50+ Free Bookkeeping Templates for Self Employed (PDF, Excel)

As a self-employed business owner, one of your most important jobs is to accurately track your finances. Bookkeeping templates for Self Employed can be incredibly helpful when it comes to staying organized and keeping a detailed record of your investments and earnings.

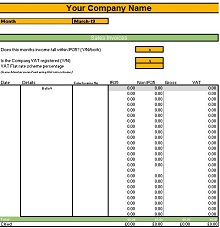

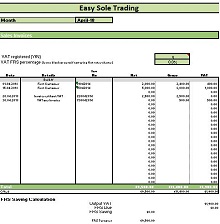

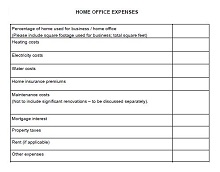

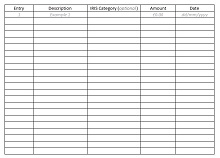

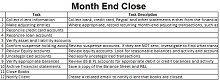

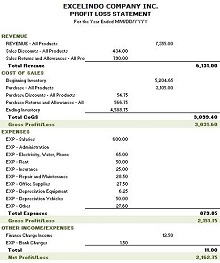

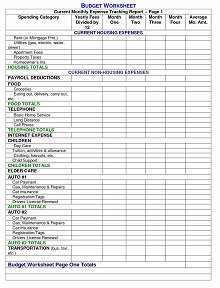

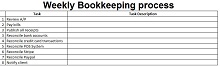

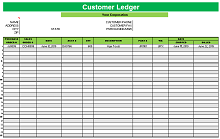

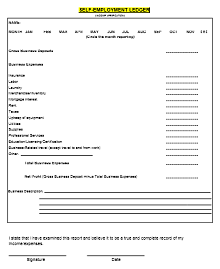

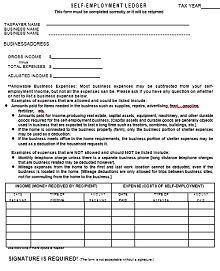

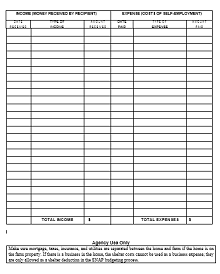

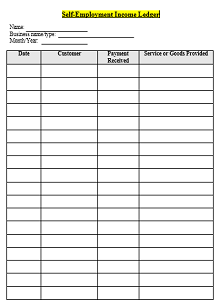

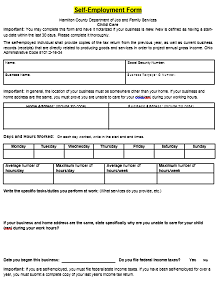

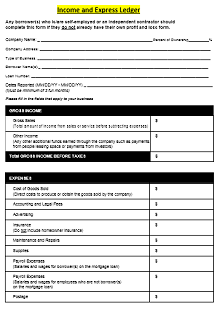

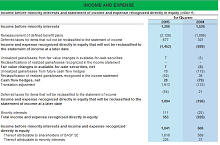

With easy-to-read tables, convenient overviews, and detailed sections for invoices, tracking expenses, sales tax, depreciation, payroll taxes, and more, bookkeeping templates provide everything you need to ensure your financial records are up-to-date and accurate. Having this critical information readily available at your fingertips helps you make sound financial decisions that will guide the future success of your business.

