15+ Free Independent Artist Budget Templates – MS Word, PDF

An independent artist budget template can be valuable for artists who want to manage their finances effectively. In the music industry, artists who work independently are responsible for their expenses, including recording, marketing, and touring. A budget template can help them plan and track their spending, empowering them to make informed decisions that will shape their careers.

With a good budget template, artists can balance their creative pursuits with their financial limitations, allowing them to focus on their work without worrying about money. Ultimately, a well-planned budget can provide security and stability for independent artists, allowing them to pursue their passions with confidence.

Download Free Independent Artist Budget Templates

Importance Of Budgeting For Independent Artists

As an independent artist, budgeting is crucial for survival and success in the competitive industry. Managing finances effectively can make or break a career as an artist. A budget can help prevent overspending and unnecessary purchases, allowing investments in important areas such as marketing and equipment.

It is also important for artists to set financial goals and create a plan to achieve them through budgeting. A well-managed budget can help alleviate financial stress and allow for more focus on the creative process. By prioritizing budgeting and financial planning, independent artists can have the financial stability and freedom to pursue their passion and reach their full potential.

Tips For Managing Your Cash Flow As An Independent Artist

As an independent artist, managing cash flow can be a daunting task. You must simultaneously juggle expenses, unpredictable income, and investing in your craft. But fear not; there are tips and strategies you can implement to make cash flow management easier. One helpful tip is to create a budget and stick to it. This will help you better understand your spending habits and allow you to plan accordingly for the months ahead.

It’s also important to have multiple income streams to ensure a steady revenue flow. Don’t put all your eggs in one basket. Another tactic is negotiating payment terms with clients and buyers to ensure you’re paid promptly. Consistent communication with your clients and buyers is key here. Lastly, don’t forget to set aside a portion of your income for taxes and emergency savings. By implementing these tips, you’ll have a better handle on your cash flow and can focus on what really matters, creating great art.

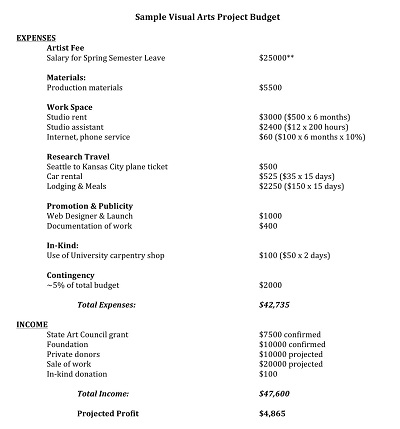

Essential Line Items for an Independent Artist Budget

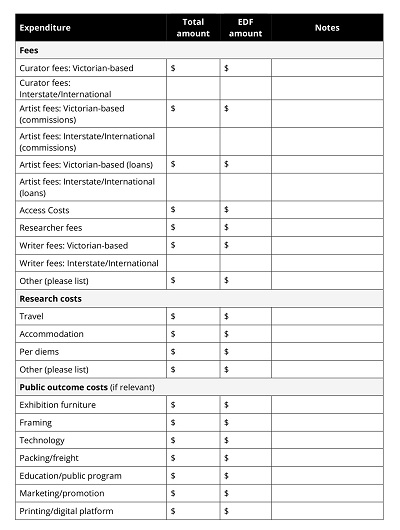

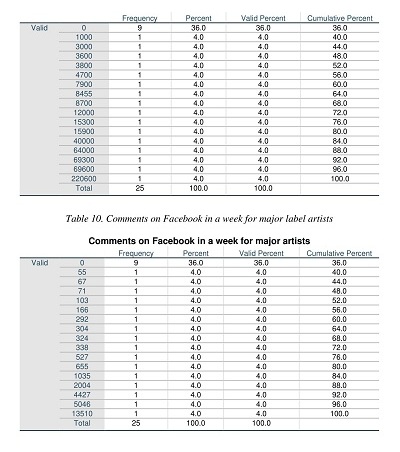

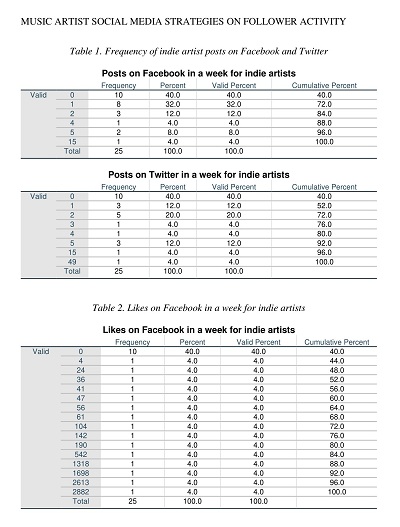

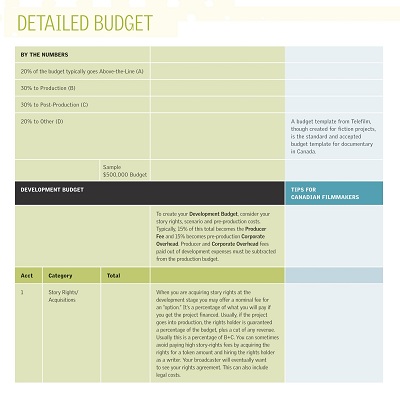

As an independent artist, setting a budget can feel overwhelming. However, understanding the essential line items that should be accounted for can make the process much easier. There are several key expenses, such as recording costs, marketing expenses, and equipment purchases. Recording costs include studio fees and paying producers or engineers to help with the process.

