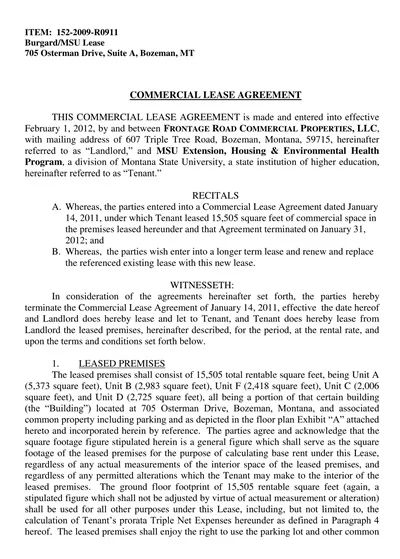

36+ Simple Commercial Lease Agreement Templates (DOC, PDF)

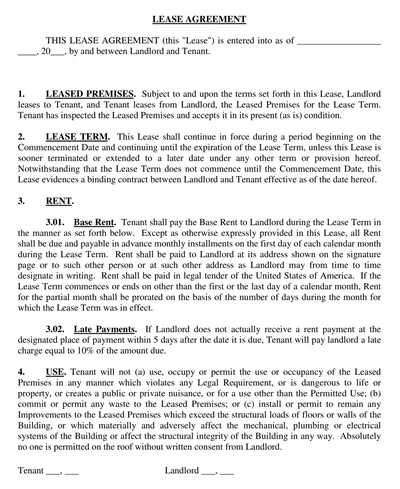

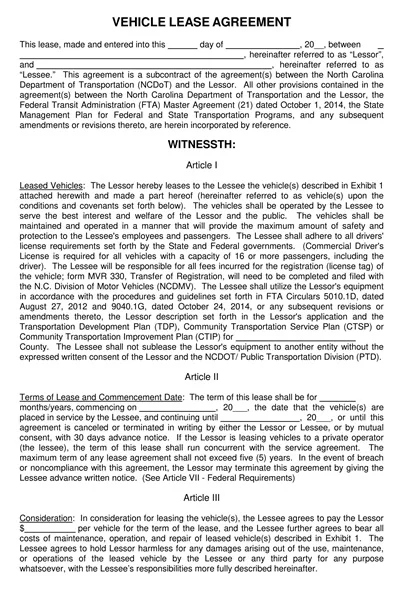

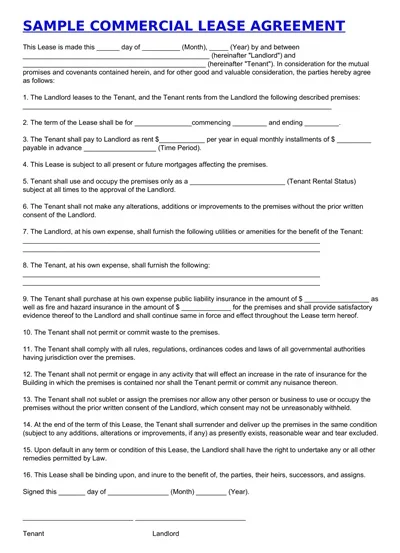

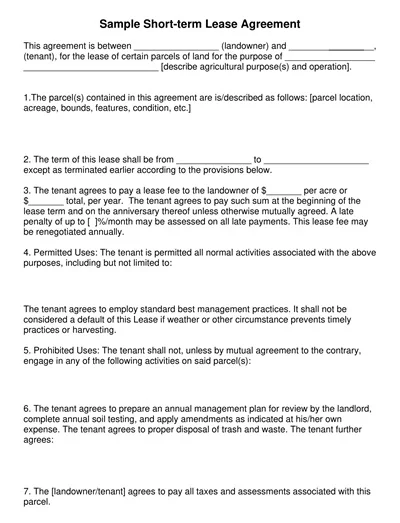

A Commercial Lease Agreement Template is a document that provides the terrain and short list of the conditions that a landlord leases the commercial property to the tenant. The outline usually comprises vital components such as the names and contact details, the address of the property, lease term duration, rent amount with payment schedules, and the tasks of both parties regarding repair and maintenance or utilities.