- Accounting Templates

- Art & Media

- Budget Templates

- Business Templates

- Calendar Templates

- Certificates

- Charts

- Education Templates

- Inventory Templates

- Invoice Templates

- Letter Templates

- Medical Templates

- Personal Templates

- Project Plan Templates

- Timesheet Templates

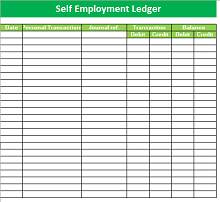

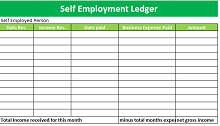

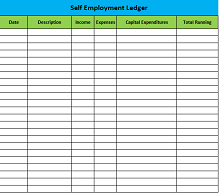

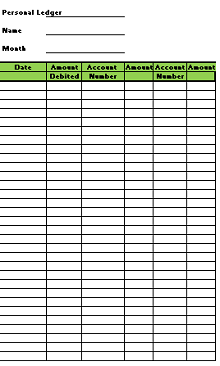

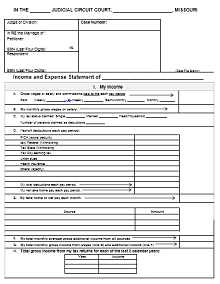

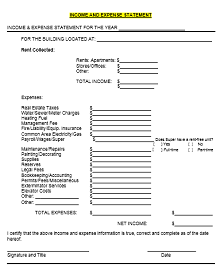

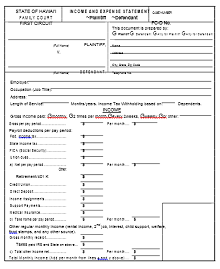

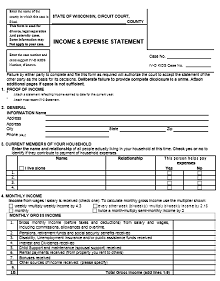

Download Free Bookkeeping Templates for Self Employed

What are Bookkeeping Templates?

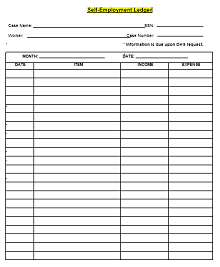

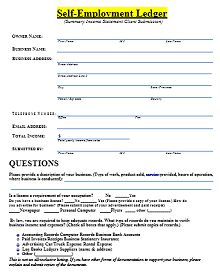

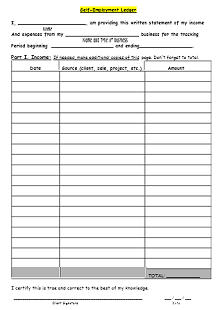

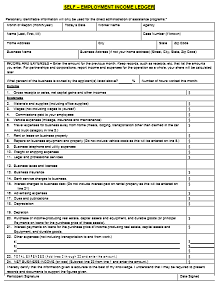

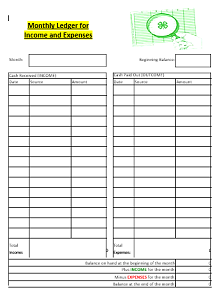

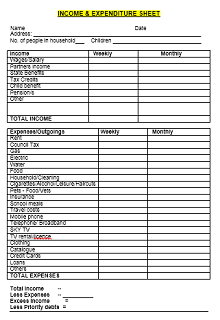

Bookkeeping templates are documents that allow self-employed professionals to easily organize their financial information. The templates are designed specifically for those who work from home or independently, typically without the help of an accountant or CPA. By using bookkeeping templates, you can quickly record income, create invoices, track expenses, monitor cash flow, and more. This makes it easier to identify spending patterns over time and spot any red flags before they become serious issues.

