20+ Free Monthly Expense Tracker Excel Templates

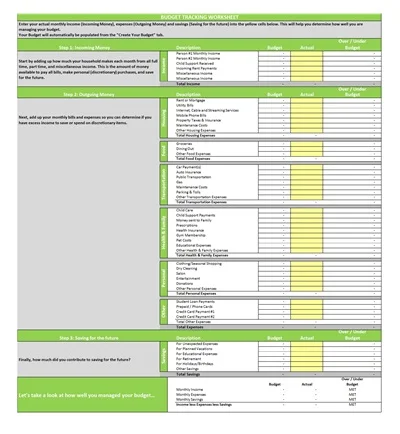

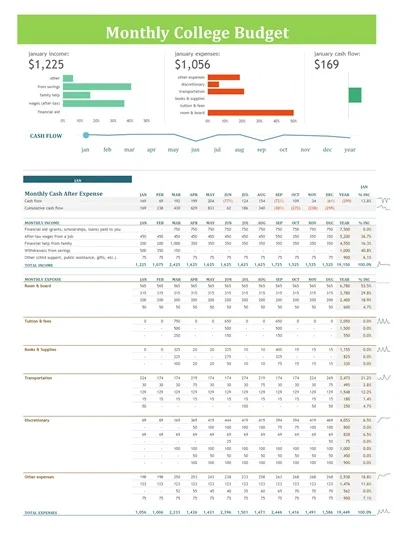

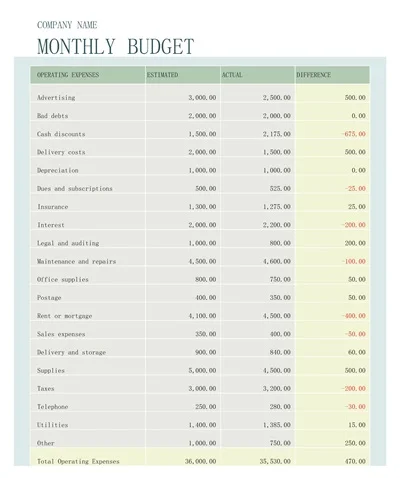

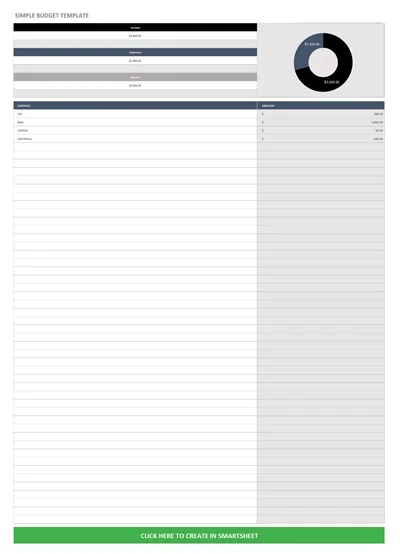

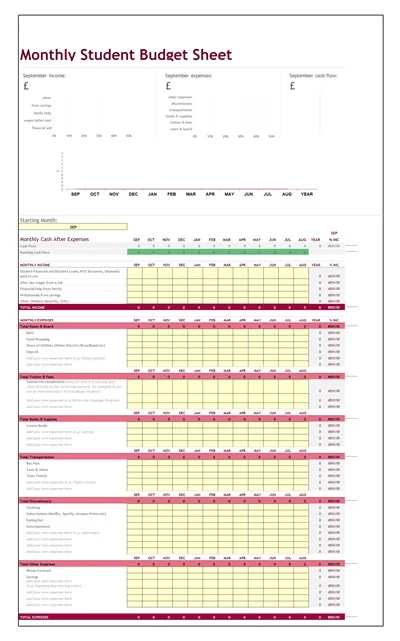

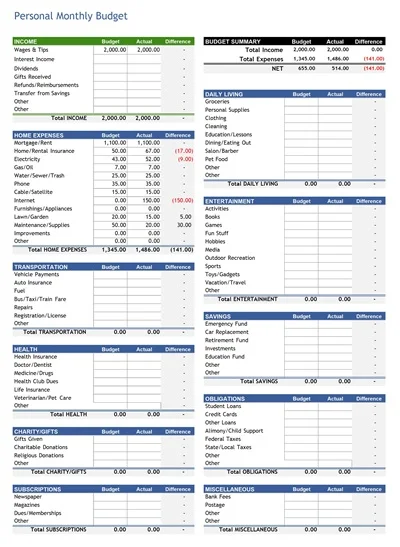

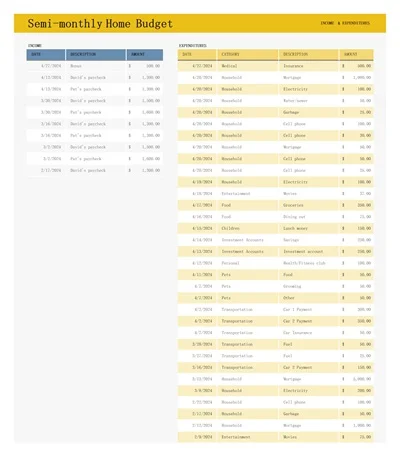

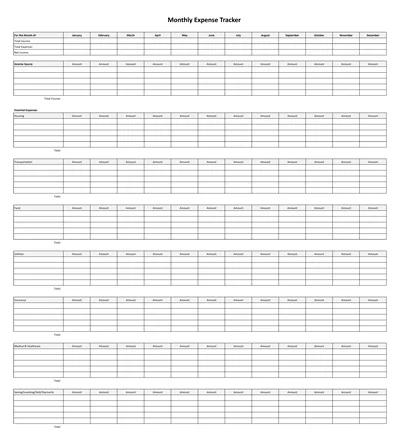

A Monthly Expense Tracker Excel Template is a preformatted spreadsheet designed to help individuals or businesses record, categorize, and analyze their expenses over a month. This customizable tool enables users to input various expenditures, such as rent or mortgage, utilities, groceries, and entertainment, providing a clear overview of financial outflows.