Moreover, it addresses the deposits for security, the clauses on renewal options, the use restrictions of the property, and the clauses for mutual termination. Through the Commercial Lease Agreement Template, both parties will be in a position to maintain transparency and also have legal protection during leasing, thus they will be able to avoid points of conflict and have a professional lease agreement.

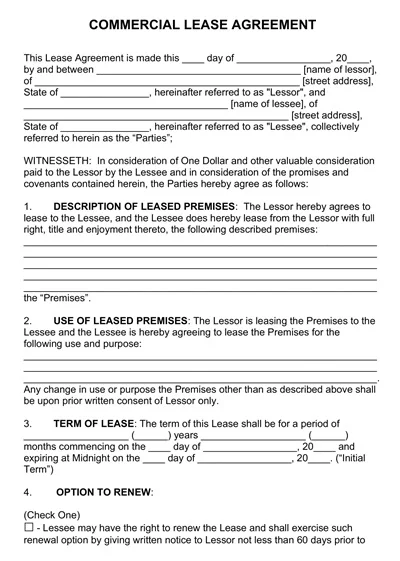

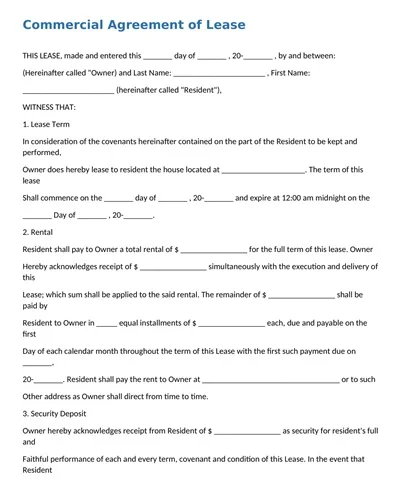