Types of Bookkeeping Templates

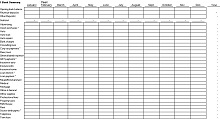

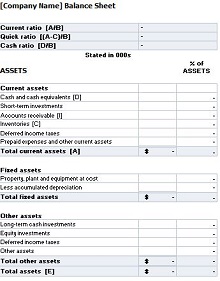

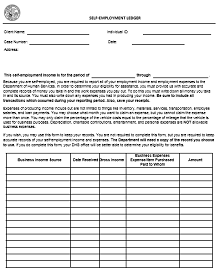

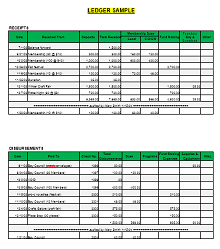

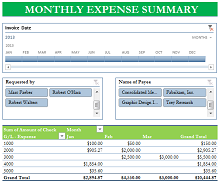

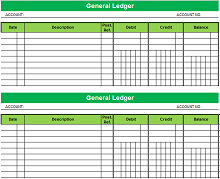

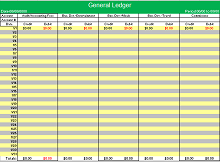

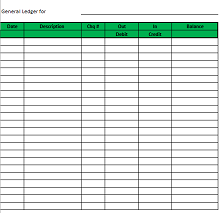

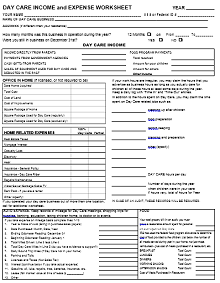

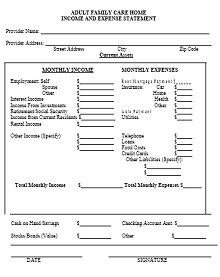

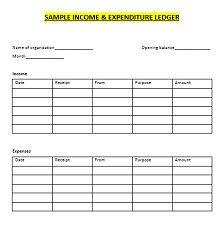

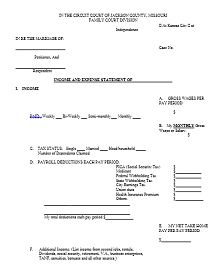

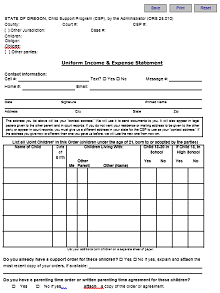

Bookkeeping templates come in all shapes and sizes. Depending on the type of business you run and how much detail you need to track, there are several different types of bookkeeping templates available for self-employed professionals. The most common types include expense reports, budget plans, profit & loss statements, balance sheets, invoices/receipts logs, accounts receivable/payable ledgers, and cash flow statements. Each type is designed to help you organize a different aspect of your finances so no data slips through the cracks.

How Bookkeeping Templates Can Help Self-Employed Professionals Get Organized

Being self-employed is a great way to take control of your career and make money, but it also means you’re responsible for managing your finances. It can be difficult to stay organized when you have multiple sources of income, expenses, and other financial tasks to manage. That’s where bookkeeping templates come in, they provide structure and organization so you can keep your finances in check.

How Can Bookkeeping Templates Help Me?

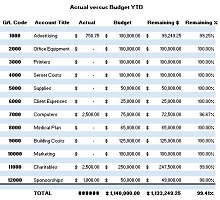

Bookkeeping templates make it easy for self-employed individuals to stay on top of their finances. By using these templates regularly, you will have a better understanding of where money is coming in and going out. This will allow you to identify any areas where you may be overspending or undercharging for services. It also gives you an accurate picture of your overall financial health so that you can plan accordingly and make informed decisions about how best to manage your money.

Streamline Your Bookkeeping with Templates

As a self-employed individual, keeping accurate and up-to-date books is an essential part of running your business. However, manually entering data into spreadsheets or traditional bookkeeping software can be tedious and time-consuming. Fortunately, there is a better way to bookkeeping templates. Here are some of the benefits of using bookkeeping templates for self-employed individuals.

Accurate Information & Organization

One of the biggest advantages of using bookkeeping templates is that they provide you with an organized system to track your income, expenses, and other financial transactions. This makes it easier to locate important documents when needed and ensures that all information is accurately recorded in one place. Additionally, since the majority of templates are created by experienced bookkeepers or accountants, you can trust that the numbers are correct and up-to-date.

Saves Time & Money

Using bookkeeping templates also saves you time and money since you won’t have to spend hours entering data into spreadsheets or other programs. Instead, all you need to do is update the template when needed and you’re done. Furthermore, most templates come with built-in features such as automated calculations which further streamlines the process. And if your business grows beyond what a template can handle, these same systems often offer additional features such as invoicing and payroll management at an affordable price.

Customizable to Fit Your Needs

Finally, many bookkeeping templates are customizable so you can tailor them to fit your individual needs. This includes being able to add new categories or columns as well as change existing ones without having to start from scratch. Plus, most providers offer support should you ever run into any issues while working on your template.