40+ Free Sample Financial Analysis Templates (MS Excel, PDF)

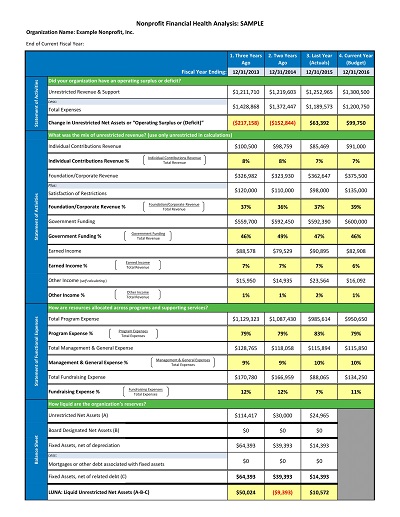

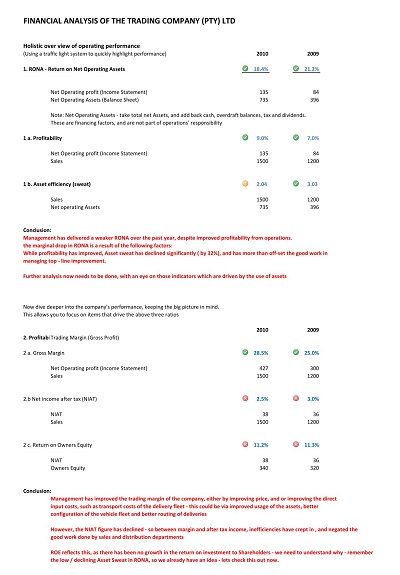

Financial analysis templates are effective tools for assessing the financial health of a business. By utilizing these templates, businesses can evaluate their financial statements and identify areas of strength and weakness. They systematically analyze key financial ratios, such as revenue growth and profitability, to support informed decision-making.

Financial analysis templates are not only useful for company managers but also for investors looking to assess the potential value of a business. As a comprehensive tool, the financial analysis template can offer valuable insights into a company’s financial position, allowing business owners to make informed decisions based on facts and figures rather than guesswork.

Download Free Sample Financial Analysis Templates

Importance of Financial Analysis in Business Decision Making

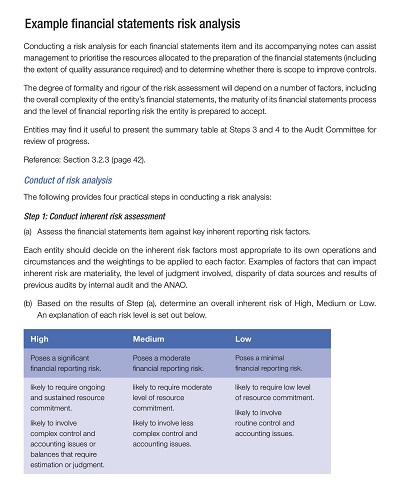

Financial analysis is a critical component of business decision-making, as it provides insights into a company’s financial health and informs important strategic decisions. Whether it’s assessing cash flow, profit margins, or debt ratios, financial analysis helps to identify potential risks and opportunities for growth.

By analyzing financial data, businesses can determine the most effective ways to allocate resources, invest in new ventures, and make decisions that ultimately contribute to long-term success. Without a thorough understanding of financial analysis, companies risk making decisions based on incomplete or inaccurate data, which can have significant consequences. For this reason, financial analysis remains a crucial tool for businesses looking to make informed and effective decisions.