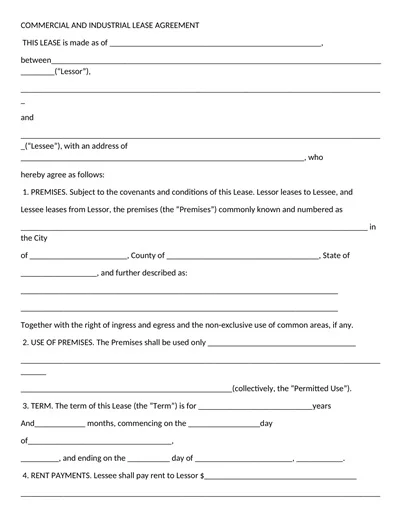

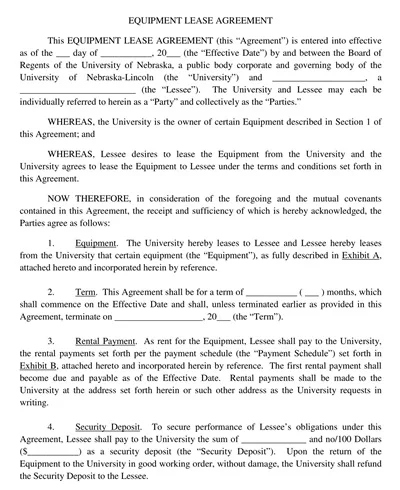

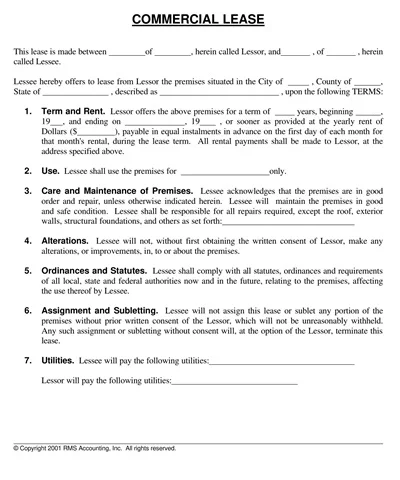

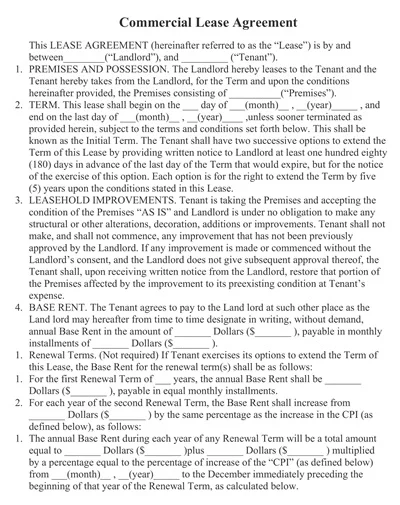

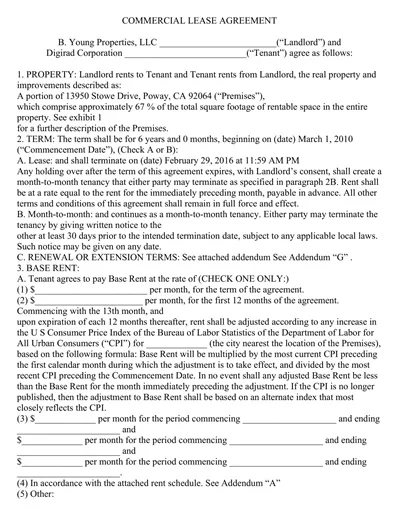

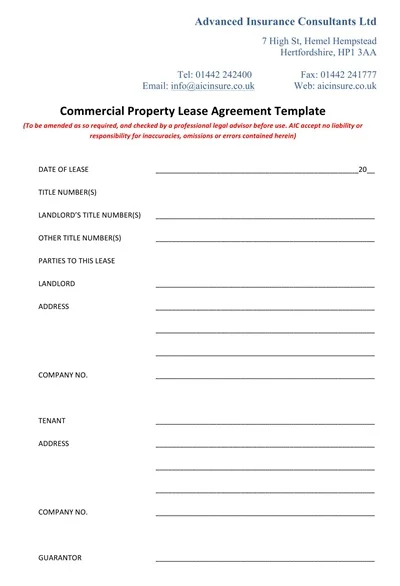

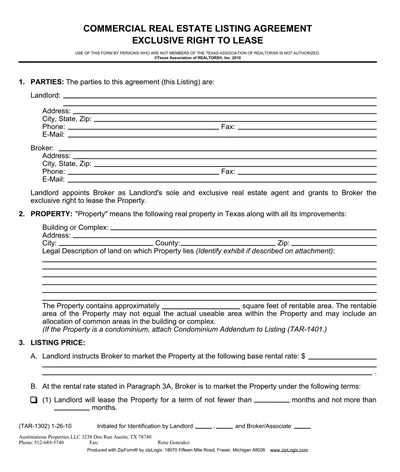

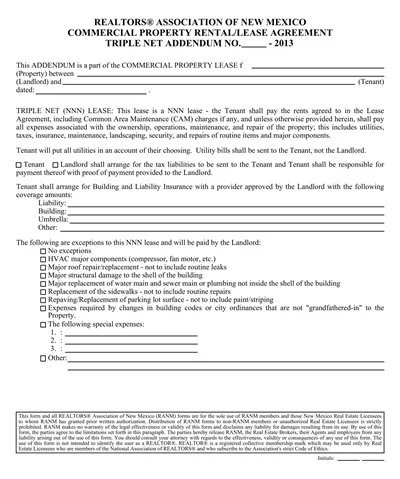

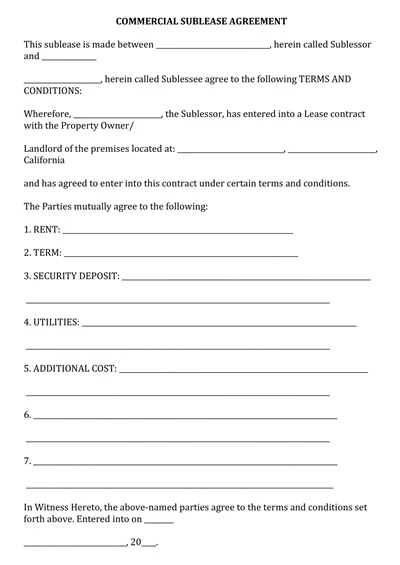

Download Simple Commercial Lease Agreement Templates

What is a Commercial Lease Agreement?

