50+ Free Debt Payment Schedule Templates – Excel, PDF

A debt payment plan is an essential tool for getting out of debt. It allows those struggling with debt to make payments towards their debts over a designated period to pay off their entire balance eventually. This plan can often be used with various forms of debt consolidation, where you can combine all your debts into one single lump sum payment at a reduced interest rate.

By creating a budget and a debt repayment plan, people can regain control of their finances while still progressing toward paying down debts. Ultimately, the goal is to develop good financial habits that will benefit you in the long run and set yourself up on solid footing even when managing future credit.

- Accounting Templates

- Art & Media

- Budget Templates

- Business Templates

- Calendar Templates

- Certificates

- Charts

- Education Templates

- Inventory Templates

- Invoice Templates

- Letter Templates

- Medical Templates

- Personal Templates

- Project Plan Templates

- Timesheet Templates

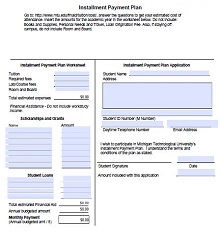

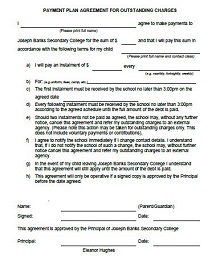

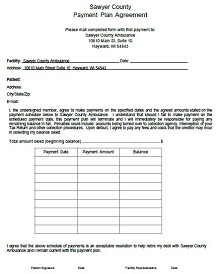

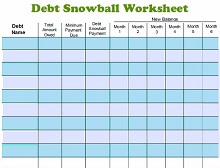

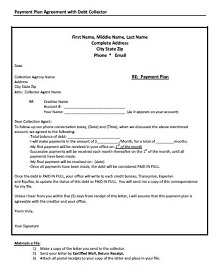

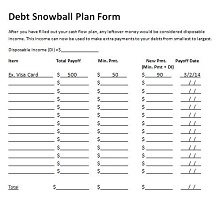

Download Free Debt Payment Schedule Templates

What is a Debt Payment Schedule?

A debt payment schedule or plan is a strategy individuals or businesses use to make consistent payments toward their debt to pay it off as soon as possible. This can involve budgeting, setting clear goals around paying down the debt and committing to making steady payments that are affordable and separate from regular expenses.

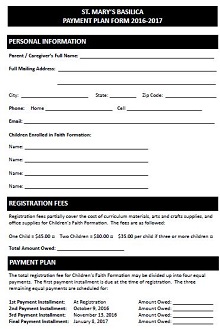

It’s important for those using a payment plan to remain organized and disciplined throughout the process so they stay on track and make progress toward clearing their balance entirely. Setting realistic timelines and breaking down the cost of each payment into smaller chunks is an effective way to manage debt repayment. Although dealing with outstanding debts can be daunting, following a debt payment plan can provide financial freedom sooner than anticipated.

Why do I need a Debt Payment Schedule?

Creating and maintaining a debt payment schedule is essential to managing your financial health. An organized plan allows you to prioritize which debts must be paid off first and what monthly payments are affordable. With a smart payment plan, you can track your goals, stay on top of supplies, and build your credit score over time.

It also keeps you from making careless or impulsive decisions about managing the money owed, therefore helping ensure that you will remain financially solvent in the long run. Ultimately, having a debt payment plan is key for taking control of your finances and creating a sound financial future.

Types of Debt Payment Schedule

Taking out loans to pay for big-ticket items like cars, homes, and college tuition can initially seem like a great idea. But when the bills start rolling in, and the payments come due, it’s easy to become overwhelmed. Fortunately, several debt payment plan options can help you get back on track. Here are some of the most popular types of debt payment schedules.

Debt Consolidation Loan

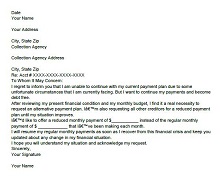

A debt consolidation loan is one of the most popular debt payment methods. With a debt consolidation loan, you take out a single loan to pay off multiple debts. This strategy can be helpful if you’re dealing with high interest rates or multiple sources of debt; by consolidating your debts into one loan with a lower interest rate, you can lower your monthly payments and make it easier to manage your finances.

Debt Settlement

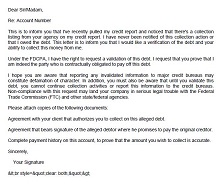

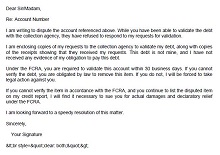

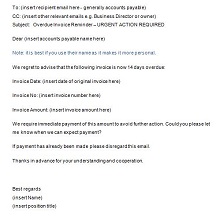

Debt settlement is another option if you struggle to make ends meet monthly. Under this type of agreement, you negotiate with creditors to reduce the total amount of money you owe them, meaning that instead of paying off the full balance, you’ll be able to pay less than what is owed in exchange for settling the account.

While this option may seem attractive at first glance, it’s important to understand that creditors are unlikely to agree to such an arrangement unless they feel it is their only recourse for collecting payment from you, so keep that in mind before agreeing to any settlement offers.