Key Tools and Techniques for Effective Financial Analysis

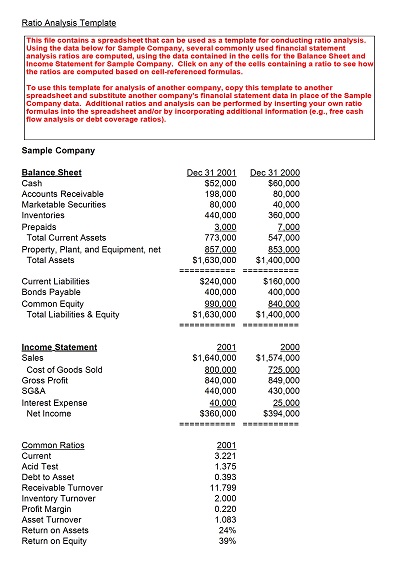

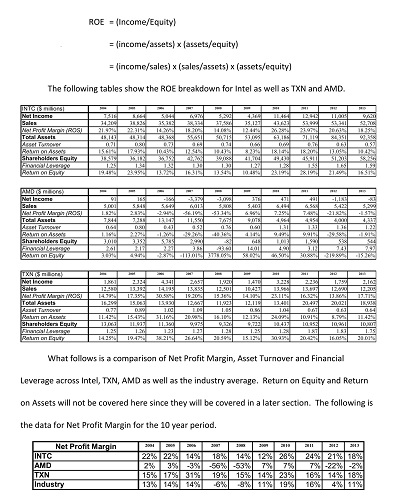

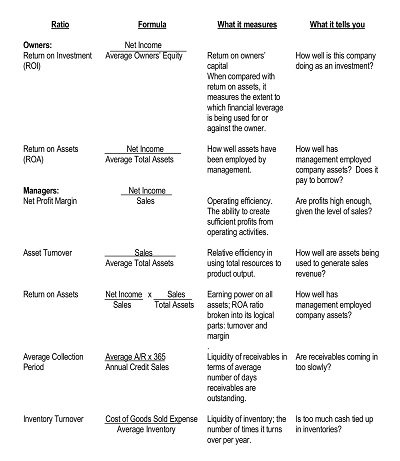

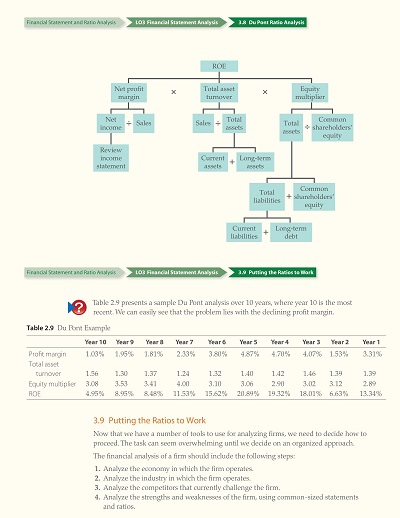

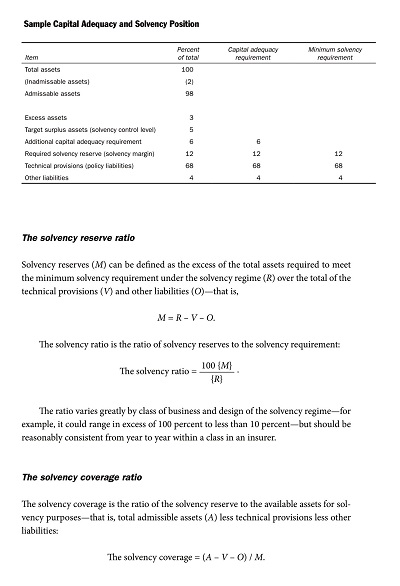

Understanding and utilizing key tools and techniques is critical for effective financial analysis. Whether you are an individual investor or a financial professional, the ability to analyze financial data can help you make informed decisions and achieve your financial goals. The most important tools and techniques include ratio, trend, and cash flow analysis. Ratio analysis allows you to compare financial data from different periods and companies, helping you to identify trends and potential areas of concern.

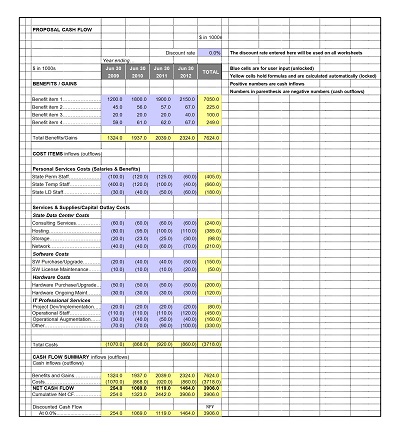

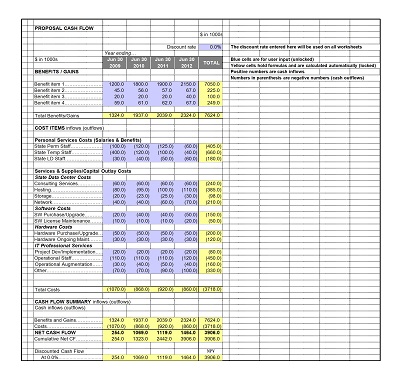

Trend analysis, on the other hand, allows you to identify patterns or trends in financial data over time and make predictions about future performance. Finally, understanding cash flow analysis can help you better understand a company’s cash flow situation and make more informed investment decisions. By mastering these key tools and techniques, you can become a more effective financial analyst and make informed investment decisions.