A Commercial Lease Agreement is a document that is set up under the law, between a landlord and a business tenant, that contains the terms and conditions of the lease of the property for commercial purposes. These particulars are illustrated herein in the form of the lease duration, rent amount, payment schedule, and both parties’ responsibilities toward maintenance and repairs.

In addition, it sets out the permitted use of the property, rules, and any terms and conditions concerning renewal or termination of the lease. Besides defining these conditions, the Commercial Lease Agreement enables the parties involved, i.e. the landlord and the tenant, to protect their interests, ensuring the agreement is understood by both parties and reducing the likelihood of disputes.

Types of Commercial Lease Agreements

You must be aware of the different types of commercial leases you can get when you decide to sign a leasing contract. Each of these involves its distinct characteristics and costs that could affect both a landlord and a tenant in different ways.

1. Complete Lease Service (Gross Lease)

A full-service tenancy arrangement, otherwise known as a gross lease, occurs when the property owner covers all expenses that are encountered in the property. Such expenditures normally consist of property tax, insurance of your building, maintenance, and utilities. The tenants have the advantage of paying rent payments but such leases are more costly in the base rent to cover the cost of the owner.

2. Net Lease

Net leases involve the tenant paying for some or all the property charges over the top of the base rent.

- Single Net Lease (N Lease): Tenants are responsible for base rent and also pay their proportional property tax.

- Double Net Lease (NN Lease): The inhabitants are liable for basic rent, property tax, and insurance premiums.

- Triple Net Lease (NNN Lease): The tenants contribute to the base rent payments, property lots taxes, insurance, and maintenance fees. This is correspondence to the most common type of NN lease.

3. Modified Gross Lease

A modified gross lease incorporates characteristics of a gross lease and a net lease at the same time. In this lease, the tenant pays the usual rent and also the portions of those operating expenses that are allocated to the unit. The particular costs, which may be charged to the tenant, can vary whereas a gross lease model could be less complex and still provide a middle ground between the total cost sharing of a net lease.

4. Percentage Lease

In a percentage lease, the tenant is supposed to pay a base rent and a part of his gross sales. Here, the rent varies according to the tenant’s income and sales results, which contributes to the landlord’s success. In a way, this lease is perfect for the retail market. The percentage extra on the base rent comes into play after the tenant’s sales have come beyond a particular limit.

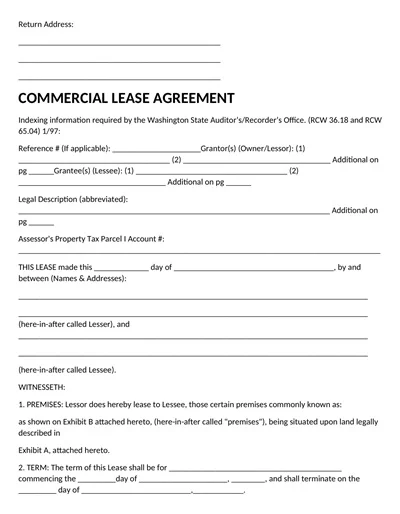

What should be included in a Commercial Lease Agreement?

A comprehensive Commercial Lease Agreement should include the following elements:

- Parties Involved: The tenant agreement shall include the names of both the landlord and the tenant.

- Property Description: Supply the specifications of the premises, the address as well as the particular area if any others than those stated in the lease. g. , parking spaces).

- Lease Term: List the rental term in the lease agreement including the start and end dates.

- Rent Details: Providing rent amount, payment frequency, payment mode, and any increases during the leases are the main points.

- Security Deposit: Inform about the deposit amount, terms and conditions for its return, and any deductions (if they are planned).

- Maintenance and Repairs: Set out the landlord and tenant duties for the housing units, pointing out what the landlord must be responsible for and what tenants can maintain by themselves.

- Use of Premises: Mention if there are any permissible uses of the property and any limitations on doing anything to it or altering it.

- Insurance Requirements: Here, you should be certain which insurance types will be mandatory and what person will purchase such insurance policies.

