40+ Personal Guarantee Form Templates (Free PDF, DOC)

Personal Guarantee Forms are an essential document for any contract involving the exchange of money or goods. By signing a personal guarantee form, you declare that you are responsible for paying off any debt or damages incurred by either party if the other goes back on their part of the agreement. Personal Guarantee Form Templates are available to help make this process easier, saving time and resources. As important as this document is in securing a business agreement, it is crucial to understand the implications of signing such a form before moving forward.

For example, understanding your financial boundaries and contractual responsibilities under the agreement could help you make an informed decision about whether to accept or deny certain requests from the other party. When used in the correct context and applied with caution, personal guarantee forms can be an effective way to ensure mutual protection when executing and enforcing contracts.

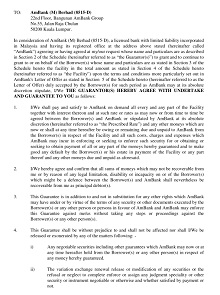

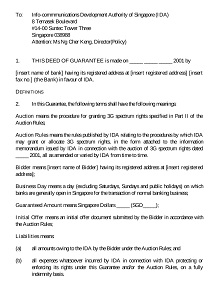

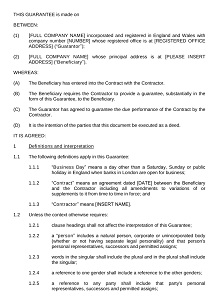

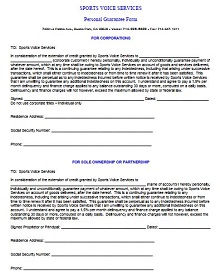

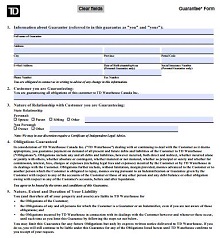

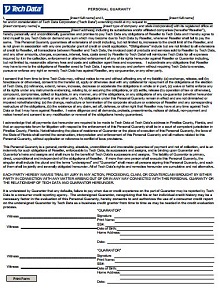

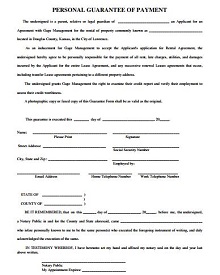

Download Free Personal Guarantee Form Templates

Types of Personal Guarantee Forms

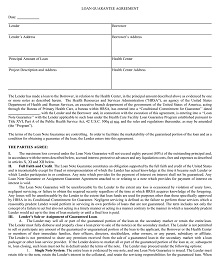

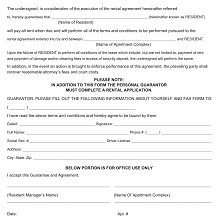

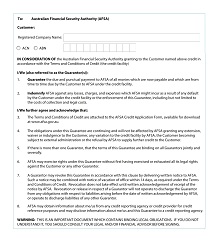

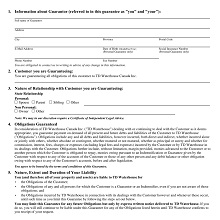

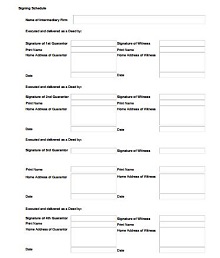

Several different kinds of forms might be required when signing a personal guarantee. These include Credit Application Form, Unsecured Loan Agreement, Lease Guarantee Agreement, and Security Deposit Receipt. The form you need will depend on the type of loan or lease agreement signed, as well as any other specific requirements from the lender or lessor.

- Security Deposit Receipts: are used when leasing a property or piece of equipment for your business. This form details all fees paid by the lessee upfront before taking possession of the leased property. It also specifies any additional fees that may apply if certain conditions are not met such as early termination clauses or late payment penalties.

- Unsecured Loan Agreements: are generally used when borrowing money from banks or other financial institutions without collateral (i.e., unsecured loans). This document outlines all terms and conditions related to repayment, including interest rates, repayment schedules, and any associated penalties for non-payment or late payments. The borrower must agree to all terms listed in this document before taking out an unsecured loan with any lender.

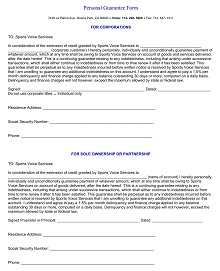

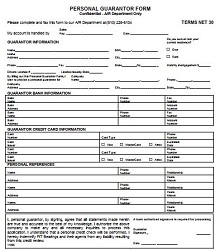

- Credit Application Form: This is typically used when applying for credit with another business entity such as a vendor or supplier. This form provides information about your company’s financial standing so that potential lenders can decide whether they want to extend credit to your company. It also includes information about any existing debts you may have with other creditors so that lenders can assess your risk level before extending credit to your business.

