organization effectively.

- Analysis of the current condition of the organization and budgeted objective increases the efficiency of the organization’s different departments.

- A budget spreadsheet determines the organization’s activities which are important to fulfill on time for the betterment of the organization.

How to create a budget for a nonprofit organization

In an organization, budgeting is a critical task to perform. The future of the whole organization is fully dependent on it. It is an important financial tool to manage the expenses and revenue of an organization. Nonprofit organizations receive donations and volunteer service to achieve the desired goals. If you have a responsibility to create it, then it isn’t easy to design it from scratch. The budget template for the nonprofit organization helps you do it correctly. Below we share some steps to create a useful budget sheet.

- Timely planning: If you want to create a successful budget for your organization, then you should start planning your budget timely. For that purpose, you need enough time to do it efficiently. You need to discuss it with other stakeholders; if they reject it or want some changes to it, then you need some time to redraft it.

- Estimate expenses: The first and most important step of creating the nonprofit budget is calculating the expenses for each month. Estimate the cost that is directly used for a specific project, monthly staff cost, and other expenses of the company such as rent and utility bills.

- Expected income: After calculating the expenses, the next step is to determine the revenue over the next year. The expenses of the organization fully depend on the current and expected money of the organization. Create a detailed list of income sources from where you expect to get funds.

- Determine variable expenses: To set up a successful budget, determine the variable expenses of your organization. These variable expenses are marketing costs, travel, shipping costs, and utilities.

- Unexpected funds: You should always be ready for unexpected costs. Assume that your organization’s computer is damaged or your company gets a big loss from a program. It would be best if you plan for such kinds of unexpected events. It will help you to handle these kinds of events efficiently.

- Financial management: It is the most crucial step in the budgeting process. Now, it’s time to organize and control all expenses according to the expected income. If an organization can’t get the funds as expected, then budgeting is the best way to handle it effectively.

- Finalize all things: Download the budget spreadsheet from our site to get started. Put all the numbers in it to track the actual result vs budget.

Benefits of nonprofit budget

If you want to give a charity in the secure hands that convey it to the needy people, nonprofit organizations play an important role in the betterment of the needy people. Some people donate money or other things to serve other people, but some provide community service for their community.

When someone offers community service, the charitable organizations issue a community service confirmation letter for the person who served. In this way, they need to draft a budget annually that shows what they expect from their donors and what the expenses are over the coming year. Some significant benefits of budgeting are as follows:

- It is the best way to control the money of the organization.

- Helpful to track and achieve the desired objectives.

- It determines the income sources, where this money will be spent, and what you will have each month.

- Budget manage, control, and organize the expenditure.

- It will give you the final number of how much you spend on a specific service at the end of the month.

- The budget sets aside the money for unexpected events that help to handle these things quickly and efficiently.

- You can track your savings with a budget sheet that may be used for starting a new project.

- Budgeting helps to monitor the performance of the organization easily.

- It provides precise analysis which helps to make important decisions.

- A budget is a way to plan the future of the organization.

- The budget sheet motivates the organization’s manager and other staff members to achieve the desired goals.

Tips to create a successful budget

When everything is going on with planning in your organization, then you can manage it more effectively. When we talk about budget, it means planning, organizing, tracking, managing, and controlling the financial resources of a nonprofit organization. It would be best if you published the details about the previous year’s budget to let donors know about their donations. It is an essential but tricky task to create an adequate budget for an organization. The templates of basic nonprofit budgets help you to create a successful budget. Follow the below-mentioned tips to create a successful budget:

- Plan in advance: Before the start of the new month or year, your budget plan should be ready. You will get better results if you plan the organization’s future on time. When you have enough time to create it, your mind is relaxed, and you can make better decisions for the betterment of the organization.

- Discuss with your team: All your hard work will be wasted if your team rejects your drafted budget, hence it is necessary to discuss it with your team before drafting it for their precise opinion.

- Prioritize the goals: Budget estimated the future expenses and income to achieve the desired goals. Analysis of the long and short-term financial objectives to make your budget prioritized.

- Be flexible: Make sure your budget should be drafted in a way that accepts any changes at any stage of the year. If you see a specific program is going to be over budget, then it should be flexible enough to adopt all the changes over time.

- Review it regularly: You should see your budget and make a clear comparison between the actual results and budget at the specific date. You should review your budget regularly and make changes that are required to achieve the desired goals.

Top 5 budget mistakes to avoid

Some companies make small mistakes while creating the financial budget; that’s why their budget is not successful. They face many financial difficulties which may lead them to failure. Below we discuss the mistakes that companies or organizations make with their solution.

- Lack of communication: Lack of communication is one of the biggest pitfalls of budgeting. An unexpected budget from the organization’s manager may create a disturbance among the stakeholders. It would help if you discussed it with your team for better results before finalizing it.

- No saving goals: When you don’t set saving goals in your budget, then your company isn’t able to start a new project or handle any unexpected funds. At the mid or start of the year when you don’t have enough money to start a program, or you need money to complete a program, then your saving is a way to do that.

- No tracking of spending: For the success of the budget, it is necessary to track your expenses. It’s a primary objective of budgeting, and if you are not tracking it, then your budget is in danger. You should set goals to track your spending at a specific date of each month. You should check your organization’s bank account regularly to prevent any pitfalls.

- Same budget every time: When you create the same budget every time, it means you are not estimating your spending which changes every month, you don’t calculate the expected income you receive which may prove a big pitfall for your company. The budget should be created after analyzing all the financial things in detail.

Frequently Asked Questions

Difference between profit and nonprofit organization?

A profit organization’s main objective is to earn profit, whereas nonprofit organization’s primary purpose is to help the needy people by collecting donations and grants.

What are the basic purposes of budgeting?

The basic purpose of budgeting is to control and manage the organization’s financial resources.

What are the elements of the budget?

The basic elements of the budget are: Set the goals, estimate expenses, expected income, coordination and flexibility.

What are the types of budget for business?

The cash flow, operating, financial, master, incremental and zero-based are the basic types of the budget for the business.

What is the capital budget?

The capital budget is a process of spending the funds for long term projects to get the maximum profit. It is also known as “investment appraisal”.

What is the master budget?

The master budget is a planning process of aggregation of all the small budgets of the organization to create the final one budget.