- Utilities and Services: Specify that the landlord has to pay the bills for utilities and services such as HOA and parking.

- Renewal and Termination: Enumerate the lease’s renewable and non-renewable circumstances; point out required notice periods.

- Default Provisions: Determine what situations class in a leasing default and what are the consequences for the parties involved.

- Dispute Resolution: In your plan include procedures for solving the disagreements by the methods such as mediation and arbitration.

- Signatures: Secure that the document is signed and have the date on it by all the parties, including a witness signature if necessary.

Do I need a Commercial Lease Agreement?

A Commercial Lease Agreement is so important for those about to commence their own business in any property they have hired. It sets out the conditions that must be met and their consequences in a written legally binding document termed the Tenancy Agreement which includes among others, the rent amount, the lease duration, and responsibilities of both tenant and landlord.

Having a Commercial Lease agreement as an active policy of both parties not only acts to provide clarity and guarding power but also acts to prevent future disputes. Collating in place the fine print of the tenancy agreement is quite critical as it binds both the landlord and tenant with clear-cut rights and duties, leading to a harmonious business partnership.

How to review a Commercial Lease Agreement

Commercial Lease Agreement is no exception; every detail must be covered to ensure all terms are mutual and can be understandable.

Here are some important points to consider:

- Lease Terms: Make sure of the length of the lease as well as the first day and the last day. Ratify renewal options and any extension conditions in the contract.

- Rent Details: Verification of rent amount, due dates, and permissible payment types is essential. Research on late fees, fines as well as any rents amount increase during the lease term.

- Security Deposit: Learn the security deposit amount asked and the terms of its deposit return. Make a note of any non-refundable deposits and fees to avoid any surprises.

- Maintenance and Repairs: Know what party has to be responsible for the building maintenance and repair. Make sure the agreement particularizes the responsibilities of both the landlord and the tenant.

- Use of Premises: Ensure that the lease indicates expressly how the property is to be utilized. See if there are any limits on some activities or you might need to issue some special permits.

- Alterations and Improvements: Make a point of finding out if the tenant is allowed to make any changes or adjustments to the property. Make sure that you have written consent from the landlord if there are any conditions or approvals needed.

- Subleasing and Assignment: Verify the terms connected to subleasing or replacing your lease with another party. Verify what the landlord wants and what restrictions are involved.

- Termination Clause: The termination ground of either party by the lease agreement must be stated clearly. Take note of any notice periods and penalties for terminating early your agreement.

- Insurance Requirements: Review the insurance documentation to make sure it is by applicable coverage amount and type. It is also mandatory to obtain the right liability and property insurance.

- Dispute Resolution: Check for the clauses dealing with sources of dispute resolution methods like arbitration and mediation to know how conflicts are resolved.

Investigating these parts of the Commercial Lease Agreement thoroughly can save you trouble anymore and keep you in peacetime.

What are a Commercial Landlord’s responsibilities?

A commercial landlord faces so various important responsibilities to guarantee that the property is safe and functional and that no one complains about its non-compliance with relevant laws. These obligations cover structural assignments such as the roof, walls, and foundation among many others besides assuring that all of the systems work perfectly fine like plumbing, heating, and electrical.

Furthermore, they are required to follow health and safety standards accordingly, which could consist of routine inspections or restoration to maintain a safe environment. Furthermore, the commercial landlords are also accountable for common areas and for keeping them clean, well-lighted, and have access day and night. Other than this, they must also comply with the terms of the rent agreement, providing a peaceful environment for the tenants to carry out their business activities and addressing any problems or complaints expeditiously. The effective communication and direct handling of these responsibilities will contribute to a favorable environment for the property owner and tenant.

