12+ Free Sample Self Direction Budget Templates – Printable PDF

A self-direction budget template is an important tool for helping individuals maximize their financial autonomy and security. It serves as a helpful guide for how to allocate income towards lifestyle costs, savings, and investments in order to reach personal goals and maintain financial stability.

A quality self-direction budget template should offer personalized guidance tailored to each individual’s goals, income, and expenses. By taking some time to customize the budget, individuals can clearly understand where their money is going, allowing them to make wiser decisions about saving, spending, and investing for maximum future benefit.

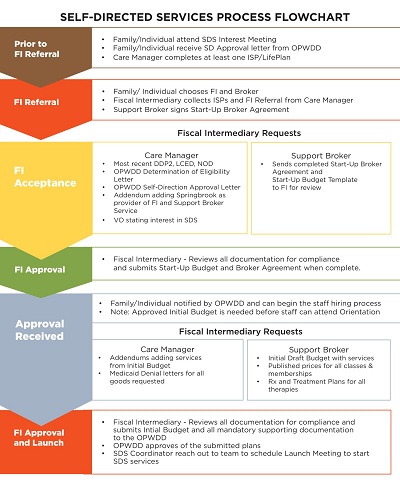

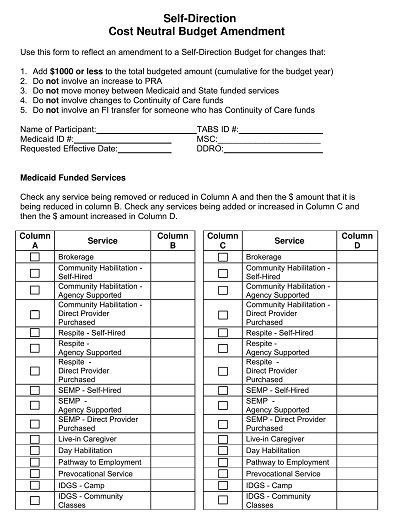

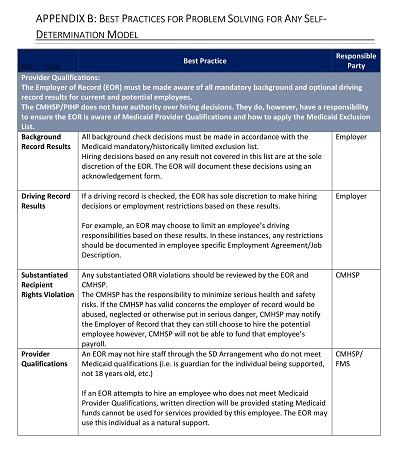

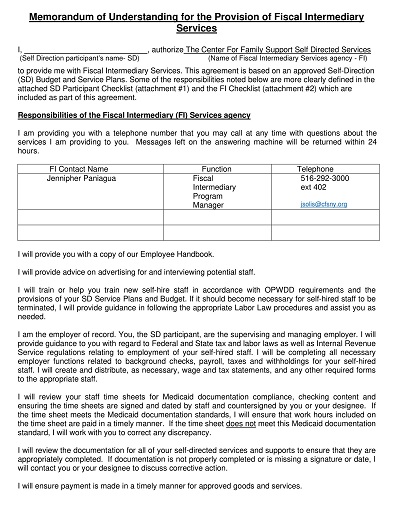

Download Free Sample Self-Direction Budget Templates

Benefits of Self-Directed Budgeting for Financial Freedom

A self-directed budget can be one of the greatest steps an individual can take toward achieving true financial freedom. By taking the time to learn how to manage and track income and expenditures successfully, an individual can create a better understanding of their overall financial situation. Self-directed budgeting helps individuals identify areas where spending could be reduced and creates more mindful spending patterns.

This organization does more than save money; it gives individuals greater control over their lives and improved peace of mind regarding their finances. Through careful analysis of their current spending habits and creativity in developing new income streams, those utilizing self-directed budgeting can substantially increase their wealth.

Achieving Financial Goals with Self-Direction Budgeting

While budgeting is often viewed as daunting, having an organized and self-directed approach to setting and achieving personal financial goals provides immense satisfaction and confidence. Through a reliable system of micro-goals that are easy to track, individuals can use budgeting tools to measure their progress against larger goals and develop better spending habits that get them ever closer to achievement.

A successful budget also sets aside discretionary funds for personal joys like vacations and entertainment, further motivating someone toward financial independence. With some dedication and organization, embarking on a self-directed journey toward achieving financial goals will be a rewarding experience for all who take it up.

How to Create a Self-Direction Budget Template

When managing finances, keeping track of every penny spent can be challenging. However, with a self-direction budget template, planning and tracking expenses becomes easier, allowing you to stay on top of your finances.

By developing a personalized budget template, you can easily identify your expenditures and track your progress. Here are some steps on how to create a self-direction budget template.

Identify Your Income and Expenses

Before creating a budget, list all the sources of income, including salary, commission, and bonuses. Once you have a list of your income sources, list all expenses incurred in your daily life, including groceries, rent, car payments, utilities, and entertainment costs. Categorizing your expenses is crucial when creating a budget to ensure no expenses are left out.

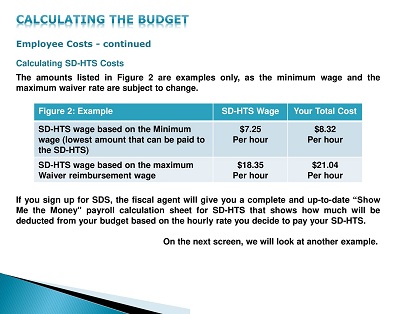

Calculate Your Monthly Income and Expenditure

Create a spreadsheet and enter the amounts under each category. Total the amount for each category to determine the total monthly expenditure and income. By calculating your monthly income and expenditure, you can quickly determine how much money goes into each category and plan accordingly.

Determine Your Financial Goals

Set financial goals based on how much money you want to save each month. Decide a figure that suits your lifestyle so you can allocate resources effectively. Make sure your goals are achievable and realistic. Besides, set aside some money for unexpected expenses or emergencies.

Allocate Funds

Allocate funds towards each category based on how much you spend each month. Always prioritize the most important categories, such as rent and groceries. Ensure that your expenses do not exceed your income. Allocate more funds towards your financial goals, but leave room for unexpected expenses.

Monitor Your Progress

Track your progress by keeping an eye on your weekly and monthly expenses. Make adjustments where necessary to ensure you are on track to achieving your financial goals.