- Lease Guarantee Agreement: This is commonly used when signing a lease agreement between two parties, typically between a landlord and tenant, where one party agrees to act as guarantor for payments made by the other party if they default on their obligations under the lease agreement. This document outlines all legal obligations assumed by both parties involved in the lease agreement, including rent amounts due each month and any penalties for non-payment or late payments due under the lease contract.

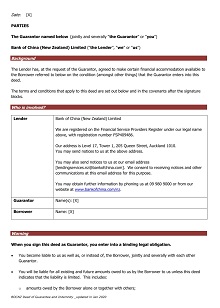

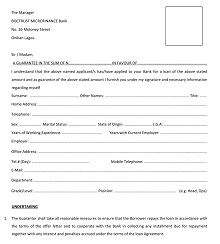

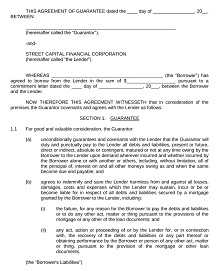

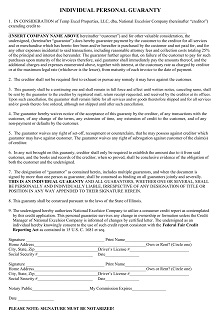

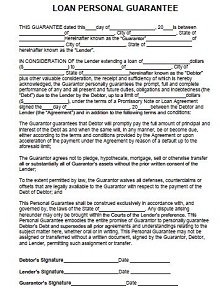

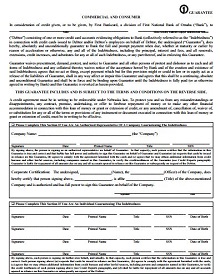

What Does a Personal Guarantee Form Look Like?

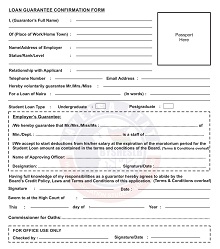

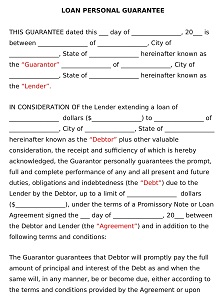

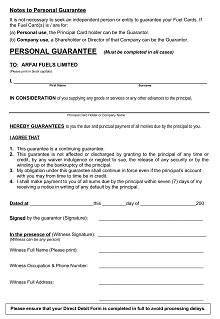

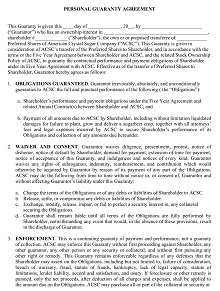

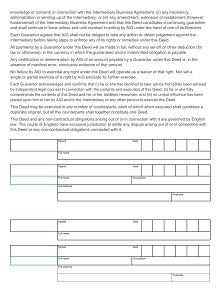

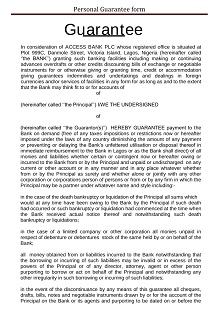

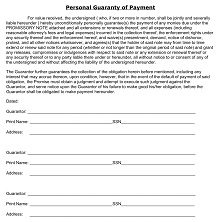

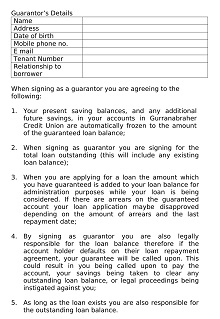

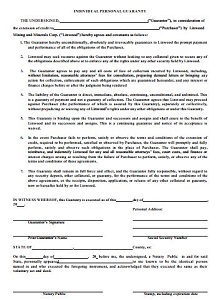

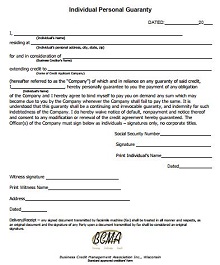

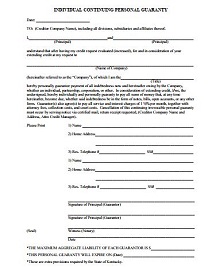

A personal guarantee form typically includes information about the individual such as name, address, date of birth, and signature. It also includes details about the loan including loan amount, interest rate, repayment terms, and due date. In addition, it will indicate that the individual agrees to be personally liable for any outstanding debts if the company fails to make its payments on time. The form must be signed by both parties before becoming legally binding.

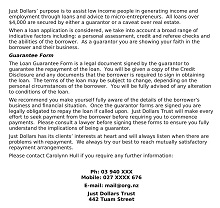

Why Do You Need a Personal Guarantee Form?

A personal guarantee form is essential for entrepreneurs and business owners who want to protect their personal assets from potential creditors should their business fail to pay its debts. By signing this document, you are agreeing that you will assume full responsibility for any outstanding debt if your company cannot repay its loans or other financial obligations. This provides extra security for lenders and can help you secure better financing options since they know they have someone else on board who is willing to take responsibility if something goes wrong.