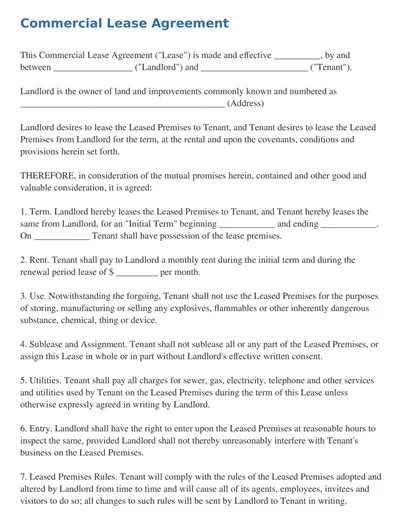

How to Write a Commercial Lease Agreement Template

Crafting a well-defined Commercial Lease Agreement is a key fundament for establishing clear duties and rights of a landlord to a tenant.

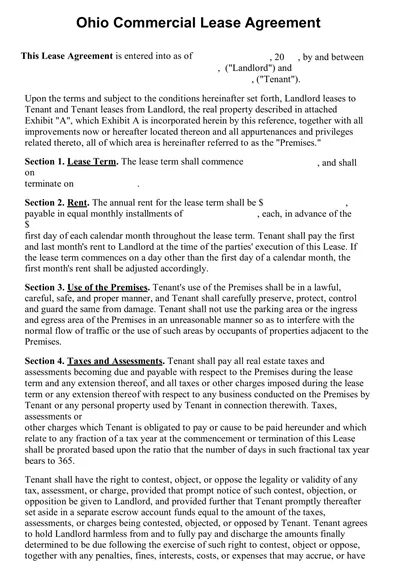

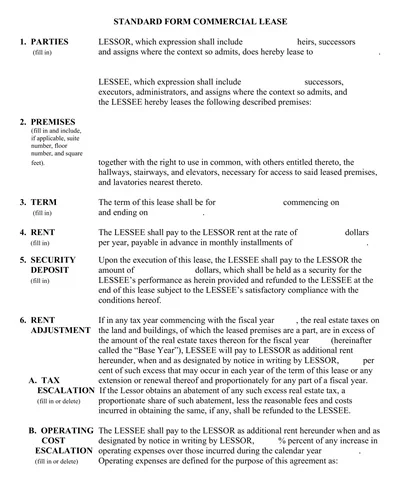

1. Title and Introduction

First, put your title “Commercial Lease Agreement” or “Commercial Tenancy Agreement” at the helm of the paper. Then you should write a paragraph with a broad introduction that deals with the purpose of the agreement and identifies the persons who are the parties.

2. Parties

It is better to indicate the names and contact information of the landlord and the tenant as well. Put the address and ID along with other information thereon. Listen to the given audio and then answer the questions provided.

3. Property Description

It is important to give a precise description of the commercial property that you are leasing. Please provide the address, and square footage, and describe the special features or use designations of the assigned property.

4. Lease Term

State your lease start date and expiration time. If the lease can be renewed, ensure that leasing conditions are specified and if possible renewal conditions for the next lease.

5. Rent Details

Specify the sum, depending on the number of transactions (e. g. weekly, biweekly, etc. ). g. The most recent address, mailing address, and the date the bill should be paid (monthly, quarterly). On the part of late payments, indicate those consequences, like higher penalties, additional charges, or even higher interest rates.

6. Security Deposit

Discuss how much the reservation deposit is what conditions they have to return to the renter and how much time will they need to return.

7. Maintenance and Repairs

Specify what should be in line for both landlord and tenant concerning fixing and repairs. Make it clear regarding what the landlord is going to do and what kind of responsibilities are included for the tenants.

8. Allowed Use and Limitation are highlights

Name the intended function and of prohibitions, even obligation denote. This could mean the enactment of zoning laws, forbidden activities as well as conditions that limit any sort of changes to the area.

9. Insurance Requirements

Specify the insurance policies that both lessor and renter will enter into the contract, ones involving liability and property insurance. Include the smallest amounts required as a baseline.

10. Default and Termination

Talk about parameters that will define a landlord’s breach of the lease and what will follow. Offer instances of breach resolutions and also phase out options.

11. Governing Law

Specify the competent legal system under the lease contract. It can be represented by, for example, a situation where a house is not far away from the city center and a very close public transport link giving quick access to the downtown.

12. Signatures

Make provisions spaces where the tenant and landlord settle the agreement by signing and dating it. Verify that the signatures are witnessed and are notarized as specified under local laws.