The template often includes features for totalling expenses, calculating monthly savings, and comparing expenses against budgeted amounts. Using such a template can gain valuable insights into spending habits, identify areas for cost reduction, and effectively manage their budget, leading to better financial health and planning.

Download Free Monthly Expense Tracker Excel Templates

What is a Monthly Expense Tracker?

A Monthly Expense Tracker is a tool designed to help individuals or households manage their finances by recording and analyzing all expenses over a month. This can be accomplished through various means, such as a spreadsheet, a mobile app, or traditional pen and paper.

By keeping track of where money is spent, users can identify patterns, make informed decisions about their spending, and set realistic budgets to improve their financial health. Additionally, it aids in pinpointing areas where they can cut back, save money, and work towards financial goals, such as building an emergency fund, saving for a vacation, or paying off debt.

Benefits of Using a Monthly Expense Tracker

Using a monthly expense tracker can significantly enhance one’s financial well-being. Here are some key benefits:

- Improved Financial Awareness: Regularly documenting expenses increases your awareness of spending habits, helping you recognize areas where you can save.

- Budget Management: A monthly expense tracker allows for better budgeting by clearly outlining where your money is going, ensuring you can make adjustments as needed.

- Goal Setting: It aids in setting realistic financial goals, such as saving for a vacation, by providing a clear picture of potential savings after necessary expenses.

- Reduced Impulse Spending: By keeping track of purchases, you’re more likely to think twice before making unnecessary purchases, reducing impulse spending.

- Early Detection of Problems: Regular tracking can help quickly identify any financial issues, such as fraudulent charges or subscriptions you no longer use, allowing for swift action.

- Savings Increase: With a clearer view of your spending, it’s easier to identify areas to cut back, increasing your ability to save for both short-term and long-term goals.

Why You Need a Monthly Expense Tracker

Implementing a monthly expense tracker is essential for managing your finances effectively. It not only helps you understand where your money is going but also allows you to identify areas where you can cut back and save. With a clear overview of your monthly expenditures, you can set realistic budgets, avoid overspending, and achieve your financial goals more efficiently.

Additionally, tracking expenses can highlight spending habits that may impact your financial health, encouraging more mindful spending decisions. In essence, a monthly expense tracker is vital for anyone looking to take control of their financial future.

How to Set Up a Monthly Expense Tracker

Setting up a monthly expense tracker is a straightforward process involving organizing your expenses to control your finances better. Here’s how you can do it:

1. Choose Your Tracking Method

Decide whether you prefer a digital tool, such as a spreadsheet or a budgeting app, or a more traditional approach, like a pen and paper. Digital tools often offer more features and automation, but writing things down may help you better remember your expenses.

2. List Your Income Sources

Include all regular income sources, such as salaries, bonuses, and other earnings. This will form the foundation of your budget, outlining how much money you have to work with each month.

3. Categorize Your Expenses

Break down your expenses into categories: rent or mortgage, utilities, groceries, entertainment, and savings. This will help you see where your money is going and identify areas where you can cut back.

4. Record Your Expenses

Regularly update your tracker with every expense. Be meticulous and include everything, no matter how small. This habit is crucial for maintaining an accurate overview of your financial health.

5. Review and Adjust

Review your expenses at the end of each month and compare them to your income. This will help you understand your spending habits and make necessary adjustments. It’s essential to be flexible and adapt your budget as your financial situation changes.

How to Create a Monthly Expense Tracker Template

Creating a monthly expense tracker template can help you manage your finances more effectively. Here’s how to set one up:

- Choose Your Platform: Decide whether to use a digital platform like Excel, Google Sheets, or a budgeting app or go traditional with a pen and paper notebook.

- Set Up Categories: Organize your expenses into categories such as rent/mortgage, utilities, groceries, entertainment, etc. This will help you track where your money is going each month.

- Create Columns: Include columns for the expense date, description, category, amount, and notes for extra context. This layout aids in both quick reviews and detailed analyses.

- Add Monthly Overview: At the top or side of the template, reserve space for a summary of monthly income and total expenses. This quick overview provides insight into your overall financial health.

- Incorporate Savings Goals: If applicable, include a section for tracking progress towards savings goals. This can motivate you to allocate funds consistently towards your objectives.

- Regular Updates: Designate a specific time weekly or daily to update the tracker with new transactions. Consistency is critical for accurate tracking and effective budget management.

- Review and Adjust: At the end of each month, review your expenses and adjust for the next month. This ongoing process allows you to refine your budget, cutting unnecessary costs and redirecting funds towards priorities.

Following these steps, you can create a personalized monthly expense tracker that helps you stay on top of your finances and make informed decisions about your spending and savings.