Financial Analysis for Strategic Planning

When it comes to strategic planning, financial analysis is an essential tool that helps organizations take a closer look at their financial position and make informed decisions about their future. With financial analysis, companies gain insights into their revenues, expenses, cash flow, and profitability, which enable them to create more effective strategies that align with their long-term goals.

Not only does financial analysis help organizations identify potential risks and opportunities and gives them a comprehensive view of their financial health, allowing them to make better decisions about resource allocation and investments. Financial analysis is a crucial component of strategic planning, enabling businesses to create sustainable growth and achieve their objectives while balancing their financial resources.

How to Create a Financial Analysis Template

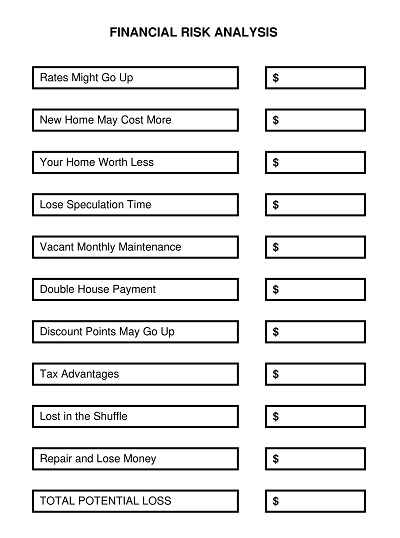

A financial analysis template is a crucial tool in determining the financial health of a company. It plays a significant role in evaluating the management’s effectiveness, assessing the company’s profitability, and identifying potential financial risks. Creating a financial analysis template may seem challenging; however, a well-structured and organized document can help you make sound business decisions.

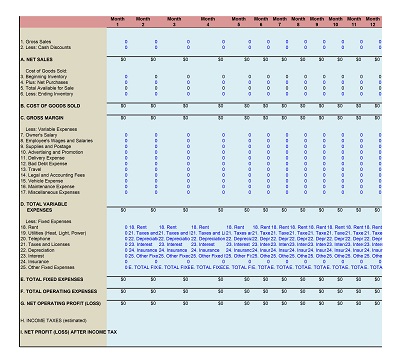

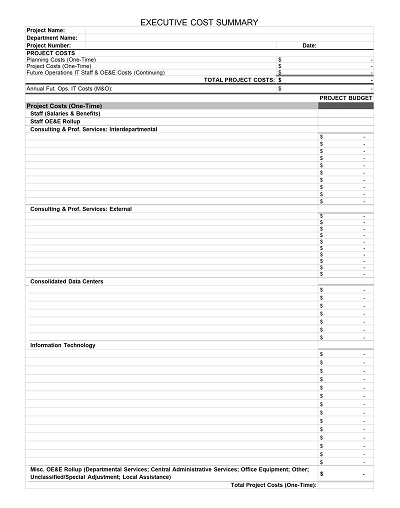

Determine the scope of your financial analysis template

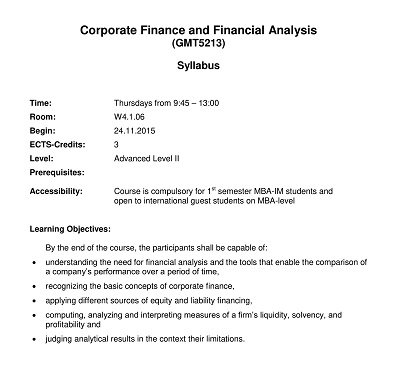

Before creating a financial analysis template, determining your analysis’s scope is essential. What particular aspect of the company’s finances are you interested in measuring? You may focus on profitability, liquidity, solvency, or debt management. Determining the scope of your analysis ensures that your template’s content is sufficient and aligns with your objectives.