Debt Management Plan (DMP)

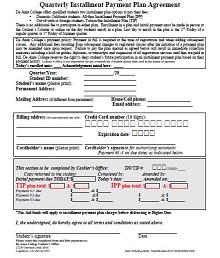

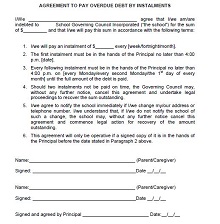

A Debt Management Plan (DMP) is another way for people struggling with debt repayment issues to get back on track financially. Under this type of agreement, your creditors will agree to reduce or eliminate certain fees and interest rates.

They may also agree to accept reduced payments until the balance is paid off in full. The key here is that all parties involved must agree on the terms before any changes can be made, so make sure all parties understand exactly what they are signing up for before entering into a DMP agreement.

How to Create a Debt Payment Schedule Template

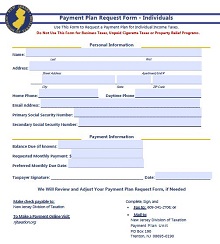

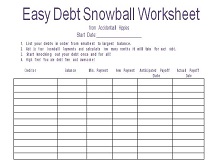

Developing a debt payment schedule template can help you manage your debt repayment. By having a structured plan, it is easier to keep up with payments, reduce interest, and ultimately get out of debt. Here are some steps to create a payment plan template.

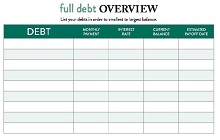

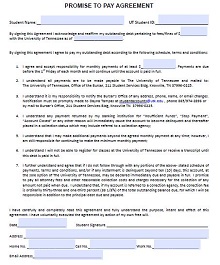

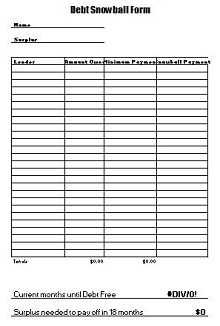

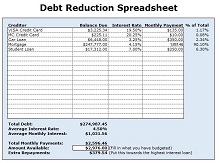

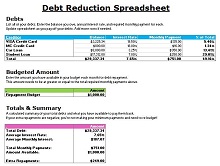

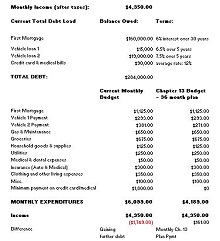

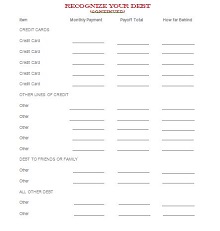

- Gather Your Financial Information – The first step in creating your debt payment plan is gathering all the information about the debts you owe. Ensure to include balances owed, interest rates, minimum payments required, and due dates. This will help ensure you have an accurate picture of all your debts to create an effective payment plan.

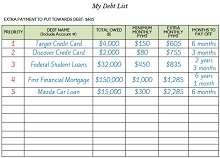

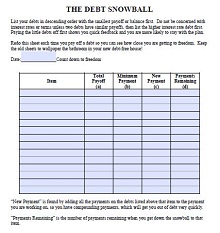

- Set Goals for Repayment – Once you have collected all the necessary information about your debt situation, it’s time to set goals for repayment. Consider how much money you can set aside monthly to repay your debts. Additionally, consider how quickly or slowly you want to pay off the different debts by setting deadlines or timelines for when each one should be paid off in full. This will help give you motivation and direction when creating a payment plan template that works best for your needs and budget.

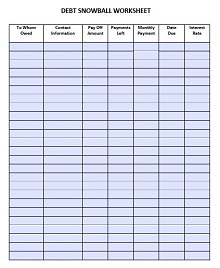

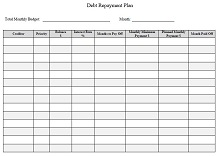

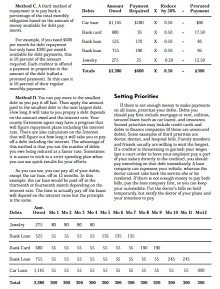

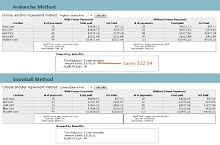

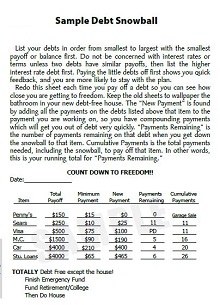

- Create Your Debt Payment Schedule Template – After setting goals and gathering financial information, it’s time to create your debt payment plan template. Start by listing out each loan with its balance owed, interest rate, and minimum payments required, as well as any deadlines or timelines associated with them, along with their due dates. Then, add up all the minimum payments required each month and compare this total with the amount available to allocate towards repayment each month. Finally, adjust the amounts allocated to each loan accordingly so that they match up with both the goal amount available and creditors’ requirements for minimum payments on loans so that nothing falls behind or goes unpaid during any given month/period.

- Monitor Progress & Adjust Accordingly – Once the template has been created, it’s important to monitor progress over time and make adjustments as needed based on changes in income or expenses or other circumstances affecting financial resources available for repayment of loans listed on the template. Doing this will help ensure success in achieving desired outcomes related to loan repayment over time while keeping track of progress made towards reaching these goals regularly throughout the process helps provide motivation which aids in staying focused on achieving desired outcomes related to loan repayment overall.