Marketing expenses might include social media advertising, promotional materials, and hiring a publicist. Remembering one-time expenses like buying new instruments or upgrading equipment is also important. It may take some time to nail down an accurate budget for your career, but knowing the necessary line items is a great place to start.

How to Create an Independent Artist Budget Template

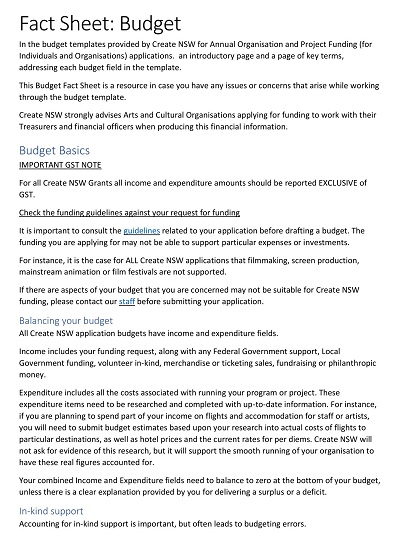

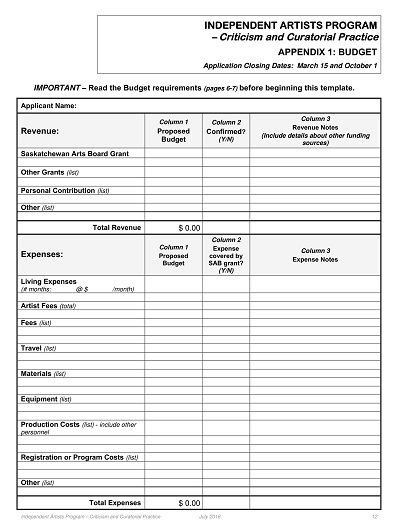

As an independent artist, it can be challenging to manage your finances, especially if you’re not earning a fixed income. But creating a budget can help you stay on top of your finances and achieve your goals. This blog post will guide you through creating a budget template specifically designed for independent artists.

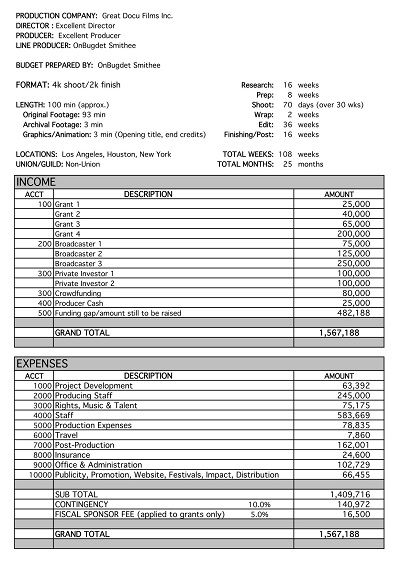

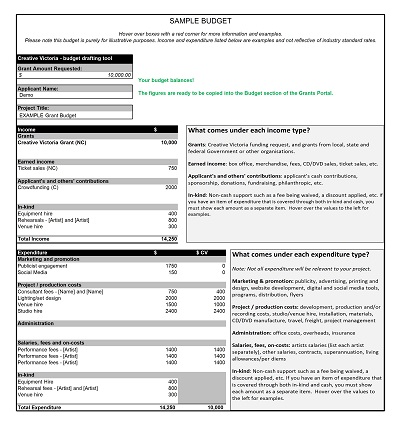

Determine Your Income

The first step is to determine your income. As an independent artist, your income may not be consistent, so you’ll need to look at your revenue streams and estimate your average monthly income. Consider income from music sales, gigs, merchandise sales, and streaming royalties. Once you have a clear idea of your average monthly income, you can move on to the next step.

Identify Your Monthly Expenses

Next, you’ll need to identify your monthly expenses. This includes everything from rent and utilities to medical expenses and equipment maintenance. Creating a comprehensive list is important to ensure you don’t miss any important expenses. Including a section for unexpected expenses or emergencies is also a good idea.

Define Your Financial Goals

Defining your financial goals is an essential part of creating a budget template. This could be anything from saving up for a new piece of equipment to going on tour. You’ll need to assign a dollar value to each goal and decide when you want to achieve it. Once you clearly understand your financial goals, you can allocate funds in your budget accordingly.

Create Your Budget Template

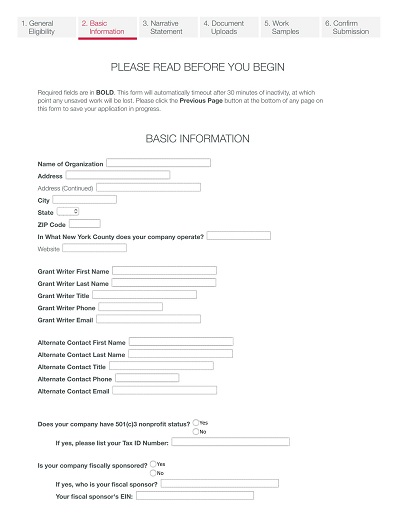

It’s time to put everything together and create your budget template. Start by creating a spreadsheet in programs like Microsoft Excel or Google Sheets. List your income streams in one column and your monthly expenses in another. Include a third column for your financial goals. Remember to include a row for unexpected expenses or emergencies. Once you’ve filled out all the details, use a formula to calculate the difference between your income and expenses. This will let you know if you’re in the black or the red each month.

Track And Update Your Budget

Creating a budget template is just the first step. To be successful, you need to track your spending and update your budget as things change. Consider checking your budget weekly or bi-weekly to ensure you stay on track. Adjust as needed, such as cutting back on expenses or increasing your savings.