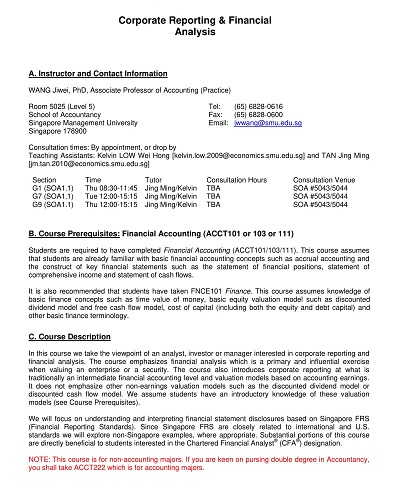

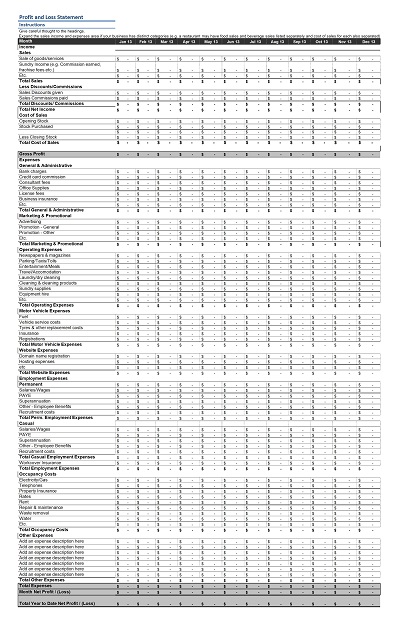

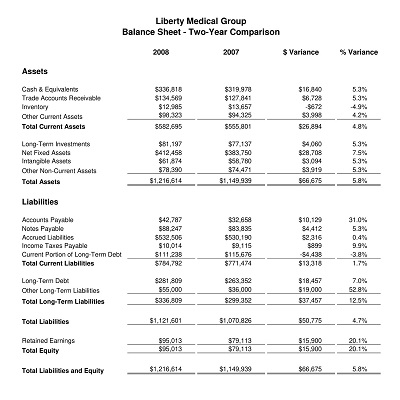

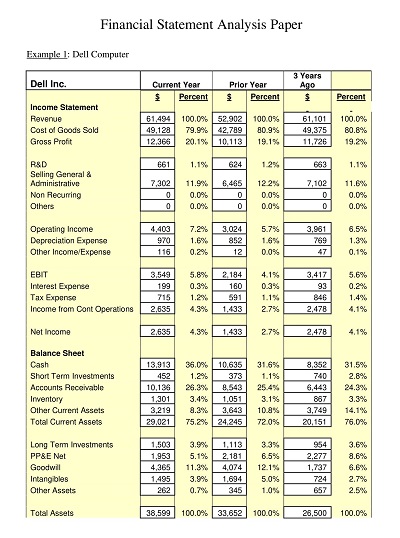

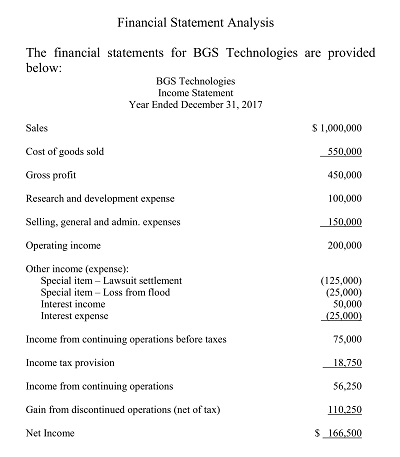

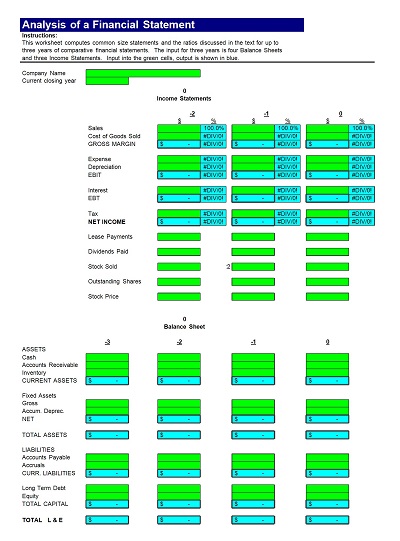

Select the financial statements for your analysis

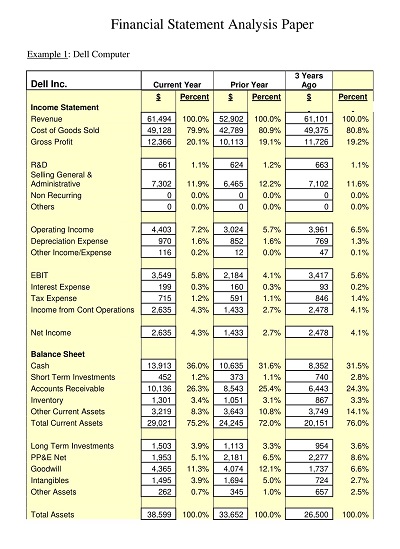

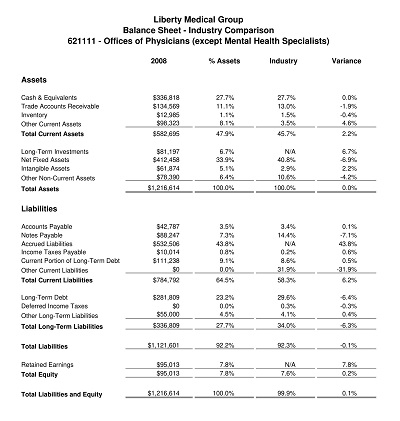

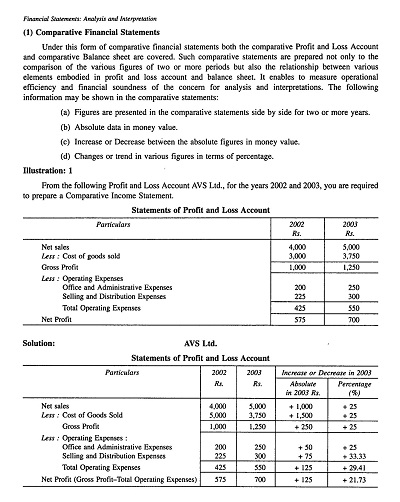

The annual financial statements companies prepare include the income statement, balance sheet, and cash flow statement. These statements provide a comprehensive overview of the company’s financial health. Your financial analysis template should include these statements to ensure that you identify the company’s financial strengths and weaknesses. You can download these statements from the company’s website or request them from their finance department.

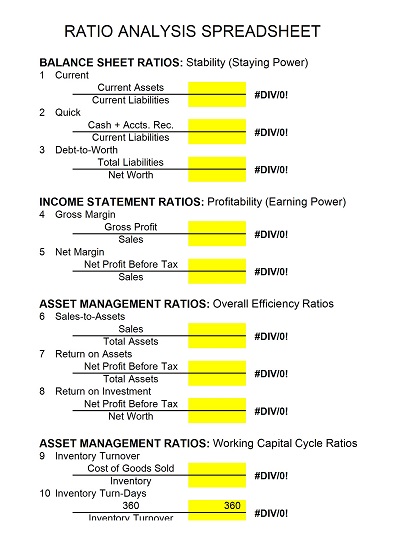

Analyze the financial statements

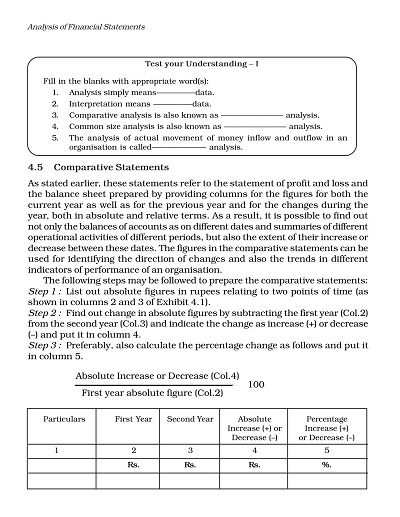

Once you have all the statements, it’s time to dive into the data. To conduct a thorough analysis, you may use financial ratios like profitability, liquidity, and solvency ratios. These ratios compare different financial metrics like revenues, costs, and assets to give you an idea of the company’s financial performance. Using ratios, you can identify relationships between different aspects of the company’s finances, allowing you to make informed decisions.

Use charts and graphs

Presenting data visually is an effective way to present the company’s financial performance. Charts and graphs represent data in a way that is easy to comprehend and interpret. You can use different graphs, depending on the data you want to represent. For example, you may use a line chart to show trends in revenue or a bar chart to illustrate the company’s debt levels. A well-designed chart or graph allows you to present your findings in a way that is easy to understand.

Add a commentary

A commentary summarizes your analysis and provides insights into the company’s finances. It should be well-written and concise while including all the critical points of your analysis. A good commentary should explain how the company performed relative to its competitors and the industry. It should also highlight the company’s strengths and weaknesses and provide recommendations for improvement.